Two titans of the trading world collide in our ‘Pepperstone vs IG’ Battle of the Brokers competition. Both are excellent and two of the most popular broker for UK traders, so which one should you choose?

Which is the Better Trading Platform: Pepperstone vs IG

When choosing between Pepperstone and IG, you’re essentially picking between two titans of trading. While IG excels at providing a huge range of trading markets, educational resources, and proprietary tools, Pepperstone counters with ultra-tight spreads, platform flexibility, and speedy execution.

So which broker deserves your trust and trading time? Let’s dive in.

1. Key Features Comparison

| IG VS Pepperstone |  First

First |  Second

Second | |

|---|---|---|---|

| Regulation | FCA (UK), ASIC (Australia), NFA (US), and more | FCA (UK), ASIC (Australia), CySEC (EU) | |

| Trading Platforms | Proprietary Platforms (L2 Dealer & ProRealTime), MT4, TradingView | MT4, MT5, cTrader, TradingView | |

| Minimum Deposit | £250 | £0 but (£200 recommended) | |

| Spreads | Spreads starting from 0.6 pips on forex | Spreads starting from 0.7 pips on forex | |

| Commissions | Spread-only pricing or £10 per side on share CFDs | £4.5 per lot on Razor accounts | |

| Range of Assets | 17,000+ | 1,200+ | |

| Education Resources | Extensive—IG Academy, webinars, tutorials | Comprehensive – Focused guides, webinars, and platform tutorials | |

| Customer Support | 24/5 via live chat, phone, and email | 24/5 via phone, chat, and email | |

| Funding Options | Credit/Debit Card, PayPal, Bank Transfer | Credit/Debit Card, PayPal, Bank Transfer | |

| Inactivity Fee | £12/month after 2 years of no activity | None | |

| Join IG | Join Pepperstone |

Here’s the quick version: Pepperstone is for traders who want speed and low costs and is great for beginner UK traders, while IG is the best for anyone who loves variety and robust tools and would suit more intermediate and advanced traders. But the details matter, so let’s dig into the juicy bits. But first, here’s the video version if you are so inclined…

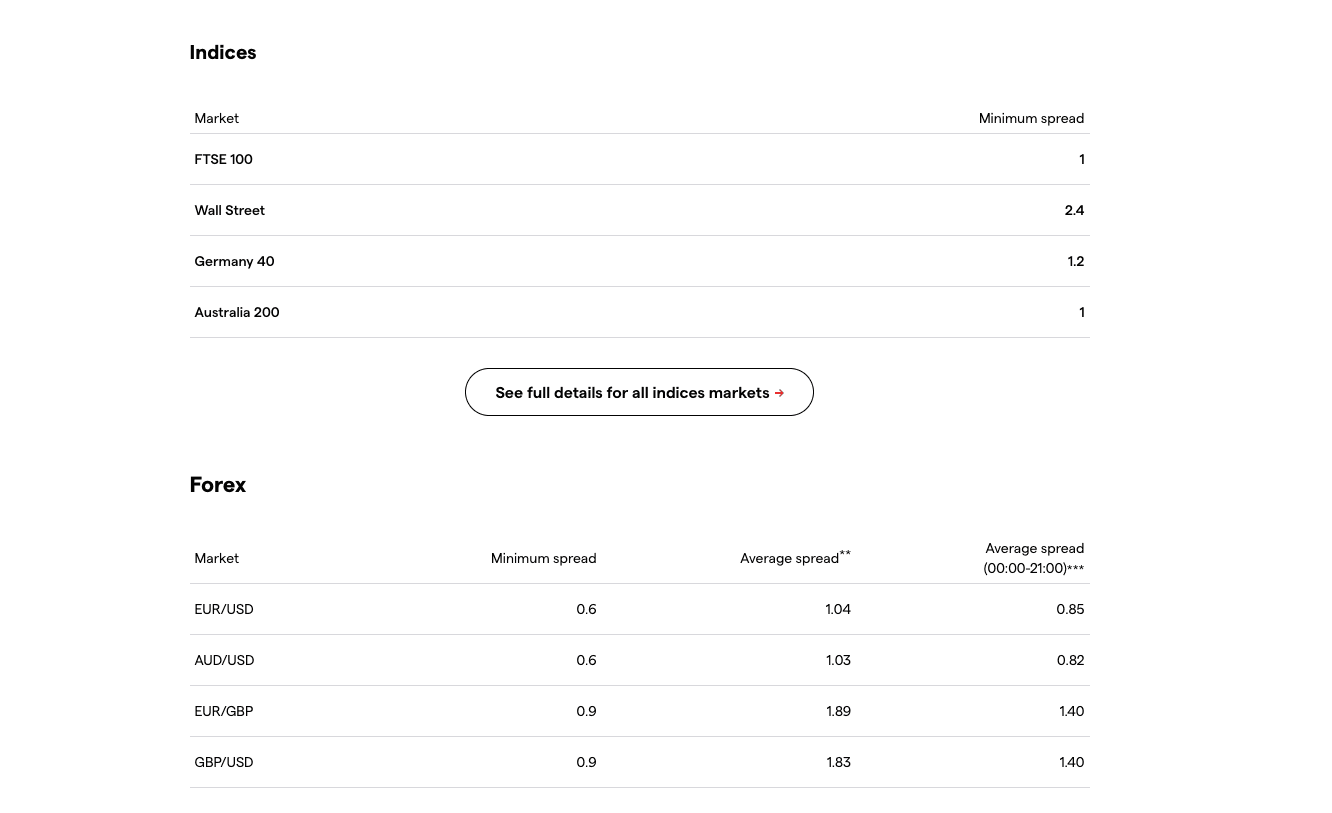

2. Fees and Spreads: Who Saves You More?

Pepperstone Fees

Let’s talk money—because that’s why we’re here, right? With Pepperstone, you can trade forex on their Razor account with spreads as tight as 0.0 pips. There’s a small £4.5 round-trip commission per lot, but for scalpers and high-frequency traders, that’s a sweet deal. If you just want their ‘normal’ account, their spread-only pricing starting from 0.7 pips.

And for stock CFDs? Zero commissions, just spreads. Love it. However, keep in mind there are overnight fees, so Pepperstone is better suited for shorter-term trades.

IG Fees

IG isn’t exactly shy with fees, but they do offer value for money. Forex spreads start at 0.6 pips, which isn’t bad but not quite as tight as Pepperstone’s Razor account. If you’re trading share CFDs, you’ll pay £10 per side, so equities fans may want to factor that in. IG also charges a £12/month inactivity fee after two years, so don’t ghost your account for too long.

Verdict

Pepperstone wins for cost efficiency, especially for forex traders. IG’s fees can add up, but the sheer range of assets offsets it if you’re into trading across multiple markets.

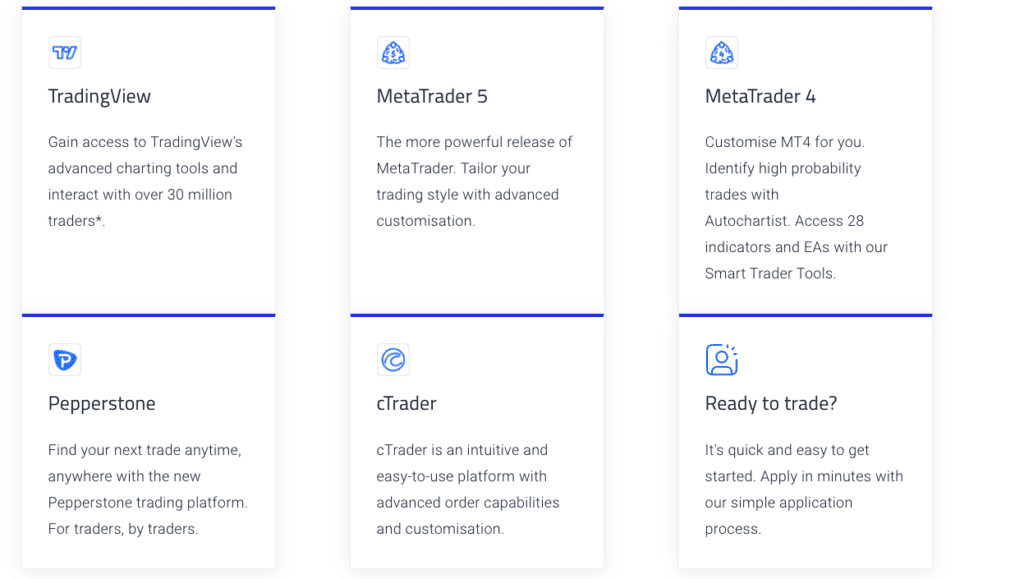

3. Trading Platforms: Who Has the Edge?

Pepperstone Platforms

Here’s where Pepperstone pretty much demolishes all competition, offering the widest range of widely-recognised platforms of any trading broker. They’re like the ‘gadget geeks‘ of trading, offering all the tools you could ever want:

- MT4/MT5: Great for automation and algo traders.

- cTrader: A favourite for scalpers.

- TradingView: The holy grail for charting and analysis fans.

If you’re the kind of trader who likes to tinker with your charts, Pepperstone’s platform flexibility is like being handed the keys to a sports car.

IG Platforms

Now, IG doesn’t mess around either. Their proprietary platforms (web trader, L2 Dealer & ProRealTime) are sleek, user-friendly, and perfect for anyone from beginners to pros. Plus, if you’re a charting wizard, ProRealTime is probably your best bet for advanced technical analysis. Oh, and yes, you can also use MT4 or TradingView, so they’ve got those bases covered too.

Verdict

It’s a close call. IG offers more variety with its proprietary tools, but if you’re all about platform flexibility, Pepperstone edges ahead.

4. Range of Tradable Assets: IG The Giant

Pepperstone Assets

With 1,200+ assets, Pepperstone isn’t trying to win a numbers game; instead, they focus on delivering a solid selection of key markets that cater to the needs of most traders. Here’s what you’ll find:

- 60+ forex pairs

- 1,200+ stocks

- Popular indices like the S&P 500

- Key stocks and commodities

One thing I love about Pepperstone’s approach is that they focus on traders who want precision over choice. You might not find thousands of niche instruments here, but what they do offer is practical, popular, and easy to trade with low costs.

IG Assets

Now, let’s talk about IG. This broker is the godfather of asset variety, boasting an eye-watering 17,000+ markets. If you’re the type of trader who likes having endless options, IG is your dream broker. Here’s the breakdown:

- 80+ forex pairs

- 6,000+ stocks (see our Stock Trading Brokers Review for more information)

- 80+ indicies

- Forex, shares, ETFs, commodities, options—you name it.

- Want niche? They’ve got it. Want mainstream? Of course, they’ve got that too.

Verdict

IG wins this one hands down. No contest. If you’re someone who wants access to everything, IG is your playground.

5. Regulation and Security: Both are Bulletproof

Pepperstone Regulation

Pepperstone has built a solid foundation with its oversight from some of the world’s most trusted regulators. For UK traders, the FCA (Financial Conduct Authority) ensures they operate transparently and safeguard client funds. Beyond that, they’re also regulated by ASIC (Australia) and CySEC (Europe), covering traders across the globe.

Let’s talk about client fund protection—because that’s the nitty-gritty detail we care about. Pepperstone segregates client funds in Tier-1 banks, meaning your money is completely separate from their operational accounts. This isn’t just some token promise; it’s a legal requirement under FCA rules. Oh, and if you’re a UK trader, you’re also covered by the FSCS scheme, protecting your funds up to £85,000 in the unlikely event Pepperstone hits trouble.

In my experience, Pepperstone has consistently proven itself as a trustworthy broker that puts client security first. Their no-nonsense approach to regulation makes them a top contender for traders who want peace of mind.

IG Regulation

IG doesn’t just meet the gold standard in regulation—it redefines it. This is a broker with nearly five decades of experience and regulatory oversight in every corner of the trading world. For UK traders, IG is fully FCA-regulated, which means transparency, strict compliance, and, yes, FSCS protection of up to £85,000.

But it doesn’t stop there. IG is also regulated by ASIC (Australia), NFA (US), and other authorities across Europe and Asia. This global reach isn’t just about prestige—it’s about offering traders reassurance no matter where they’re based.

One thing that stands out about IG is their emphasis on operational security. They’re big on client fund segregation, using Tier-1 banks to ensure that your money stays your money. And with their robust risk management systems, you’re trading on a platform that prioritises stability even during volatile market conditions.

Overall, IG is the definition of “safe hands.” Whether you’re a beginner or a pro, it’s hard not to feel confident knowing they’ve got decades of experience and a suite of top-tier regulators backing them up.

Verdict

Both Pepperstone and IG are bulletproof when it comes to regulation, but IG’s broader global regulatory coverage gives it the edge. If you’re a UK trader, both offer FCA regulation and FSCS protection, so your funds are equally safe either way.

6. Customer Support

Pepperstone

I’ll keep this short: Pepperstone’s support is fast, friendly, and available 24/5 via live chat, phone, and email. If you’re stuck, they’ll sort you out quickly.

IG

IG’s support team is just as good—24/5 availability and a comprehensive FAQ section that’s genuinely helpful. The only downside? It can take a minute or two to connect during peak times.

Verdict

This one’s a tie. Both brokers offer reliable, responsive support.

7. Educational Resources

Pepperstone Education

Pepperstone is all about practicality when it comes to education. Their library of webinars, video tutorials, and trading guides is tailored toward forex and CFD traders. The content is concise, easy to follow, and gets straight to the point—perfect if you don’t want to wade through unnecessary fluff.

That said, their educational offering isn’t as deep as IG’s. While you’ll find plenty of helpful content to sharpen your skills, it’s more focused on trading strategies than market analysis or advanced techniques.

IG Education

Here’s where IG really flexes its muscles. The IG Academy is one of the best in the business, offering a mix of beginner-friendly courses, live webinars, and in-depth tutorials. Whether you’re learning the basics of stock trading or diving into advanced technical analysis, there’s something for every skill level.

One thing I loved about IG’s approach is the sheer variety. They don’t just give you static resources; you get live market analysis sessions, interactive courses, and step-by-step trading guides. It’s like having a trading mentor on speed dial. And the best part? It’s all free for IG users.

Verdict

IG wins here, hands down. Their educational resources are unmatched.

FAQ’s

1. Is Pepperstone better than IG for Forex trading?

Pepperstone is better for forex trading if low spreads and execution speed are your top priorities. On their Razor Account, I consistently hit 0.0–0.1 pips spreads on EUR/USD during peak trading hours—combined with a £4.50 round-turn commission, it’s tailor-made for scalpers and high-volume traders.

IG, on the other hand, starts at 0.6 pips on their forex spreads, which is good but not quite as sharp as Pepperstone. So, if you’re trying to squeeze every bit of profit out of your trades, Pepperstone is your best bet. IG does win on variety though, offering 80+ forex pairs compared to Pepperstone’s 60+, but let’s be honest—most of us stick to the major pairs anyway.

For me, it’s Pepperstone for forex—purely because of those unbeatable spreads and super fast execution.

2. Is Pepperstone better than IG for beginner traders?

IG is the better choice for beginners—hands down. When I first tested IG’s platform, I was a little confused – not going to lie (see my review) – but after a couple days I started to think, “Ah, this makes sense.” It’s clean, intuitive, and doesn’t throw a million buttons at you. IG also has the IG Academy, which, in my opinion, is one of the best learning hubs out there for traders just starting out. You get everything from step-by-step tutorials to live webinars that break down complex concepts in plain English.

Pepperstone is excellent, but platforms like MT4, MT5, and cTrader aren’t exactly beginner-friendly. If you’re just starting out, it’s a bit like getting behind the wheel of a Formula 1 car—you’ll need time to figure out all the knobs and levers.

So, if you’re a beginner who values simplicity and guidance, IG is the way to go.

3. Is Pepperstone better than IG for day trading?

Pepperstone wins for day trading because of its super-tight spreads and fast execution. I tested their Razor account during peak market hours, and seeing 0.0–0.1 pips spreads on EUR/USD felt like hitting the jackpot as a day trader. When you’re making multiple trades a day, those savings are the difference between a great day and a frustrating one.

What really sets Pepperstone apart is its platform variety. Whether you’re scalping on cTrader, automating trades on MT4, or running chart analysis on TradingView, Pepperstone has a tool that fits your style perfectly. IG is excellent too, but if you need that precision and flexibility as a day trader, Pepperstone takes the crown.

4. Is Pepperstone better than IG for UK traders?

IG is the better choice for UK traders who want market variety and an all-in-one trading experience. I mean, let’s face it—IG is the godfather of UK trading. They’ve been around since the 70s, are FCA-regulated, and give you access to a ridiculous 17,000+ markets.

Pepperstone, though, isn’t exactly slacking. They’re also FCA-regulated, with client funds held securely in Tier-1 accounts and FSCS protection up to £85,000. So, safety-wise, it’s neck and neck.

The real question is what you value most. If you’re looking for a massive range of stocks, indices, and forex pairs—all under one roof—IG takes it. But if you’re focused on forex or CFDs with lower costs, Pepperstone still makes a lot of sense.

5. Is Pepperstone better than IG for stock trading?

IG is better for stock trading because it’s all about variety and tools. You have access to 6,000+ stocks across the UK, US, Europe, and Asia, it’s a dream for equity traders. Their charting tools on ProRealTime are also some of the best I’ve tested for analysing individual stocks.

Pepperstone’s stock offering is smaller—around 1,200+ share CFDs—but it does come with one big perk: commission-free trading on the Standard Account. If you’re a frequent trader, that adds up quickly.

If you’re trading stocks casually or want lower fees, Pepperstone is still worth considering. But for stock traders who love choice, IG wins.

6. Is Pepperstone better than IG for trading platforms?

Pepperstone takes the edge for platform variety. You get MT4, MT5, cTrader, and TradingView, giving you options for scalping, automation, and advanced charting. If you’re picky about your tools (like I am), Pepperstone feels like it was built just for you.

IG’s platforms are decent though…. Their ProRealTime tool is great for charting, and the web trader platform is a great all-in-one solution and pretty god for beginners. You can also use MT4 and TradingView with IG, but it feels like you’re more tied into their ecosystem.

If you love flexibility and want to play with multiple platforms, Pepperstone wins. If you want a solid proprietary platform, IG is for you.

7. Is IG better than Pepperstone for educational resources?

Yes, IG is better for education by a country mile. I’ve said it before, and I’ll say it again: the IG Academy is a game-changer. From live webinars to structured courses, they make learning to trade feel doable—even if you’ve never placed a trade in your life.

Pepperstone’s resources are good, especially their strategy guides and forex-focused webinars, but it’s more targeted towards traders who already have some experience. If you’re looking for a full learning experience that grows with you, IG’s education is top-tier.

8. Is IG safer than Pepperstone?

Both Pepperstone and IG are equally safe for UK traders. They’re both FCA-regulated, offer FSCS protection up to £85,000, and hold client funds in segregated Tier-1 accounts. Basically, you couldn’t ask for better safeguards.

IG does have the edge when it comes to longevity, though. With nearly 50 years in the business, they’re the OG trading platform. Pepperstone, while newer, has also built a reputation as one of the safest brokers out there. Either way, your funds are in good hands.

9. Is Pepperstone better than IG for high-volume traders?

Pepperstone is better for high-volume traders because of its low spreads and commission structure. On the Razor Account, spreads start at 0.0 pips, and the commission is just £4.50 round-turn per lot. If you’re trading frequently, those savings add up fast.

IG’s spreads are competitive too, starting at 0.6 pips, but the costs can climb if you’re trading stocks or using their share CFDs, which come with a £10 per side commission. For forex and CFD traders running high volumes, Pepperstone’s lower costs make it the smarter choice.

10. Is Pepperstone better than IG for TradingView users?

Both brokers integrate with TradingView, but Pepperstone takes the edge for flexibility. With Pepperstone, you can switch between TradingView, MT4, MT5, and cTrader—so if you ever want to explore other platforms, you’ve got options.

IG’s TradingView integration is just as smooth, but you’re more tied to their ecosystem. That’s not a bad thing—IG’s proprietary tools are excellent—but it’s less flexible compared to Pepperstone.

If you’re purely on TradingView, both brokers deliver. But for platform variety alongside TradingView, Pepperstone wins.

Final Verdict

| Criteria | Winner |

| Fees and Spreads | Pepperstone |

| Platforms | Pepperstone |

| Asset Range | IG |

| Customer Support | IG |

| Education | IG |

Overall Winner: IG

If you’re looking for the ultimate trading experience with a massive range of markets and unbeatable educational tools, IG is the clear choice. But if you’re a trader who loves tight spreads, lightning-fast execution, and a variety of platforms, Pepperstone is equally impressive.

£250 Minimum Deposit

Best Range

IG offers 17,000+ trading instruments and combines robust regulation with cutting-edge platforms like ProRealTime, TradingView, and L2 Dealer.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Who Should You Choose?

- Choose IG if you want a massive range of tradable assets, world-class education, and advanced tools.

- Choose Pepperstone if you’re focused on forex or CFDs and want low costs with platform versatility.

Still undecided? Open demo accounts with both brokers and see which one feels right for you!

If you want to see our other reviews of Pepperstone vs ActivTrades or IG vs City Index feel free to check them out before making a final call.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025