Let’s be honest—if you are a complete beginner, starting out in trading can feel like walking into a room where everyone speaks a different language. Words like pips, lots, leverage, and stop losses get thrown around, and you’re sat there thinking, “Am I supposed to know all of this already?” Yep—I’ve been there too.

This beginners trading guide is your one-stop shop, breaking down the most common trading terms, explained in plain English with real examples. Whether you’re wondering how lot sizes work, what happens to your £500 deposit, or what the heck a “pip” is, I’ve got you covered.

If you just want to skip ahead please just use the ‘Table of Contents’ below and just click on anything, you’ll quickly find the answer to your question.

Order Types Explained for Beginners

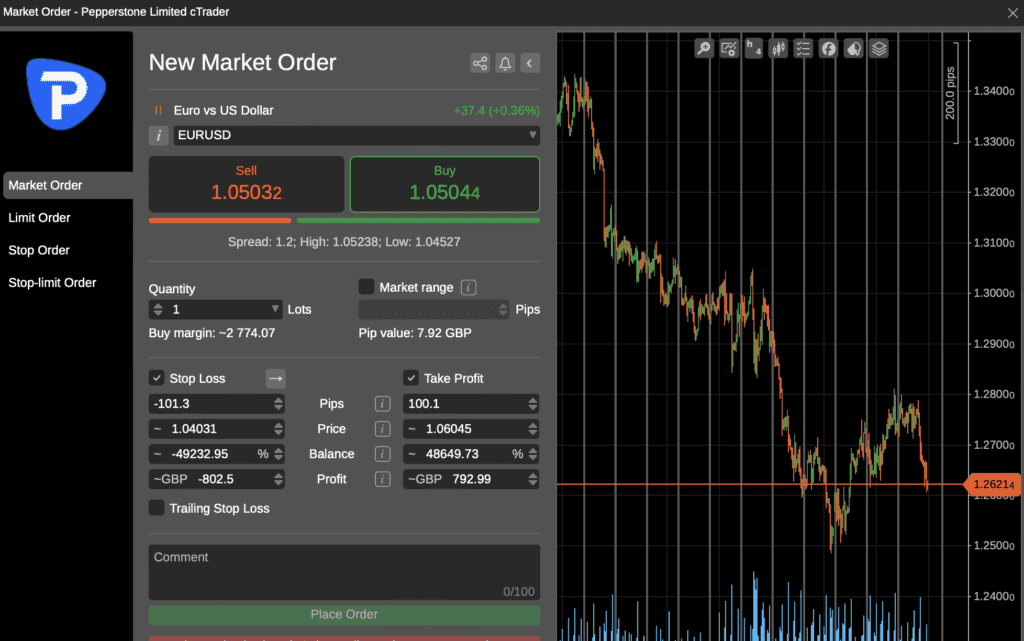

What is a Market Order?

A market order is an order to buy or sell an asset immediately at the current market price.

Think of it like grabbing the closest loaf of bread in a supermarket—it’s quick, and you take what’s available.

- Example: If GBP/USD is trading at 1.2500 and you place a market order to buy, your trade will execute at the nearest available price—1.2500 (or very close to it).

When to Use It:

- You want to enter or exit a trade immediately.

- You’re not too worried about small price differences.

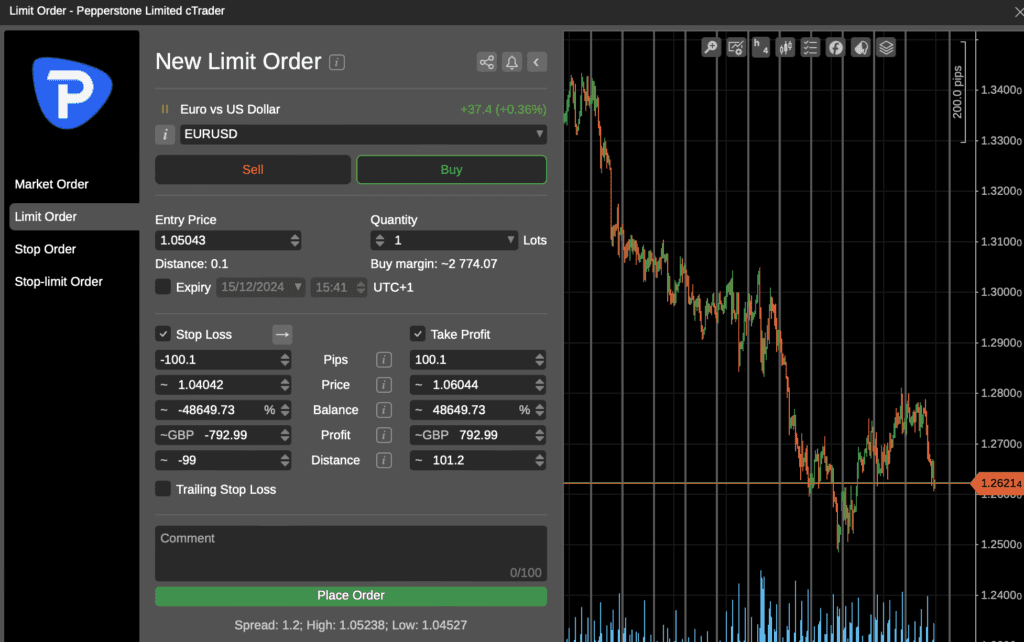

What is a Limit Order?

A limit order lets you set a specific price where you want to buy or sell an asset.

It’s like waiting for a sale. You decide you’ll only buy that loaf of bread if it drops to £1.50.

- Example: If GBP/USD is at 1.2500 but you only want to buy if it drops to 1.2480, you’d place a buy limit order. Your trade will execute automatically if the price hits 1.2480.

When to Use It:

- You want to buy or sell at a specific price.

- You’re willing to wait for the market to hit your target.

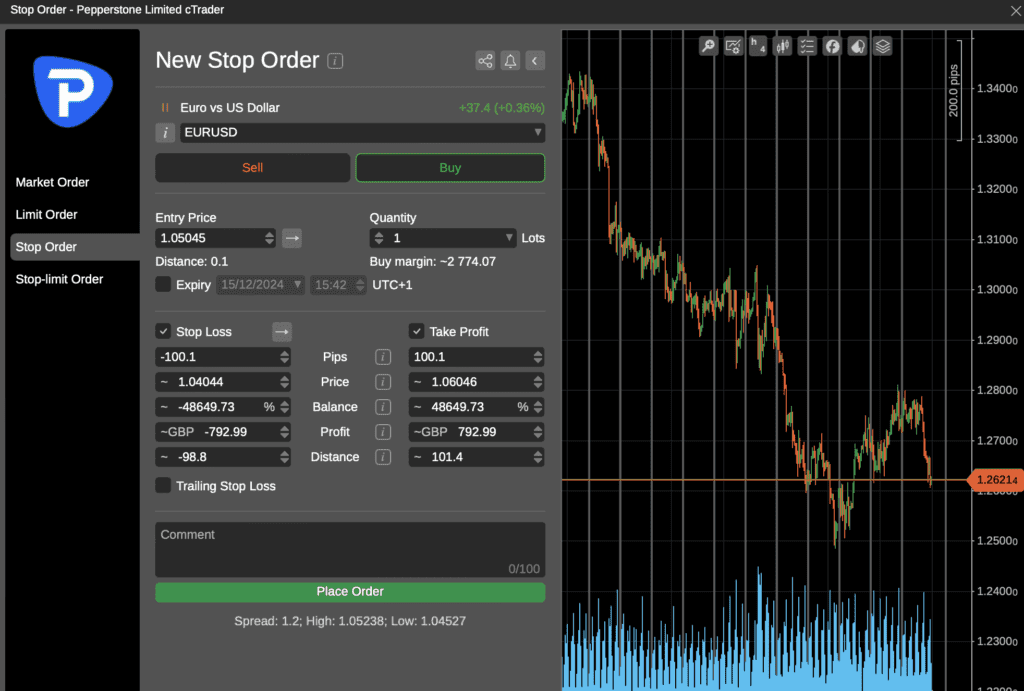

What is a Stop Order?

Listen, firstly, I never use this, and I’ve been trading for well over 10 years so feel free to skip the section if you need but here’s what a stop order is:

A stop order is an order to buy or sell an asset once the price reaches a specific level, known as the stop price. When the stop price is hit, the stop order becomes a market order and executes immediately at the best available price.

Essentially, stop orders are used to either:

- Limit Losses: Close a trade if the market moves against you (e.g., a stop-loss order).

- Enter Trades: Open a position when the price moves past a certain level, confirming momentum in your favor.

Types of Stop Orders:

- Stop-Loss Order: This closes your trade automatically if the market moves against you to limit losses. For example:

- You buy GBP/USD at 1.2500.

- You set a stop-loss at 1.2450.

- If the price falls to 1.2450, your trade closes to limit the loss.

- Buy Stop Order: Used to enter a long position if the price rises above a certain level. For example:

- If EUR/USD is trading at 1.2000 and you set a buy stop at 1.2050, your order will trigger once the price hits 1.2050.

- Sell Stop Order: Used to enter a short position if the price drops below a certain level. For example:

- If gold is trading at $2,000 and you set a sell stop at $1,980, your order triggers once the price hits $1,980.

Why Use a Stop Order?

- Limit Risk: A stop-loss order prevents excessive losses by automatically closing losing trades.

- Trade Momentum: A buy or sell stop order helps you catch trends as they break key price levels.

- Discipline: Stop orders ensure you stick to your risk management plan without second-guessing.

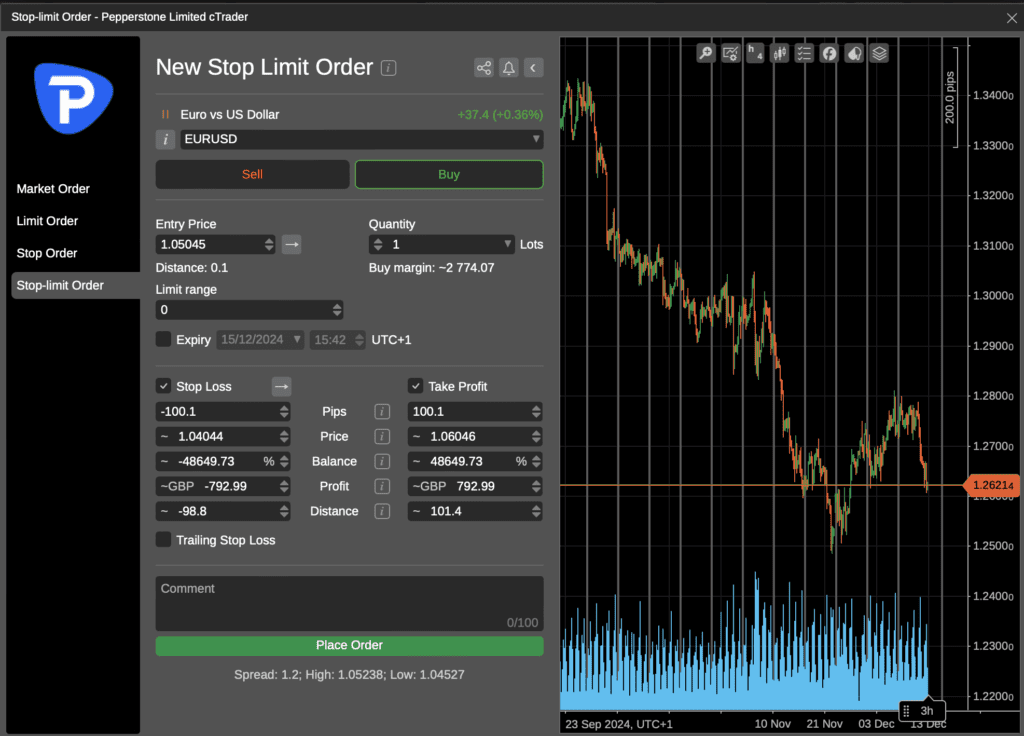

What is a Stop-Limit Order?

And this is where I can here you tuning out now… but bear with us or feel free to skip but stop-limit orders are the kind of thing that until you need to use them, there may be no point in learning about them. But for those curious folk, here’s what a stop-limit order actually is:

A stop-limit order combines two key features: a stop price and a limit price. When the price reaches the stop level, the order becomes a limit order rather than a market order.

In simpler terms:

- Stop Price: The price at which the order is activated.

- Limit Price: The price you’re willing to accept (or better) for the trade.

How Does a Stop-Limit Order Work?

Let’s break it down:

- You set the stop price: The price level at which the trade activates.

- You set the limit price: The maximum price you’ll pay for a buy order (or the minimum price you’ll accept for a sell order).

- If the stop price is hit: The order converts to a limit order and only executes if the market price matches or improves upon your limit price.

Example of a Stop-Limit Order (Buy):

- EUR/USD is trading at 1.2000.

- You set a stop price at 1.2050 and a limit price at 1.2060.

- If the price reaches 1.2050, the order becomes a limit order to buy EUR/USD at 1.2060 or better.

- If the price jumps straight to 1.2070, your order won’t execute because it’s above your limit price.

Example of a Stop-Limit Order (Sell):

- You own gold, trading at $2,000.

- You set a stop price at $1,980 and a limit price at $1,975.

- If gold drops to $1,980, the order converts to a sell limit order at $1,975 or better.

- If the price falls too quickly and hits $1,970, the order won’t execute because it’s below your limit price.

Why Use a Stop-Limit Order?

- Control Execution Price: Unlike stop orders, which execute at market price, stop-limit orders give you control over the price you’ll buy or sell at.

- Avoid Slippage: In volatile markets, slippage can cause stop orders to execute at unfavorable prices. A stop-limit order prevents this.

- Precision Trading: Stop-limit orders are perfect for traders who want to ensure they don’t enter or exit at worse prices than expected.

Stop Order vs. Stop-Limit Order: What’s the Difference?

| Feature | Stop Order | Stop-Limit Order |

|---|---|---|

| Execution Type | Converts to a market order. | Converts to a limit order. |

| Price Control | Executes at the best available price. | Executes only at your set limit price. |

| Risk of Slippage | Higher chance of slippage in volatility. | Avoids slippage but risks no execution. |

| Use Case | For guaranteed execution (at any price). | For price control (with execution risk). |

When to Use a Stop-Limit Order vs. a Stop Order?

- Use a stop order when execution is more important than price (e.g., in fast-moving markets).

- Use a stop-limit order when price control is crucial, but you’re willing to risk the order not executing.

Quick Recap for Beginners

- Stop Order: Triggers a market order at the stop price. Fast execution but no price control.

- Stop-Limit Order: Triggers a limit order at the stop price, ensuring price control but risking no execution in volatile markets.

Both tools are essential for risk management and trade precision. Choosing between them depends on your strategy, market conditions, and how much control you want over your trade execution.

Risk / Reward Explained for Beginners

What is a Stop Loss, and Why Does It Matter?

A stop loss is a tool that automatically closes your trade if the market moves against you by a specified amount.

The point? To limit your losses and protect your account.

- Example: You buy GBP/USD at 1.2500 and set a stop loss at 1.2450. If the price falls to 1.2450, your broker will close the trade automatically, ensuring you don’t lose more than you planned.

Why It’s Important:

- Trading without a stop loss is like driving without brakes—dangerous.

- It keeps your losses manageable, especially when markets get volatile.

What is a Take Profit?

A take profit (TP) is an order you set to automatically close your trade when the price reaches a certain level of profit. Essentially, it’s a way to lock in your gains without having to sit in front of your screen all day.

If you’re aiming to “take profit” at a specific point, you’re setting a clear target. For example:

- You buy EUR/USD at 1.2500.

- You set your take profit at 1.2550.

- If the price hits 1.2550, the trade automatically closes, locking in your profit.

Why Use a Take Profit?

- Emotion-Free Trading: TPs remove the temptation to hold onto a winning trade too long, hoping for even more profit.

- Peace of Mind: You don’t need to monitor the trade constantly—if it hits your target, the order closes.

- Risk-to-Reward Control: A TP helps you plan trades with a clear risk-to-reward ratio (e.g., risking 10 pips to gain 20 pips).

Is a Trailing Stop Loss the Same as a Take Profit?

No, a trailing stop loss and a take profit serve different purposes:

- Take Profit: Closes the trade when your price target is hit, locking in a specific profit.

- Trailing Stop Loss: Follows the price as it moves in your favor and closes the trade if the price reverses by a set amount.

Key Difference:

- A TP locks in profits at a fixed level.

- A trailing stop protects profits dynamically as the market moves.

Example of a Trailing Stop vs. Take Profit:

- You buy GBP/USD at 1.3000.

- You set a take profit at 1.3050 (50-pip target).

- You also set a trailing stop loss of 20 pips.

If the price rises to 1.3030, your trailing stop moves to 1.3010. If the price hits 1.3050, your take profit closes the trade. But if the market reverses from 1.3030, your trailing stop ensures you still lock in a small profit.

How Do I Find a Good Trailing Stop Loss Level?

A good trailing stop loss level depends on the market volatility, the timeframe you’re trading, and your risk tolerance. The key is to strike a balance:

- Too Tight: The stop loss could trigger prematurely on small price movements.

- Too Loose: You risk giving back too much of your profit.

Here are some methods to find the best trailing stop level:

1. Use a Fixed Pip Distance

A simple approach is to trail your stop by a fixed number of pips. For example:

- If you’re trading EUR/USD, you might use a 20-pip trailing stop on a short-term trade.

- For longer trades, you might widen this to 50 pips.

2. Follow Market Volatility (ATR Method)

The Average True Range (ATR) is a volatility indicator that shows the average movement of a market.

- A higher ATR means the market is volatile, so you need a wider trailing stop.

- A lower ATR means you can use a tighter stop.

How to Use ATR:

- If the ATR is 20 pips, set your trailing stop at 1.5x ATR (30 pips).

- This gives the trade room to “breathe” while still protecting your profits.

3. Use Support and Resistance Levels

Identify key support or resistance levels on your chart:

- Place your trailing stop just below a recent support level (for a buy trade).

- Place it just above a recent resistance level (for a sell trade).

This method uses price structure to guide your stop placement.

4. Percentage-Based Trailing Stops

Set a trailing stop as a percentage of the trade value. For example:

- You could trail by 1% or 2% of the asset’s price.

- If you buy a stock at £100, a 2% trailing stop would move to £98 as the price rises.

Key Tip: Combine trailing stops with take profits to maximize profits while minimizing risk. For instance, set a TP at a fixed level but use a trailing stop to lock in gains if the market keeps running in your favour.

How Do I ‘Scale Out’ of Positions?

Scaling out of a position means closing part of your trade while keeping the rest open. This strategy allows you to lock in some profit while still giving the trade room to run further.

Why Scale Out?

- Lock in Profit: By closing part of the position, you secure some gains even if the market reverses.

- Manage Risk: Reducing position size minimizes potential losses on the remaining trade.

- Ride the Trend: If the trade keeps moving in your favor, you’ll benefit from the remaining position.

Example of Scaling Out:

- You buy 1 lot of EUR/USD at 1.2000.

- Your take profit is set at 1.2050.

- When the price reaches 1.2030, you close half the position (0.5 lots) and secure a profit.

- You let the remaining 0.5 lots run to your original target of 1.2050.

If the price reverses after hitting 1.2030, you’ve still locked in profit on half the trade. If it hits 1.2050, you maximize your overall gains.

If I Deposit £500, Am I Trading With That Money?

Yes, when you deposit £500 into your trading account, that’s the money you trade with—but there’s a twist.

Many brokers offer leverage, which allows you to control a much larger trade size with a smaller deposit.

- Example: With 1:30 leverage (the FCA’s maximum for retail traders), your £500 deposit lets you control a position worth up to £15,000.

The Catch: Leverage amplifies both profits and losses. While it increases your trading power, it also increases your risk. Always trade carefully.

What Happens if My Stop Loss is Larger Than My Account Balance?

If your stop loss is set so high that your potential loss exceeds your account balance, don’t panic—you’re still protected.

Under FCA regulations, brokers offer negative balance protection, meaning you can’t lose more than your deposit.

- Example: You have £500 in your account and place a trade with a stop loss that would lose you £800. The broker will close your trade before your losses exceed £500, protecting you from debt.

Good to Know: This protection only applies to retail traders. Professional accounts are not guaranteed the same safeguards.

What is a Lot Size in Trading?

A lot size determines the amount of the asset you’re trading. In forex, lots are used to standardize trade sizes:

- Standard lot = 100,000 units of currency

- Mini lot = 10,000 units

- Micro lot = 1,000 units

- Nano lot = 100 units

Why It Matters: Lot size affects how much you gain or lose for each pip (more on pips later). Larger lots mean higher profits—but also higher risks.

How Do I Calculate Lot Size?

To calculate lot size, use this simple formula:

Lot Size = (Risk Amount ÷ Stop Loss in Pips) ÷ Pip Value

- Example: You’re risking £50 with a stop loss of 10 pips, and the pip value is £1.

Lot Size = (£50 ÷ 10 pips) ÷ £1 = 0.5 (a mini lot).

Most brokers also provide lot size calculators to save you the manual maths.

What is a Good Lot Size for £500, £1,000, or £1,500?

Choosing the right lot size depends on your balance and risk tolerance. Here’s a rough guide:

- £500 Balance: Start with micro lots (0.01 lot) to keep risk low. Each pip movement is worth ~£0.10.

- £1,000 Balance: Consider mini lots (0.1 lot) if you’re confident. Each pip = ~£1.

- £1,500 Balance: Mix between micro and mini lots depending on your stop loss and risk strategy.

Rule of Thumb: Never risk more than 1-2% of your balance on a single trade.

What is a Pip in Trading?

A pip stands for “percentage in point” and is the smallest price movement in most forex pairs.

For most currency pairs, a pip is the fourth decimal place. For Japanese yen pairs, it’s the second decimal place.

- Example: If GBP/USD moves from 1.2500 to 1.2501, that’s a 1-pip movement.

Why Pips Matter:

Pips help measure price changes and calculate your profits or losses.

How Much is a Pip Worth?

The value of a pip depends on your lot size:

- Standard lot (1.0): 1 pip = £10

- Mini lot (0.1): 1 pip = £1

- Micro lot (0.01): 1 pip = £0.10

Example: You trade a mini lot (0.1) of GBP/USD, and the price moves 20 pips in your favour. Your profit = 20 pips x £1 = £20.

What is Leverage, and How Does It Work?

Leverage allows you to control a larger position with a smaller amount of capital.

- Example: With 1:30 leverage, a £100 deposit lets you control a £3,000 position.

How It Works:

- Profits are calculated on the full trade size, not just your deposit.

- But losses are also magnified, so be careful!

FCA Rules: For UK retail traders, leverage is capped at:

- 1:30 for major forex pairs

- 1:20 for minor forex pairs and indices

- 1:10 for commodities like gold

- 1:5 for stocks

Technical Terms Explained for Beginners

What is Margin?

Margin is the amount of money you need to open and maintain a leveraged trade.

Think of it as a deposit that the broker “locks up” while your trade is open.

- Example: If you open a £10,000 trade with 1:50 leverage, your margin requirement is £200 (£10,000 ÷ 50).

What is Margin in Trading?

Margin is the amount of money you need to deposit to open a leveraged position. Think of it as a “good faith” deposit that your broker holds to ensure you can cover any potential losses on the trade.

Margin is directly linked to leverage. For example:

- With 1:30 leverage, you need to put up just 3.33% of the trade value as margin.

- If you want to open a £3,000 position, you’ll need:

Margin = £3,000 x 3.33% = £100

How Margin Works in Practice:

- You deposit £500 into your trading account.

- You open a trade worth £1,500 (thanks to 1:30 leverage).

- The broker holds part of your £500 as “margin” (let’s say £50).

If the market moves against you and your losses get close to your margin amount, the broker will issue a margin call—a warning that you need to deposit more funds or risk having your position closed automatically.

Important Note: FCA regulations protect retail traders with negative balance protection, so you can’t lose more than your deposit. This ensures that even if the market moves aggressively against you, your account won’t dip below zero.

What is a Margin Call, and How Do I Avoid It?

A margin call happens when your account balance falls below the required margin level. At this point, your broker will either ask you to deposit more money or close your trade to prevent further losses.

Why Do Margin Calls Happen?

- Your trade moves against you, and your equity drops.

- You’re trading with too much leverage relative to your account size.

Example:

- You open a £3,000 position with £100 margin (1:30 leverage).

- If the trade moves £90 against you, your equity falls close to the margin requirement.

- The broker issues a margin call, and if you don’t add more funds, they’ll close the trade.

How to Avoid Margin Calls:

- Use Lower Leverage: Start with smaller trades to reduce your risk.

- Set Stop Losses: This ensures trades close automatically before your losses get too big.

- Monitor Your Margin Level: Keep an eye on your available margin and adjust your positions if necessary.

What is Leverage and Margin Combined?

Now that we’ve covered leverage and margin individually, let’s clarify how they work together.

Leverage determines how much you can control relative to your deposit, while margin is the amount you must put up to open that trade.

Example:

- Leverage: 1:30

- Trade Size: £3,000

- Margin Required: £3,000 ÷ 30 = £100

If the trade goes against you, your losses will still be calculated based on the full £3,000 position, not just the £100 margin you put up. This is why managing risk and position size is crucial when using leverage.

What is Risk Management, and Why is It Important?

Risk management is the process of protecting your trading capital by limiting potential losses on each trade. Without it, you could blow up your account after just a few bad trades.

Here’s how you can implement effective risk management:

- Only Risk 1-2% of Your Account Per Trade:

- If you have £1,000 in your account, risk no more than £10-£20 per trade.

- Use Stop Losses:

- Always set a stop loss to cap your downside. If the market moves against you, the trade closes automatically, limiting your loss.

- Position Sizing:

- Use the correct lot size for your account size (refer to our earlier section).

- Diversify Your Trades:

- Don’t put all your capital into one asset. Spread your risk across forex pairs, indices, and commodities.

- Keep Leverage Low:

- High leverage can magnify losses. Stick to 1:10 or lower if you’re new to trading.

Example of Safe Risk Management:

- Account Balance: £1,000

- Trade Risk: 2% (£20)

- Stop Loss: 20 pips

- Lot Size: 0.1 (mini lot, £1 per pip)

If your stop loss gets hit, you lose £20—but your account is still intact, and you can keep trading.

What is Slippage, and Why Does It Happen?

Slippage occurs when your trade executes at a price different from what you expected. This usually happens in fast-moving or highly volatile markets.

Example:

- You place a buy order at 1.2500, but the market jumps quickly, and your order executes at 1.2503. That 3-pip difference is slippage.

Why Slippage Happens:

- Market Volatility: Price can change rapidly during news events or economic releases.

- Liquidity Issues: If there aren’t enough buyers or sellers at your desired price, the broker executes the trade at the next best available price.

How to Reduce Slippage:

- Trade during major market hours when liquidity is high.

- Use limit orders instead of market orders.

- Avoid trading during high-impact news events if you’re risk-averse.

Fees Explained for Beginners

What are Spreads and Commissions in Trading?

The spread is the difference between the bid (sell) price and the ask (buy) price. It’s essentially the cost of placing a trade and is how brokers make money.

Example:

- Bid: 1.2500

- Ask: 1.2502

- Spread: 2 pips

Types of Spreads:

- Fixed Spreads: Stay the same regardless of market conditions.

- Variable Spreads: Change based on market volatility and liquidity.

Commissions:

Some brokers charge a commission per trade in addition to spreads, particularly on “Raw” or “ECN” accounts with very tight spreads.

How to Choose the Right Broker Based on Costs:

- If you’re a beginner, look for brokers with low fixed spreads and no commissions.

- For scalpers and high-frequency traders, brokers with low variable spreads and commissions are ideal.

What are Swap Fees in Trading?

Swap fees (or overnight fees) are charges applied when you hold a leveraged position overnight. Brokers charge these fees because you’re effectively borrowing money to keep the trade open.

How Swap Fees Work:

- If you buy a forex pair, you’re borrowing the currency with the lower interest rate and holding the one with the higher rate.

- You earn or pay the difference in interest rates (the “swap”).

Example:

- You buy GBP/USD and hold it overnight. If the interest rate for GBP is higher than USD, you’ll earn a small amount. If it’s lower, you’ll pay a fee.

Key Tip: If you plan to hold trades for multiple days, factor swap fees into your strategy.

What Tools Do Beginner Traders Need?

To set yourself up for success, here are the key tools every trader should use:

- Economic Calendar:

- Track major economic events like interest rate decisions or employment reports that impact the markets.

- Demo Accounts:

- Practise trading with virtual money before risking real funds.

- Trading Calculators:

- Use calculators to determine pip value, lot size, and margin requirements.

- Risk Management Tools:

- Set stop losses, take-profit levels, and trailing stops to manage your trades effectively.

- Charting Software:

- Use platforms like MetaTrader or TradingView for technical analysis and price tracking.

You can always check out a broker review and we actually review the tools & education that each broker provides – XTB is actually our favourite broker for education so if you are interested in using their platform you can always sign-up using the link below.

No Minimum Deposit

Best for Investing

XTB offers a proprietary platform with incredible trading resources & educational material in an easy-to-use, low cost trading environment. Perfect for currency traders.

73% of retail investor accounts lose money when trading CFDs with XTB Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Bonus Tips for Beginner Traders in the UK

- Always use a stop loss—it’s your best friend for managing risk.

- Start small: Trade micro lots until you get comfortable.

- Practice on a demo account: It’s the safest way to learn without risking real money.

- Understand leverage: It’s a double-edged sword—great when you’re winning, brutal when you’re losing.

Conclusion: Getting Started

We know trading can feel overwhelming at first, but understanding these key concepts—like pips, lots, leverage, and margin—will give you a solid foundation to build on.

The most important lessons for beginners are:

- Always manage your risk by setting stop losses and using appropriate lot sizes.

- Start small and trade with low leverage until you gain more experience.

- Take advantage of demo accounts to practice before committing real money.

Trading is a journey, and like any skill, it takes time and practice. But with the right tools and a clear understanding of the basics, you’ll be well on your way to navigating the markets confidently.

Ready to get started? We recommend opening a demo account with a trusted FCA-regulated broker and start practising to get a feel of it. The best trading ‘platforms’ which are actually brokers, of beginners are Plus500 or IG depending on what kinds of things you want to trade and how long you imagine yourself trading, whether casual or more advanced.

If you want to check out Plus500, feel free to use the link below to visit their site.

£100 Minimum Deposit

Best Mobile App

Plus500 is a great mobile-first trading platform for UK traders looking to get started with CFD trading.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Resources for Beginner Traders

BabyPips School of Pipsology

Source: BabyPips

URL: https://www.babypips.com/learn/forex

Investopedia’s Trading for Beginners

Source: Investopedia

URL: https://www.investopedia.com/articles/trading/05/011705.asp

IG Academy’s Online Trading Courses

Source: IG Academy

URL: https://www.ig.com/uk/learn-to-trade/ig-academy/courses

Coursera’s Trading Strategies in Emerging Markets

Source: Coursera

URL: https://www.coursera.org/search?query=trading

ForexTime’s Forex Trading for Beginners

Source: FXTM

URL: https://www.forextime.com/education/forex-trading-for-beginners

Saxo Bank’s How to Start Forex Trading Guide

Source: Saxo Bank

URL: https://www.home.saxo/learn/guides/forex/how-to-start-forex-trading

CMC Markets’ Forex Trading for Beginners

Source: CMC Markets

URL: https://www.cmcmarkets.com/en-gb/learn-forex/forex-trading-for-beginners

Fusion Markets’ Beginner’s Guide to Trading Forex

Source: Fusion Markets

URL: https://fusionmarkets.com/posts/beginners-guide-to-trading-forex

- Can I Make a Living from Trading in the UK? - December 26, 2024

- Beginners Trading Guide for UK Traders - December 15, 2024

- Trading in the UK? Here are Some Key Facts. - December 10, 2024