Forex.com, owned by the fantastic StoneX Group, is perhaps one of the best trading platforms that I’ve had the pleasure of trading. They offer tight spreads, a beginner-friendly platform, and great educational content, making it a top trading broker for all experience levels.

- FOREX.com Broker Review: UK 2025

- Is FOREX.com a Good Broker?

- What Can I Trade on FOREX.com

- What Are the Fees for FOREX.com?

- What Are FOREX.com’s Trading Platforms?

- Does FOREX.com Have Fast Execution Speeds?

- Is it Easy to Get Up and Running on Forex.com?

- Is It Easy to Deposit and Withdraw Funds on FOREX.com?

- Is FOREX.com a Safe and Regulated Broker?

- Is FOREX.com Beginner-Friendly?

- Is FOREX.com the Right Broker for You?

- Final Verdict

- Who Should Use FOREX.com?

- FAQs

FOREX.com Broker Review: UK 2025

When I first dove into FOREX.com, I already knew (like you probably do) that it was a heavyweight in the trading space. Launched ‘back’ in 2001, this broker has been around long enough to earn a solid reputation among UK traders.

But what I really wanted to know was—can it still hold its ground in the more conventional trading world against competitors like Pepperstone, IG, and it’s sister site City index? After weeks of testing FOREX.com’s platforms, fees, execution speeds, and educational resources, I came away with a clear picture….

In Summary: If you’re a UK trader who’s serious about forex and CFD trading, FOREX.com has a lot to offer. From competitive spreads to a solid lineup of platforms (including MetaTrader 4 and 5, TradingView and Apple & Android apps), it’s a frankly incredible choice.

But it’s not without its quirks—especially when it comes to market variety – it’s no IG – so if you are looking to trade forward contracts on chickens feet you’ll be unlikely to find it, but they have everything an FX trader needs. Here’s everything you need to know to decide if FOREX.com is the right fit for you.

Is FOREX.com a Good Broker?

- Regulated by the FCA, ensuring UK traders are in safe hands

- Tight forex spreads starting from 0.8 pips on major pairs

- Access to MT4, MT5, and a sleek proprietary Web Trader platform

- Excellent educational resources for beginners and intermediate traders

- Fast execution speeds, ideal for day traders and scalpers

- Limited range of tradable instruments compared to IG

- £15 inactivity fee after one year of no trading

FOREX.com is a fantastic choice if you’re focused on forex and CFD trading. It’s FCA-regulated, has some of the tightest spreads around, and offers a range of trading platforms that cater to both beginners and advanced traders. The educational resources are (surprisingly!?) strong, and execution speeds were impressive in my testing.

If you’re looking for thousands of tradable instruments, they key is in the name… so you might want to look elsewhere.

What Can I Trade on FOREX.com

Trading Markets – 4 / 5 Stars

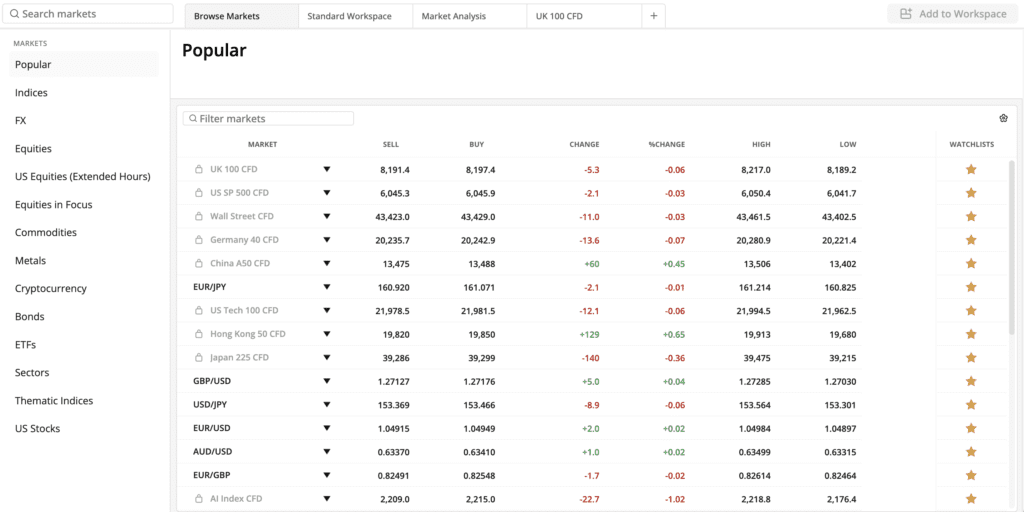

Hmmm… take a wild guess. FOREX.com keeps things fairly streamlined when it comes to tradable markets, with a strong focus on forex and CFDs. You won’t get the huge market variety that brokers like IG or City Index offer, but what’s here is solid, especially for currency traders.

What You Can Trade:

- Forex: You get access to 80+ currency pairs, from major pairs like EUR/USD and GBP/USD to less common exotics like USD/TRY. Spreads on major pairs start at a competitive 0.8 pips.

- Indices: Trade major global indices like the FTSE 100, NASDAQ 100, and S&P 500. I found the spreads here to be reliable and consistent during testing.

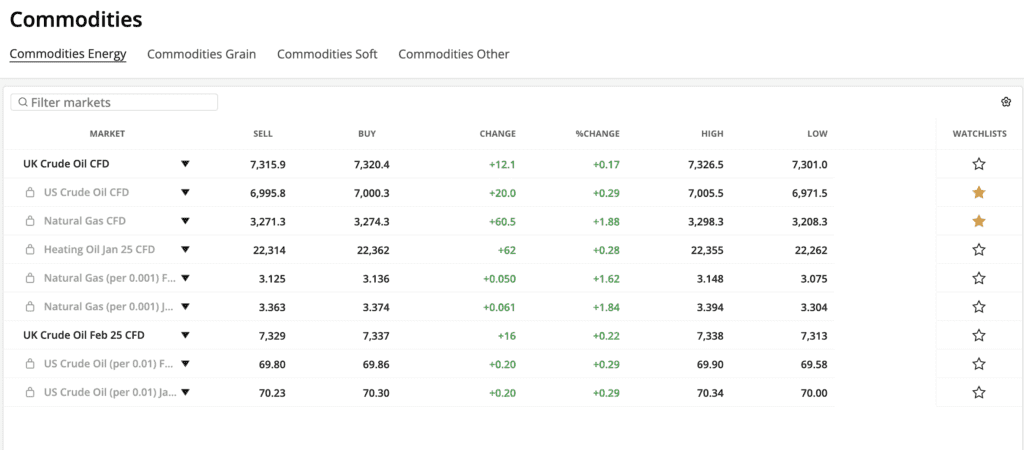

- Commodities: A decent mix of commodities like gold, silver, nat sas, soybean, wheat, crude oil etc. so the classics. Spreads on gold start at 0.3 points, which is competitive. However, there weren’t as many options as I would’ve liked to be honest (see screenshot below).

- Shares: FOREX.com offers share CFDs from major markets like the UK and US. While the range is smaller compared to IG, you still get access to key stocks from the UK & US.

- Cryptocurrencies: Due to FCA regulations, crypto CFDs are not available for UK retail clients (if you don’t know that by now…)

My Experience:

I spent most of my time trading (drumroll please…) forex, focusing on GBP/USD and EUR/USD pairs. I was particularly impressed with the spreads, which held up consistently during both high and low volatility periods. The execution speeds were solid too—there was minimal slippage, even during fast-moving markets.

When I tested indices like the FTSE 100 and NASDAQ 100, the spreads remained competitive. While the range of commodities and shares isn’t groundbreaking, it’s good enough for traders who want to dip into other markets without leaving their forex focus behind.

Verdict:

If you’re all about forex trading, FOREX.com delivers. The range of pairs, competitive spreads, and solid execution speeds make it a strong option for currency traders. If you need a broker with access to thousands of shares or niche markets, however, IG or City Index might be a better fit.

Forex.com Markets Summary.

Great selection of classic options and a currency trader’s best friend – not going to get any super niche options but enough to satisfy intermediate and advanced traders.

What Are the Fees for FOREX.com?

Fees – 4.5 / 5 Stars

FOREX.com’s fees are competitive, especially for forex traders. They’re clear, transparent (I mean they literally spell it all out for your on their site!), and easy to understand—which something I always appreciate.

What to Expect:

- Forex Spreads: Spreads start from 0.5 pips on major pairs like EUR/USD (was more like 0.8 when I was trading but still good). So this is inline with the competition / top brokers.

- Shares CFDs: FOREX.com operates has share / stocks with commissions of 0.08%.

- Inactivity Fees: A £15 monthly fee kicks in after 12 months of inactivity—so keep that in mind if you don’t trade regularly. If you are wondering whether this is high, no, it’s not compared to other brokers.

- Deposit/Withdrawal Fees: There are no fees for deposits or withdrawals on FOREX.com’s side, though your bank may charge you for certain methods.

My Experience:

I tested FOREX.com’s Standard account and found the forex spreads competitive across the board. EUR/USD consistently stayed around 0.8–1 pip during peak trading hours, which is perfectly reasonable for most traders. For more experienced traders, the RAW Spread account is worth considering for even tighter spreads, especially if you trade in higher volumes.

The lack of deposit or withdrawal fees is always a plus, and while the inactivity fee is annoying, it’s pretty standard across brokers.

Verdict:

FOREX.com offers competitive fees, particularly for forex trading. The spreads are tight and the lack of funding fees is a bonus. Just don’t let your account sit idle for too long, or you’ll get hit with that inactivity fee.

Forex.com Fees Summary.

Inactivity fee kicks in a bit sooner than I would’ve liked but broadly competitive spreads and no deposit or withdrawal fees.

What Are FOREX.com’s Trading Platforms?

Trading Platforms – 5/ 5 Stars

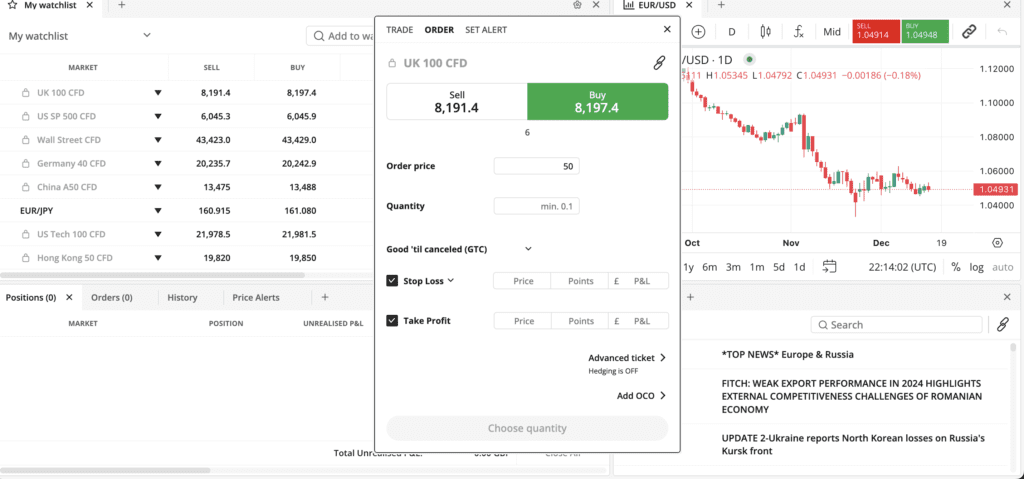

OK, this was a shocker for me. I thought the spreads would be the highlight of Forex.com – I really did. However, I was frankly blown away by their platform and I have seen a lot of platforms – don’t judge me! It has this kind of sophisticated simplicity you would find in XTB, combined with the clarity of Plus500 and the versatility of IG – but somehow it gracefully combines all of these into an easy trading experience.

Guess what… you also get your old faithfuls of MetaTrader 4 and 5, along with their proprietary Web Trader, TradingView integration and mobile platforms for both iOS and Android. So yeah, there really isn’t anything to complain about even if you tried.

What’s Available:

- MetaTrader 4 (MT4): The classic platform for forex traders. It’s reliable, customizable, and great for automated trading with Expert Advisors (EAs).

- MetaTrader 5 (MT5): An upgrade on MT4, with extra timeframes, order types, and features like Depth of Market (DOM). Perfect for traders who want more advanced tools.

- Web Trader Platform: FOREX.com’s proprietary platform offers a clean, intuitive interface with advanced charting, real-time analysis, and easy order execution.

- Mobile App: The mobile platform mirrors the Web Trader experience, making it easy to trade and manage your account on the go.

My Experience:

I spent most of my time on the Web Trader platform and found it impressive. The charting tools are sleek and easy to use, with plenty of indicators to customize your analysis. It’s perfect if you want a streamlined trading experience without the bells and whistles of MT4 or MT5.

That said, I’m a big fan of MT4 and MT5 for their flexibility. I set up a couple of Expert Advisors during testing, and the execution was smooth, with no major delays or glitches. The mobile app was another standout—it felt like a fully-fledged trading platform rather than a cut-down version, which is exactly what you want when trading on the go.

Verdict:

FOREX.com’s platforms are top-notch. Whether you’re a fan of MetaTrader or prefer a simple web-based solution, there’s something here for everyone. The mobile app is particularly impressive, and the addition of MT5 gives advanced traders more tools to work with.

Forex.com Platform Summary.

Awesome, truly proprietary platform built for ease-of-use and simplicity. One of the best platforms and integrates with MT5 / MT4 as well as TradingView. Also, the mobile app is stellar.

Does FOREX.com Have Fast Execution Speeds?

Execution Speed – 5 / 5 Stars

In short: Yes, FOREX.com absolutely delivers when it comes to execution speed. With a No Dealing Desk (NDD) model, trades are sent directly to the market with minimal interference, ensuring you get reliable, fast order execution.

My Experience:

I tested FOREX.com’s execution speed across major forex pairs (EUR/USD, GBP/USD) and indices (FTSE 100, NASDAQ 100) during both high and low volatility periods. Orders were executed almost instantly, with barely any noticeable slippage. For day traders and scalpers—where speed can make or break your profits—this was a huge plus.

The NDD model means you’re getting raw market prices with no broker intervention, which builds trust. Combine this with tight spreads, and it’s clear why FOREX.com appeals to high-frequency and algo traders.

Verdict:

FOREX.com crushed it when it comes to execution speed. Whether you’re scalping, day trading, or running automated strategies, the NDD model ensures trades are executed quickly and reliably.

Forex.com Speed Summary.

Quick, lightning speed for execution thanks to NDD model.

Is it Easy to Get Up and Running on Forex.com?

Onboarding Process – 5 / 5 Stars

Getting started with FOREX.com literally took me about 10-15 minutes… it was super straightforward (a tiny bit longer than others though… They so have it directly on their homepage so it was really convenient.

My Experience

I signed up for a live account to see how the process holds up. The online application took me around 10 minutes, asking for the usual details: name, address, employment status, trading experience, and financial background. FOREX.com does require you to verify your identity and address (a standard regulatory process), so I uploaded my photo ID and a utility bill.

Here’s the part I liked: within 24 hours, my account was verified and ready to go. No unnecessary delays, no awkward back-and-forths—just smooth, efficient verification. If you’re impatient (like me) to start trading, this streamlined process is a big win.

For those who want to test the waters first, FOREX.com’s demo account is perfect – it’s about 1 minute and all you need is you email address and they then generate a password which is awesome and saves any hassle of creating your own password. You get access to £10,000 in virtual funds, and the same platform is the same as live trading, so you can practice your strategies (and see why i lied it so much) before trading anything. I always recommend demo accounts to beginners, and FOREX.com’s version ticks all the right boxes.

Verdict

FOREX.com makes onboarding incredibly easy. Whether you’re opening a live account or trying out the demo, the process is quick, intuitive, and beginner-friendly. It’s exactly what you want when getting started with a new broker.

Forex.com Onboarding Summary.

No obvious onboarding issues and demo account provided for practice accounts.

Is It Easy to Deposit and Withdraw Funds on FOREX.com?

Deposit & Withdrawal – 4.5 / 5 Stars

Depositing and withdrawing money on FOREX.com is straightforward, with a solid range of payment options and a clear, fee-free process. The minimum deposit is £100 for Forex.com, which is not £0, but it’s close enough and fees nominal more than anything just to prove that you are serious and might actually trade something.

What You Can Use:

- Debit/Credit Cards: Deposits are instant, making this the quickest option to get started.

- Bank Transfer: Typically takes 1–2 business days to process, depending on your bank.

- PayPal: A great option for traders who prefer using e-wallets for speed and convenience.

My Experience:

Depositing funds with FOREX.com was seamless. I used a debit card for my initial deposit, and the money hit my trading account within seconds. For withdrawals, I tested a bank transfer, and the funds arrived in my account in two business days—well within their stated timeframe.

The best part? FOREX.com doesn’t charge any deposit or withdrawal fees. That said, it’s worth noting that some third-party fees might still apply, depending on your bank or payment provider.

One minor issue I noticed was the lack of instant withdrawals for PayPal. While deposits are fast, withdrawals took slightly longer than expected—something to keep in mind if you need quick access to your funds.

Verdict:

FOREX.com makes depositing and withdrawing funds simple and fee-free. The variety of payment methods ensures you can choose what works best for you, though withdrawals could be slightly quicker on PayPal.

Forex.com Deposit & Withdrawal Summary.

There is a minimum deposit of £100 which might turn off some newer traders and the deposit options are fairly standard.

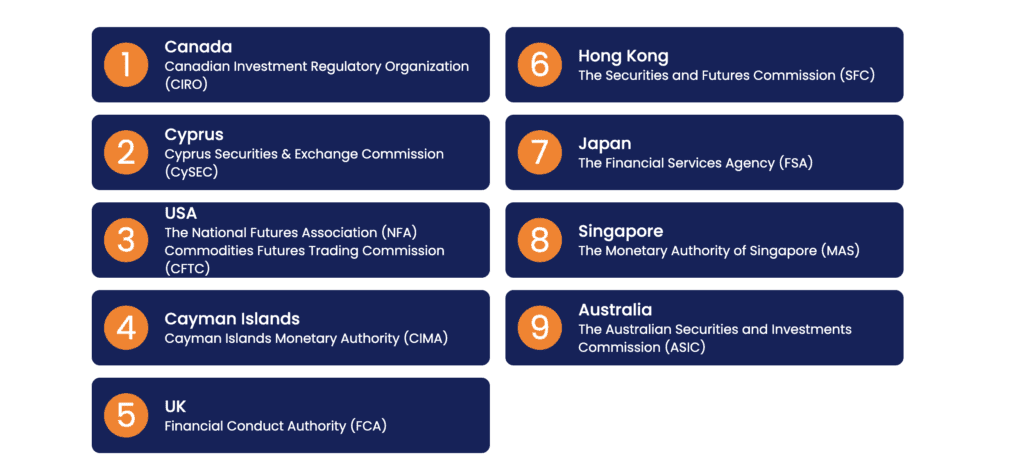

Is FOREX.com a Safe and Regulated Broker?

Regulation and Security – 5 / 5 Stars

If regulation and security are at the top of your checklist (and they should be), FOREX.com ticks all the boxes. They’re regulated by some of the most respected financial authorities worldwide, including ASIC, NFA & CFTC in the USA and, of course, the FCA here in the UK.

What Makes Them Safe:

- FCA Regulation: As an FCA-regulated broker, FOREX.com must meet strict financial standards to ensure transparency and client fund protection.

- Segregated Client Funds: Your funds are held in Tier-1 banks, separate from the broker’s operational funds. This means even if FOREX.com goes under (unlikely), your money is safe.

- Negative Balance Protection: Retail clients can’t lose more than their account balance, a must-have feature when using leverage.

- FSCS Protection: UK traders are covered up to £85,000 under the Financial Services Compensation Scheme (FSCS).

My Experience:

From the moment I signed up, I felt confident trading with FOREX.com. They have more protections than nearly everyone else in the game apart from IG.

For UK traders, the FSCS protection is an excellent safety net—though I hope you’ll never need it! Combine that with negative balance protection, and it’s clear that FOREX.com takes security seriously.

Verdict:

FOREX.com is one of the safest brokers you can trade with. FCA regulation, segregated funds, and FSCS coverage make it a rock-solid option for UK traders.

Forex.com Regulation Summary.

Back by StoneX (publicly traded financial services provider), regulated across multiple jurisdictions – not just the UK.

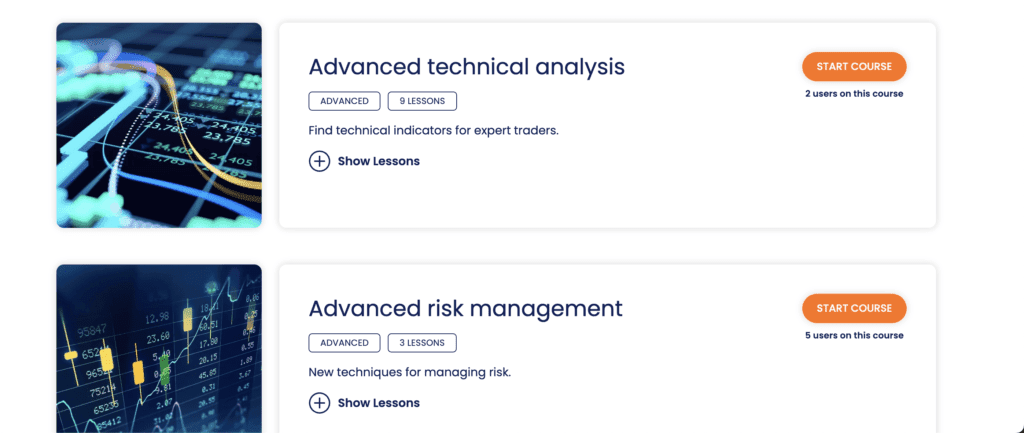

Is FOREX.com Beginner-Friendly?

Education – 5/ 5 Stars

Yes, Forex.com is great for beginner traders in the UK. FOREX.com has done a great job providing educational resources for traders of all experience levels. From beginner-friendly guides to more advanced strategy tips, there’s plenty to dig into if you’re looking to improve your trading skills.

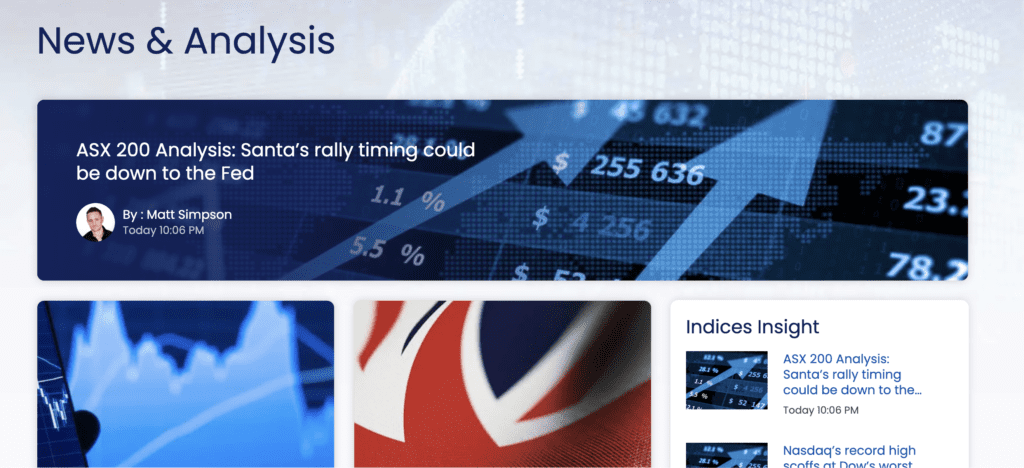

What’s Available:

- Trading Academy: A library of articles, videos, and tutorials covering everything from forex basics to advanced charting strategies.

- Webinars: Regular live webinars featuring market experts who share tips, strategies, and insights.

- Market Analysis: Daily updates on key market events, economic reports, and potential trading opportunities.

- Platform Tutorials: Step-by-step guides on using their platforms, including MetaTrader and Web Trader.

My Experience:

As someone who’s spent a lot of time testing broker education resources, I found FOREX.com’s content to be well-structured, detailed, thorough and easy to follow. The Trading Academy is a goldmine for beginners—covering everything from what pips are to how leverage works.

For more experienced traders, their market analysis and webinars offer actionable insights to refine your strategies. I tuned into one of their forex-focused webinars, and the presenter broke down the latest market trends in a clear and relatable way.

If I had one minor gripe, it’s that FOREX.com’s educational content leans heavily toward forex trading. If you’re interested in learning more about indices or shares, the content feels a bit limited compared to IG or XTB.

Verdict:

FOREX.com’s educational resources are excellent, especially for beginners and intermediate forex traders. The Trading Academy and webinars provide clear, actionable content, though there’s room to expand for non-forex markets.

Forex.com Education Summary.

Detailed and comprehensive educational resources – frankly one of the best we’ve seen for beginners, intermediate and more advanced traders.

Is FOREX.com the Right Broker for You?

FOREX.com stands out as a top choice for UK traders who are serious about forex trading. With tight spreads, reliable platforms, and fast execution speeds, it’s a broker that delivers where it matters most. The FCA regulation, segregated funds, and FSCS protection make it an excellent option for security-conscious traders.

That said, it’s not perfect. If you’re looking for market variety or a wider selection of share CFDs, brokers like IG or even it’s sister site City Index might be a better fit. But for forex traders, FOREX.com is hard to beat.

Final Verdict

So, is FOREX.com worth your time and money? Here’s my take:

If you’re a forex trader looking for a broker that offers competitive pricing, a strong regulatory framework, and access to advanced tools, FOREX.com is an excellent choice. They offer frankly an incredible range of platforms, all of which are great combined with super quick execution and low spreads. It’s one of the best brokers around for UK traders, hands-down.

While FOREX.com might not have the most diverse asset range compared to brokers like IG or City Index, it’s hard to argue with its focus on forex trading—it’s literally in the name. For forex traders and those wanting access to commodities and indices, FOREX.com delivers in spades.

Who Should Use FOREX.com?

✅ Choose FOREX.com if:

- You’re focused on forex and commodities trading.

- You want low spreads and transparent pricing.

- You value fast execution and platform flexibility (MT4, MT5, and Web Trader).

- You’re a UK trader looking for a broker with FCA regulation.

❌ Consider alternatives if:

- You want a huge range of assets like IG’s 17,000+ markets.

- You’re primarily a stock or ETF trader looking for zero-commission trading.

FAQs

Here are answers to some of the most common questions traders ask about FOREX.com:

- Is FOREX.com regulated in the UK?

Yes, FOREX.com is fully regulated by the FCA (Financial Conduct Authority) in the UK, ensuring a secure and transparent trading environment. - What platforms does FOREX.com offer?

FOREX.com provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Web Trader platform, which is intuitive and feature-rich. - What is the minimum deposit at FOREX.com?

The minimum deposit is £100, making it accessible for beginner traders. - Does FOREX.com charge any inactivity fees?

Yes, FOREX.com charges a monthly inactivity fee of £15 after 12 months of no trading activity. - Can I trade cryptocurrencies on FOREX.com?

No, crypto CFDs are not available for UK retail clients due to FCA regulations. However, professional traders may have access to crypto trading. - How long does it take to withdraw funds from FOREX.com?

Withdrawals via debit/credit cards and PayPal typically take 1–2 business days, while bank transfers may take up to 3–5 business days. - Is there a FOREX.com demo account?

Yes, FOREX.com offers a free demo account with virtual funds, allowing you to practice trading before risking real money. - Does FOREX.com offer negative balance protection?

Yes, retail traders are protected from losing more than their account balance under FCA regulations.

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025

- Forex.com vs Pepperstone - December 26, 2024