It’s the ‘Battle of The UK Brokers’ with IG vs City Index in our Battle of the Brokers series. IG proves once again why they are the top UK trading brokers but facing off against stiff competition in City Index, here’s how it went down.

Which is the Better Trading Platform: IG or City Index?

Choosing between IG and City Index can feel like a tug-of-war between two excellent (British might I add…) brokers. Both are trusted giants in the trading world, offering a robust set of tools, extensive market coverage, and a reputation built over decades (and when I say decades I really mean it!). So, which one deserves a spot on your trading journey?

Let’s dig into the key features, platforms, costs, and extras to help you decide.

1. Key Features Comparison

| IG VS City Index |  First

First |  Second

Second | |

|---|---|---|---|

| Regulation | FCA (UK), ASIC (Australia), NFA (US), and more | FCA (UK) | |

| Trading Platforms | Proprietary Platforms, MT4, TradingView | Proprietary Web Trader, MT4, TradingView | |

| Minimum Deposit | £250 | £100 | |

| Spreads | Starting from 0.6 pips on forex | Starting from 0.7 pips on forex | |

| Commissions | Spread-only pricing or £10 per side on share CFDs | Spread-only pricing for most products | |

| Range of Assets | 17,000+ (largest we review!) | 13,500+ (impressive but not IG-level) | |

| Education Resources | Extensive—IG Academy, webinars, tutorials | Comprehensive but slightly less than IG | |

| Customer Support | 24/5 via live chat, phone, and email | 24/5 via phone, chat, and email | |

| Funding Options | Credit/Debit Card, PayPal, Bank Transfer | Credit/Debit Card, PayPal, Bank Transfer | |

| Inactivity Fee | £12/month after 2 years of no activity | £12/month after 1 year of no activity | |

| Join IG | Join City index |

In Summary: IG impresses with its massive range of markets and industry-leading educational tools, while City Index brings a beginner-friendly vibe and a diverse array of trading instruments. But the devil’s in the details—so let’s get into it.

2. Fees and Spreads: Who Wins on Costs?

IG Fees

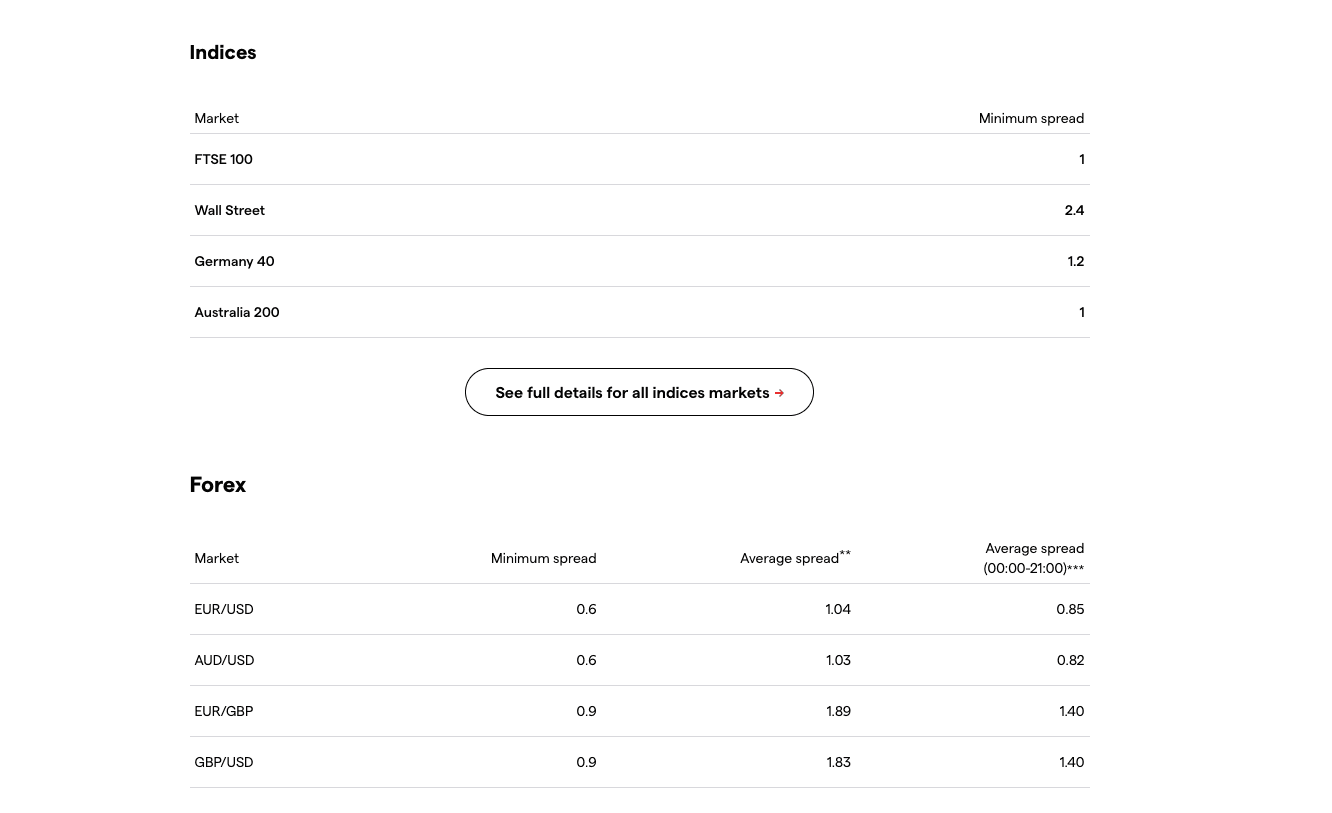

IG’s forex spreads start from 0.6 pips on major pairs like EUR/USD with an average of 0.85 (see screenshot above), making it a competitive choice for active traders. For share CFDs, IG charges a £10 per side commission, so it’s worth factoring in if equities are your thing. There’s no deposit or withdrawal fee, but keep in mind their £12 monthly inactivity fee after two years.

City Index Fees

City Index takes a no-nonsense approach with spreads starting from 0.8 pips on forex and no commission on most products. The inactivity fee for City Index kicks in after only 1 year so it’s definitely something UK traders need to watch out for. Share CFD traders will appreciate their competitive spread-only pricing.

Verdict

If you’re primarily a forex trader, IG edges out City Index with tighter spreads and a fairer inactivity fee only kicking in after 24 months.

3. Trading Platforms: Which Broker’s Tech Reigns Supreme?

IG Trading Platforms

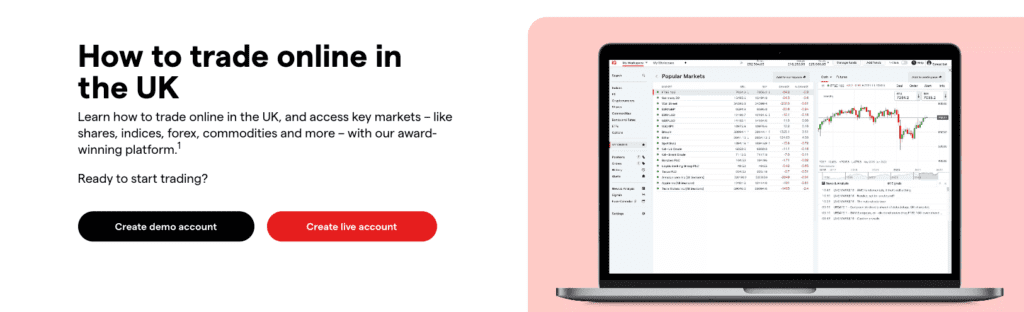

IG delivers versatility with its proprietary platforms, which offers deep customisation for advanced traders. For fans of familiar platforms, IG also supports MT4, TradingView but its proprietary platforms like ProRealTime & L2 Dealer make it one of the top brokers in the UK.

City Index Trading Platforms

City Index’s Web Trader platform is intuitive and beginner-friendly. It’s great for traders who want simplicity without sacrificing essential features. For those looking for more advanced tools, MT4 and TradingView compatibility give you flexibility.

Verdict

IG’s platform variety takes the crown here. While City Index’s Web Trader is polished, IG’s addition of ProRealTime and broader integration make it a clear winner.

4. Range of Tradable Assets: IG Towers Over the Competition

IG Asset Range

IG offers an astonishing (frankly incredible) 17,000+ tradable markets, including forex, shares, commodities, cryptocurrencies, ETFs, and more. Whether you’re into niche stocks or global indices, IG has something for everyone.

City Index Asset Range

With access to 13,500+ instruments, City Index isn’t far behind. It covers forex, indices, commodities, and shares, but it can’t quite match IG’s massive selection.

Verdict

If variety is what you’re after, IG is the clear winner with its unmatched market coverage.

5. Regulation and Security

IG Regulation

IG is one of the most trusted names in the industry, regulated by top-tier authorities, including the FCA (UK), ASIC (Australia), and the NFA (US). Client funds are securely held in segregated accounts, and UK clients are protected under the FSCS up to £85,000.

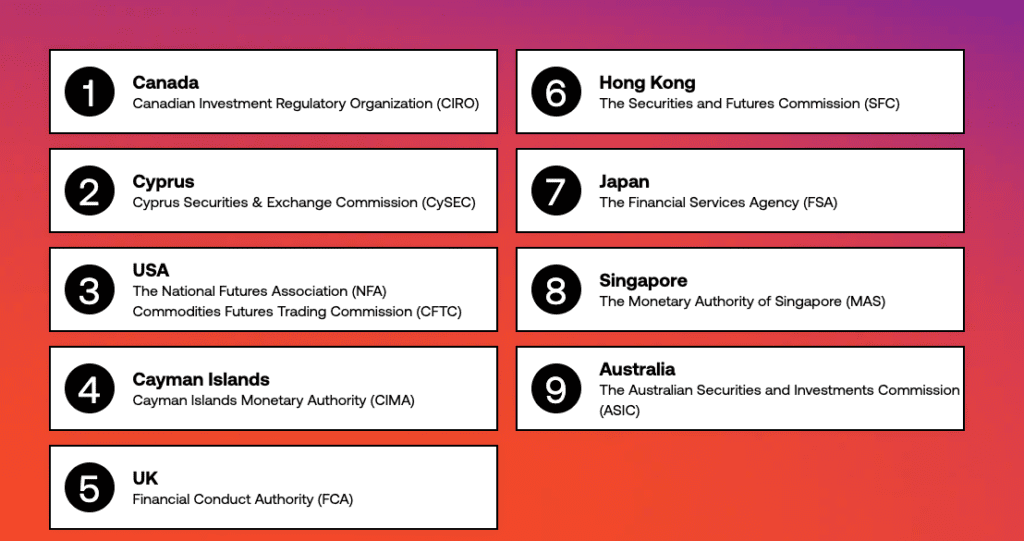

City Index Regulation

City Index is no slouch when it comes to safety. It’s regulated by the FCA (UK) and also offers client fund segregation. While their coverage is slightly less global than IG’s, it’s still highly secure for UK traders.

Verdict

Both brokers are rock-solid in terms of security, but IG wins for its broader global regulation.

6. Customer Support

IG Support

IG offers 24/5 support via live chat, phone, and email. During testing, their team responded quickly and effectively, even for more complex queries.

City Index Support

City Index also provides 24/5 support, with helpful agents available via phone, chat, and email. Their support quality was comparable to IG’s during our tests.

Verdict:

It’s a tie. Both brokers offer reliable, responsive support.

7. Educational Resources

IG Education

IG goes above and beyond with its IG Academy, offering comprehensive courses, webinars, tutorials, and live market analysis. Whether you’re a newbie or a seasoned trader, you’ll find valuable content here.

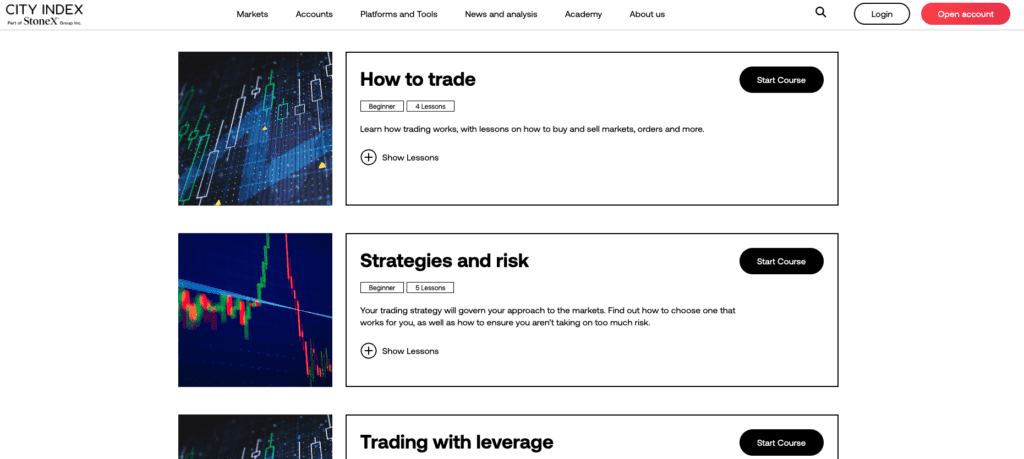

City Index Education

City Index provides solid resources, including their Trading Academy, webinars, and guides. However, the library isn’t as extensive as IG’s.

Verdict:

IG takes the lead with its deeper and more diverse educational offerings.

FAQ’s

1. Is IG better than City Index for Forex trading?

IG is slightly better than City Index for forex trading because of its tighter spreads and advanced tools. IG’s spreads start at 0.6 pips on major pairs like EUR/USD, which is sharper compared to City Index’s 0.8 pips starting point. If you’re an active trader placing lots of trades, those savings add up fast.

City Index, on the other hand, offers spread-only pricing—no commissions—which makes it great for casual traders who don’t want to overthink their costs. For me, IG gets the edge here because it combines low spreads with tools like ProRealTime and MT4, giving you everything you need to optimise your forex strategy.

2. Is IG better than City Index for beginner traders?

City Index is better than IG for beginners because of its simple platform and no-fuss experience. City Index’s Webtrader just feels super intuitive and doesn’t overwhelm you with buttons and charts. If you’re just starting out, it’s like jumping into a car and knowing exactly where everything is.

IG is fantastic, but its platforms can feel a bit overwhelming at first, especially with advanced tools like ProRealTime and L2 Dealer. That said, IG’s Academy is a massive plus for beginners who want to learn quickly—it’s easily the best education hub out there.

So, if you want simplicity and ease of use, City Index is your go-to. If you’re keen on learning and don’t mind a short learning curve, IG still delivers.

3. Is IG better than City Index for day trading?

IG is better than City Index for day trading because of its lower spreads and powerful tools. When I tested IG’s forex spreads during peak trading hours, they stayed consistently at 0.6–0.7 pips for EUR/USD, which is perfect for day traders. Plus, IG’s integration with ProRealTime gives you some of the best charting tools around, which is just incredibly useful when you’re watching for quick moves.

City Index is still a decent platform though, their spreads are solid, and the MT4 integration works well. But where IG really pulls ahead is in its platform variety and access to over 17,000 markets. For me, the tighter spreads, more tradable assets and better charting tools make IG a better pick for day traders.

4. Is IG better than City Index for UK traders?

IG is the better choice for UK traders if you want access to a huge range of markets and advanced tools. IG has been the heavyweight of UK trading since the 70s, and it shows. They’re FCA-regulated, offer FSCS protection up to £85,000, and give you access to an insane 17,000+ markets—forex, shares, indices, ETFs, commodities, the lot.

City Index is equally solid for UK traders, with FCA regulation and client fund segregation. They also have a strong focus on spread betting, which is tax-free for UK residents—a big advantage if that’s part of your trading plan.

If you want pure variety and tools, IG takes the crown. But if simplicity and spread betting are a priority, City Index is worth a look.

5. Is IG better than City Index for stock trading?

IG is the better broker for stock trading purely because of its sheer variety. You get access to 6,000+ shares across the UK, US, Europe, and Asia, so IG’s range is hard to beat. You also get charting tools like ProRealTime and direct market access (DMA) through their L2 Dealer platform (bear in mind it’s paid though…), and it’s perfect for stock traders.

City Index isn’t far behind either, with 13,500+ tradable assets, including stocks, indices, and commodities. What I liked is their spread-only pricing, which works well for smaller positions since you’re not hit with hefty commissions.

If you want advanced tools and a massive stock range, IG wins. For casual stock traders looking for simplicity, City Index is still a strong contender.

6. Is IG better than City Index for trading platforms?

IG wins for platform variety, especially if you’re an advanced trader. With IG, you get access to their web trader, the advanced ProRealTime, L2 Dealer and MT4.

City Index’s Web Trader is one of the best platforms I’ve tested for beginners—clean, intuitive, and functional. For traders who want more flexibility, they also support MT4 and TradingView, which is a nice bonus.

If you’re a more advanced trader or someone who loves customisation, IG is the way to go. But for beginners who want something easy and efficient, City Index delivers.

7. Is IG better than City Index for educational resources?

IG is miles ahead when it comes to education. The IG Academy is a beast—it’s packed with beginner-friendly courses, live webinars, and in-depth tutorials that make learning to trade feel manageable. Whether you’re just starting out or want to fine-tune your strategy, IG has you covered.

City Index does a decent job with their Trading Academy and webinars, but it doesn’t go nearly as deep as IG. It’s good for brushing up on the basics, but if you’re looking for a comprehensive learning experience, IG is better.

8. Is IG safer than City Index?

Both IG and City Index are equally safe for UK traders. They’re both FCA-regulated, offer FSCS protection up to £85,000, and hold client funds in segregated Tier-1 bank accounts. Basically, your money is as secure as it can get with either broker.

IG does have the edge in reputation—it’s been around since 1974, so you know they’re rock-solid. City Index, while slightly newer, has also been trusted by traders for decades and is just as reliable. Either way, you’re in safe hands.

9. Is IG better than City Index for high-volume trading?

IG edges ahead for high-volume traders because of its tighter spreads and platform tools. With forex spreads starting at 0.6 pips, IG is cost-effective for traders who are active throughout the day. Plus, tools like ProRealTime and direct market access (DMA) make it easy to execute larger trades with precision.

City Index is still competitive, with spread-only pricing that works well for frequent trading. However, their spreads are slightly wider, starting at 0.8 pips, which can add up if you’re trading in high volumes.

For me, IG’s lower costs and advanced tools give it the edge for high-volume trading.

10. Is City Index better than IG for spread betting?

Yes, City Index is better for spread betting. They’ve been one of the go-to brokers for spread betting in the UK for years, offering competitive spreads and a platform that’s easy to use. If you’re spread betting, the tax-free benefits combined with City Index’s no-commission pricing make it a strong option.

IG also offers spread betting (they actually invented spread betting believe it or not!), and so naturally, it’s just as reliable with plenty of markets to trade. But since City Index has a sharper focus on this style of trading, they come out on top for UK spread bettors.

Final Verdict

| Criteria | Winner |

|---|---|

| Fees and Spreads | IG |

| Platforms | IG |

| Asset Range | IG |

| Regulation and Security | IG |

| Customer Support | IG |

| Educational Resources | IG |

While it may seem like a clean sweep for IG, it’s worth keeping in mind that City Index is one of the best brokers in the UK. It towers above most ordinary brokers in terms of platforms, spread betting offerings, range of instruments (over 13000!) and general usability. IG is no challenger, they are the best broker in the UK for a reason and even against stiff competition like City Index, they remain the go-to UK trading broker for advanced and intermediate-level traders with purely unmatched levels of security, assets and educational resources.

£500 Recommended Deposit

Best Overall

IG offers 17,000+ trading instruments and combines robust regulation with cutting-edge platforms like ProRealTime, TradingView, and L2 Dealer.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Who Should You Choose?

IG is the go-to choice for traders who want it all: a massive range of markets, tight spreads, and unparalleled educational resources. It’s perfect for intermediate and experienced traders looking for versatility and advanced tools.

City Index, on the other hand, shines for beginners and casual traders who appreciate a user-friendly platform, no inactivity fees, and straightforward pricing.

Still unsure? Here’s a quick summary:

- Choose IG for advanced tools, market variety, and in-depth education.

- Choose City Index for simplicity, no inactivity fees, and competitive spreads.

- Can I Make a Living from Trading in the UK? - December 26, 2024

- Beginners Trading Guide for UK Traders - December 15, 2024

- Trading in the UK? Here are Some Key Facts. - December 10, 2024