EightCap is a fantastic broker for the pick-up-and-go style trader who wants to get started in TradingView quickly and easily. They offer fewer trading markets than other big-hitters but they are still worthwhile for beginner traders.

EightCap Trading Broker Review: UK 2025

I first came across Eightcap when I was looking for a broker that specialised in forex and CFD trading with low costs and plenty of platform flexibility.

Whilst not meeting everything on my criteria, especially when it comes to platform flexibility, and not being as widely recognised as some of the bigger names like IG, City Index or Pepperstone, Eightcap has steadily built a strong reputation since its founding in 2009.

So, does this Australian-based broker live up to the hype? After several weeks of testing their features, trading platforms, and pricing, I can say that Eightcap has a lot to offer. Their standout features include tight spreads, integration with TradingView.

Here’s my comprehensive review, based on hands-on experience.

- Regulated by ASIC and FCA, ensuring a secure trading environment

- Fast execution speeds with no-dealing desk (NDD) trading

- Strong customer support, available 24/5

- No e-wallet options like PayPal or Skrill for deposits and withdrawals

- Limited selection of share CFDs compared to some competitors

- No other trading platform other than TradingView

Is Eightcap a Good Broker for Beginner Traders in the UK?

In my experience, Eightcap is a great choice for UK traders who are just starting out and want a simple and cost-effective way to trade forex and CFDs. They might not have as many features or instruments as some bigger brokers, but what they do, they do well.

EightCap seems to be targeted towards millennial and GenZ beginner traders. Unlike some other brokers, they partnered with TradingView and for good reason. Most beginners learn to trade through that platform, and EightCap knows this group exists and is only growing. Now this isn’t to detract from their fantastic, laser-focus on execution but let’s just say if you are looking for a all-round comprehensive, some would even say ‘old-school‘ broker, then this might not be the choice for you.

Does EightCap have a Lot of Markets to Trade?

Trading Markets – 4 / 5 Stars

Eightcap focuses on forex and CFDs, offering over 600 instruments. While this is a decent selection, it’s not as extensive as brokers like City Index, which provide thousands of assets. The range is more focused on core instruments, so if you’re after niche assets, you might find the options limited.

What You Can Trade

- Forex:

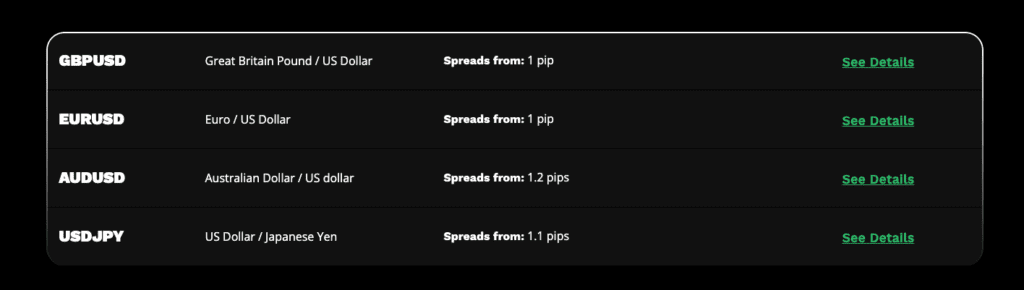

Forex is the star of the show here. Eightcap offers 40+ currency pairs, including majors, minors, and exotics. Spreads start at 1.0 pips for pairs like EUR/USD on the Standard account, which is in line with other brokers offering commission-free trading. - Indices:

The index range covers all the big names, including the FTSE 100, NASDAQ 100, and S&P 500. During my testing, they stayed pretty consistent even during busy trading hours. - Commodities:

If you trade gold, oil, or silver, Eightcap has you covered. I traded gold with fairly decent spreads compared to other brokers, and I found the costs competitive for both day trading and longer-term positions. - Shares and ETFs:

Eightcap offers share CFDs for global companies like Tesla and Apple, but the range is smaller compared to brokers like XTB or City Index. This could be limiting if you’re focused on stock trading. - Cryptocurrencies:

Crypto CFDs are available for professional traders, with options including Bitcoin and Ethereum. Retail traders, however, won’t have access due to FCA restrictions.

My Experience

I spent most of my time trading forex and indices, and Eightcap delivered a smooth experience. Spreads on EUR/USD were consistent, and I didn’t experience any unexpected costs. Trading indices like the S&P 500 was equally straightforward, with fast execution speeds that made it easy to respond to market movements.

The share CFD range felt a bit restrictive. While the big names were available, I missed having access to a broader selection, particularly for smaller companies or ETFs.

Verdict

While EightCap’s market range won’t blow you away, it’s a strong choice if your focus is Forex or major indices. For a broader selection, brokers like IG or XTB may be better fits.

EightCap Markets Summary

600+ CFD instruments to trade – not the widest selection but all the majors are covered.

What Are the Fees on EightCap?

Fees – 4 / 5 Stars

Eightcap’s fee structure is simple and transparent. For UK traders, there’s only one account type – the standard account – you do not have access to a Raw or Razor account (where you are charged a fixed cost per round-turn), instead you only have access to a spread-only model where the price is baked into the cost of trading, with no commissions.

What to Expect

- Forex Spreads: Spreads start at 1.0 pips on EUR/USD and similar pairs (see above).

- Indices Spreads: Index trading spreads start at 0.5 points for indices like the NASDAQ 100.

- Commodities Spreads: Gold spreads start at 0.12 points, while crude oil spreads are around 3.0 points.

- Inactivity Fees: Eightcap charges a $50 fee after three months of inactivity.

My Experience

The spread-only model on the Standard account worked well for me, especially since there are no commissions to calculate. On EUR/USD, spreads stayed at 1.0 pips during most of my trades, which felt competitive for the account type.

For indices, I found the 0.5-point spread on the FTSE 100 to be consistent throughout the day, even during periods of moderate volatility. However, the inactivity fee does stand out as something to watch for, especially if you don’t trade regularly.

Verdict

Eightcap’s fees are fair and straightforward, making them a good option for traders who value simplicity. While the lack of a commission-based Raw account might deter some, the Standard account’s spreads are competitive enough for most retail traders.

EightCap Fees Summary

Not the lowest fees available but given the ease-of-use for setting up and trading on TradingView it felt fine to pay a little more – as strange as it might be.

Does EightCap have Fast Execution?

Execution Speed – 4.5 / 5 Stars

Execution speed is a critical factor for any trader, especially if you’re into scalping or day trading. With EightCap’s no-dealing desk (NDD) model, trades are executed directly in the market with minimal interference, which I found to be a key advantage to getting trades done quickly.

My Experience

From the moment I started trading with EightCap, the execution speed stood out. I tested multiple instruments, including EUR/USD and the FTSE 100, during high-volatility periods like major economic announcements. Despite the market fluctuations, my trades went through almost instantly, with no significant slippage.

For algo trading, I used TradingView’s automation tools integrated with EightCap, and the performance was seamless. Trades triggered by my strategies were executed without a noticeable delay, which is crucial for maintaining strategy accuracy.

On the commodities front, gold and crude oil orders executed quickly and reliably, even during peak trading hours. This consistency gave me the confidence to place trades knowing the platform could keep up.

Verdict

EightCap excels in execution speed, making it a fantastic choice for traders who rely on precision, like scalpers and algo traders. The NDD model ensures transparency and minimal latency, delivering a smooth experience across all instruments.

EightCap Speed Summary

Good speed. My feeling is they work with TradingView directly to ensure seamless integration.

Is it Easy to Withdraw & Deposit with EightCap?

Deposit & Withdrawal – 4 / 5 Stars

Managing funds with EightCap in the UK is fairly straightforward, with several deposit and withdrawal options like debit cards, bank transfers taking roughly 1-3 days for withdrawals. However, the lack of e-wallets like PayPal or Skrill for UK clients is a slight drawback.

What You Can Use

- Bank Transfers: These take 1–3 business days to process.

- Debit/Credit Cards: Most deposits are processed instantly.

- No E-Wallets: Popular methods like PayPal or Neteller are unavailable for UK traders, which limits flexibility.

My Experience

I used a debit card for my initial deposit, and the funds were available in my trading account within minutes. The process was smooth and didn’t involve any extra steps, which was a plus.

For withdrawals, I tested both a bank transfer and a card withdrawal. The bank transfer took two business days to reach my account, while the card withdrawal was slightly quicker, arriving within 24 hours. I appreciated that EightCap doesn’t charge any fees on their end for deposits or withdrawals, but it’s worth noting that your payment provider might add its own charges.

One limitation was the absence of e-wallet options. While I’m comfortable using cards and bank transfers, having PayPal or Skrill would add convenience for traders who prefer those methods.

Verdict

EightCap’s deposit and withdrawal process is simple and fee-free on their side, but the lack of e-wallet options for UK clients is noticeable. Despite this, the fast processing times and transparent policies make it easy to manage your funds.

EightCap Deposit & Withdrawal Summary

Very standard deposit options lacking any e-wallets and more advanced deposit options but good enough for most traders.

Is EightCap a Legit & Trusted Broker

Regulation and Security – 5 / 5 Stars

When choosing a broker, regulation and fund security are non-negotiable. EightCap scores top marks in this area, being regulated by some of the most trusted authorities in the world (ASIC & FCA).

Who Regulates EightCap?

- Financial Conduct Authority (FCA): Ensures stringent operational and financial standards for UK traders.

- Australian Securities and Investments Commission (ASIC): Adds another layer of trust for international clients.

- Cyprus Securities and Exchange Commission (CySEC): Covers European operations under MiFID II compliance.

The FCA’s regulation means you have negative balance protection meaning that you won’t lose more than your account balance if a trade goes sideways.

For UK traders, there’s the added protection of the Financial Services Compensation Scheme (FSCS), which covers funds up to £85,000 in case of insolvency.

Verdict

EightCap’s strong regulatory framework makes it a trustworthy option for UK traders. With FCA oversight, client fund segregation, and FSCS protection, your money is in safe hands.

EightCap Regulation Summary

Being regulated by the FCA is good enough but different legal structures across jurisdictions means different regulation under different names.

Is it Easy to Get Started with EightCap?

Onboarding – 4 / 5 Stars

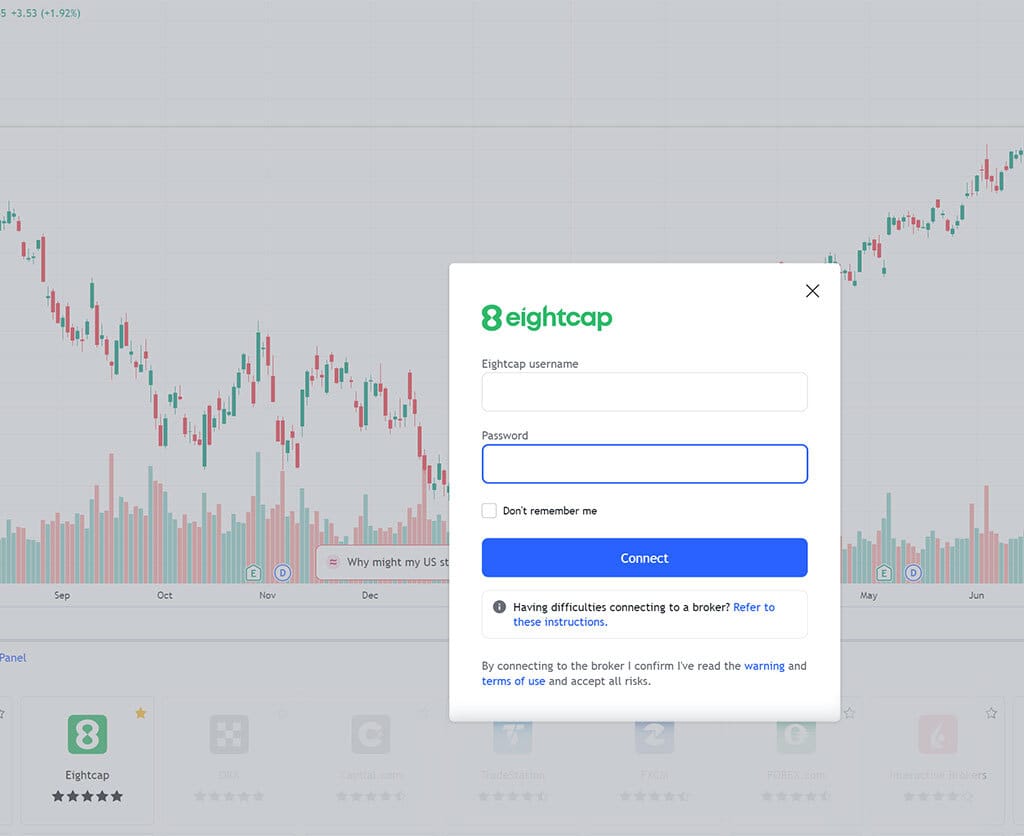

Opening an account with EightCap was one of the smoothest experiences I’ve had with a broker. The process is fully digital and designed to get you trading quickly – especially as you can do most of it pretty easily just by clicking the TradingView link (see screenshot above).

My Experience

I filled out the online application in under 10 minutes. The form asked for the usual details, like my name, address, and trading experience. For verification, I uploaded a photo ID and a utility bill. Within 24 hours, my account was approved, and I was ready to go.

What stood out was the clarity of the process. Each step was explained, and there were helpful prompts if I missed anything. The availability of a demo account was another plus—it’s ideal for testing strategies or getting used to the platform without risking real money.

Verdict

EightCap makes onboarding quick and hassle-free. Whether you’re a beginner or an experienced trader, the process is straightforward, and the demo account adds a layer of flexibility for those who want to practice first.

EightCap Onboarding Summary

Perhaps one of the easiest brokers to get up and running with, EightCap gives only one access point – TradingView. Whilst great for traders there it might be a drawback for more intermediate or advanced traders.

Is EightCap Good for Beginner Traders?

Education – 3 / 5 Stars

It’s a bit of a mixed bag when it comes to the question ‘Is EightCap a good broker for beginners‘. The reason is that it’s simple enough to get started through TradingView – one of the most popular platforms in the UK for trading – but once you are registered there is a huge lack of educational materials for beginner traders.

EightCap is still in the process of building out a comprehensive library of resources for traders, so whilst I did manage to find everything I was looking for as it pertains to EightCap themselves or what they offered, it wasn’t a comprehensive trading education like that offered by XTB, City Index or Vantage.

What’s Available

- Trading Tutorials: Video guides covering platform features, basic strategies, and market concepts.

- Webinars: Regular live sessions hosted by trading experts.

- Market Analysis: Daily insights into economic events and market movements.

- Trading Tools: Tools like Capitalise.ai to help refine and automate your strategies.

My Experience

In my digging around, all I could find was their EightCap Labs section which they will admit is a bit of a work-in-progress and probably not something you really want to spend too long on! However, there were a few educational videos I managed to find which were beginner-friendly and well-structured, though more advanced traders might find the content a bit basic. I’ve heard through the grapevine that they plan to expand the range of educational materials soon so I guess watch this space.

Verdict

EightCap’s educational resources are practical and accessible, especially for newer traders. While there’s room to expand the offering for advanced users, the mix of webinars, market updates, and tools provides great value.

EightCap Education Summary

Difficult to find, limited and WIP make it tough to rate this highly.

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025

- Forex.com vs Pepperstone - December 26, 2024