Investing in stocks has become more accessible than ever, with countless platforms offering easy-to-use tools, low fees, and a broad range of tradable assets. But not all stock trading brokers are created equal—especially if you’re a UK trader – here’s a list of our top 5 brokers for UK traders.

Best Stock Trading Brokers for UK Traders

To help you find the best UK stock trading broker, I’ve rolled up my sleeves, tested the platforms, compared fees, and dug into customer support to bring you the ultimate guide to stock trading brokers in the UK.

Let’s dive in and discover who’s worth your time, money, and trust when it comes to trading stocks.

Top 5 Stock Trading Platforms for UK Traders

Our top 5 stock trading platforms for UK traders, in order of excellence are IG, Pepperstone, City Index, XTB and ActivTrades. After thorough testing, my top pick is IG, thanks to its massive range of stocks (6,000+ globally), intuitive trading platform, and outstanding educational resources.

Stock Range

Offers over 6,000+ stocks from global markets.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Lowest Fees

Tight spreads starting at 0.0 pips with competitive commissions.

75.5% of retail investor accounts lose money when trading on margin with this provider

Most User Friendly

Intuitive Web Trader platform with spread betting options.

Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best for Beginners

User-friendly platform with no minimum deposit and excellent education.

76% of retail investor accounts lose money when trading CFDs with XTB Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best for Security

FCA-regulated with segregated funds and additional insurance.

83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

However, different traders have different needs, so here’s a quick overview to help you decide:

Most User-Friendly Platform: City Index

For the Most Stock Choices: IG

For Low Costs and Active Traders: Pepperstone

Best for Beginners: XTB

What Makes a Great Stock Trading Platform?

Whether you’re a beginner dipping your toes into the stock market or a seasoned trader looking for advanced tools, the best stock trading platforms share some key features:

- Fees and Commissions: Are the charges for buying and selling stocks transparent and competitive?

- Stock Range: Does the broker offer a wide selection of equities from global markets?

- Platforms and Tools: Are the tools easy to use? Do they support advanced analytics for active traders?

- Regulation and Safety: Is the broker FCA-regulated, and do they offer protections like segregated funds?

- Customer Support and Education: Does the broker help you learn and offer reliable support when needed?

With these factors in mind, here’s how our top UK brokers stack up for stock trading. the UK.

Top Stock Trading Brokers for UK Traders Ranked

Finding the best stock trading broker in the UK depends on your individual needs, whether it’s cost efficiency, platform variety, or market range. While IG takes the top spot for its stock variety and features, Pepperstone and XTB cater to traders seeking low costs and user-friendly platforms.

1. IG: Best Overall Stock Trading Broker

I’ve got to hand it to IG—they’re unbeatable when it comes to stock variety. The exact number of tradable stocks varies wildly, even on IG’s own site – that’s how many they offer(!) Some estimates say 6,000+ shares with other reports on their site claiming they have 13,000+ and even on that same webpage they claim over 17,000+. So we’ve gone for the conservative estimate, where IG definitely has more than 6,000 stocks to trade globally, with an estimate of 6,000-17,000+ stocks tradable for UK traders. Either way, you’ll never feel limited in your trading choices. Plus, their intuitive platform and competitive fees make them perfect for both beginners and pros.

IG: Best Overall Stock Broker for Trading

When it comes to stock trading in the UK, IG is a clear leader. Established in 1974, IG has earned its reputation as one of the most trusted brokers globally, offering access to over 6,000 stocks from markets across the globe, including the UK, US, Europe, and Asia.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why UK Stock Traders Love IG

Cost of Trading Stocks on IG

IG charges £3 per trade for UK stocks if you’re an active trader (three trades or more per month) and £8 per trade for less frequent users. For US shares, they offer $0 commission when you place three trades in the previous month.

How Many Stocks Can You Trade on IG in the UK?

You can trade between 6,000+ and 17,000+ stocks with IG – the estimates on how many stocks you can trade on IG varies wildly, even on their own site with estimates between 6,000+ on their Shares Trading Guide & 13,000 – 17,000 on their UK Shares page. Either way, IG offers the largest selections of equities for UK traders, including markets in the UK, US, Europe, and Asia.

What Platforms are Available for Stock Traders?

IG’s proprietary trading platform is highly customizable, and ProRealTime integration offers advanced charting. Traders can also use MetaTrader 4 (MT4) if they prefer.

How Fast is Stock Trade Execution?

IG provides ultra-low latency execution, ensuring your trades are executed at the best available price, even during high volatility.

Key Featires of Stock Trading on IG

- UK Shares: Commission starts at £3 per trade (frequent trader rate) or £8 per trade for occasional traders.

- US Shares: £0 commission on trades when you place three trades in the previous month.

- No hidden fees for deposits or withdrawals.

Platform Options

- Proprietary IG Trading Platform (customisable and beginner-friendly).

- MetaTrader 4 for traders wanting a familiar interface.

- ProRealTime for advanced traders needing in-depth analysis tools.

Regulation and Security

Fully regulated by the FCA, IG ensures segregated client funds and negative balance protection, so your investments are secure.

Summary of IG on Stock Trading

If you’re serious about stock trading, IG is hard to beat. They’ve been around since 1974, so you know they’re trustworthy, and the numbers speak for themselves: 6,000+ stocks across the UK, US, Europe, and Asia. Whether you’re looking for the big tech names like Apple or Tesla or you fancy dabbling in smaller markets, they’ve got it all. Their platform is also super customisable, so whether you’re a beginner or a seasoned trader, it adapts to you.

And the fees? They’re pretty fair… For UK stocks, you’re looking at £3 per trade if you’re active (making three trades a month) or £8 if you’re more casual. US shares are $0 commission if you meet the same criteria—how’s that for value? I also love that you can choose between their user-friendly proprietary platform, ProRealTime for advanced analysis, or even MetaTrader 4 for the classic feel.

Add in FCA regulation, segregated client funds, and their excellent IG Academy for learning, and it’s clear why IG is my top pick for UK stock traders.

If you want to learn more about IG, feel free to check out our detailed IG review.

£250 Minimum Deposit

Best Range

IG offers 17,000+ trading instruments and combines robust regulation with cutting-edge platforms like ProRealTime, TradingView, and L2 Dealer.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

2. Pepperstone: Best for Low-Cost Stock Trading

Pepperstone’s low fees and super-fast execution make it a dream for traders who love efficiency. Sure, they only offer 1,200 stocks, which definitely isn’t the largest on this list (!) but with competitive spreads and platforms like TradingView, it’s a solid choice for cost-conscious UK traders.

Pepperstone: Razor-Thin Stock Spreads

Known for its forex dominance, Pepperstone has also built a solid stock trading offering. While its range of stocks is smaller than IG (at only 1,200+), its low fees and platform variety make it a fantastic option for cost-conscious traders.

75.5% of retail investor accounts lose money when trading on margin with this provider

Why UK Stock Traders Love Pepperstone

Cost of Trading Stocks on Pepperstone

Pepperstone offers commission-free trading on stock CFDs with competitive spreads. For active traders using the Razor account, spreads start from 0.0 pips with a £5 round-trip commission per lot.

How Many Stocks Can You Trade on Pepperstone in the UK?

Pepperstone provides access to over 1,200 stocks, focusing on popular US, UK, and European equities.

What Platforms are Available for Stock Traders?

Pepperstone supports MT4, MT5, cTrader, and TradingView, allowing traders to pick a platform that suits their strategy.

How Fast is Stock Trade Execution?

With a No Dealing Desk (NDD) execution model, Pepperstone ensures lightning-fast trade execution, ideal for day traders and scalpers.

Key Features of Stock Trading on Pepperstone

- Commission-free trading on most CFDs.

- Spreads for popular stocks like Apple and Tesla are highly competitive.

- Overnight holding fees apply, so it’s better suited for short-term trades.

Stock Range on Pepperstone

Pepperstone offers 1,200+ stocks, focusing mainly on popular US, UK, and European equities.

Who is it For?

If you’re a trader who values speed, affordability, and platform versatility, Pepperstone is an excellent choice for stock CFDs.

Summary for Pepperstone on Stock Trading

Pepperstone might be best known for forex, but they’re pretty darn impressive when it comes to stock trading too. With over 1,200 stocks, they focus on the big hitters in the UK, US, and European markets. Admittedly, their stock range isn’t as extensive as IG, but if you value low costs and fast execution, they’ve nailed it.

The spreads are tight, and for most stock CFDs, you’re looking at commission-free trading, which is perfect for casual traders. If you’re a bit more advanced, the Razor account is where the magic happens, with spreads starting at 0.0 pips and a £5 round-trip commission per lot.

What really sets Pepperstone apart, though, is the platform choice. You can trade on MT4, MT5, cTrader, or TradingView—so no matter how you like to work, they’ve got you covered. I tested their execution speeds on a few trades, and it’s ridiculously fast. Day traders and scalpers will love it.

Add in FCA regulation, no deposit/withdrawal fees, and negative balance protection, and you’ve got a broker that’s reliable, affordable, and versatile.

If you’d like to learn more about Pepperstone, we’ve got side-by-side broker comparisons and in-depth reviews.

No Minimum Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent range of assets in the financial trading markets, including CFD's for commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

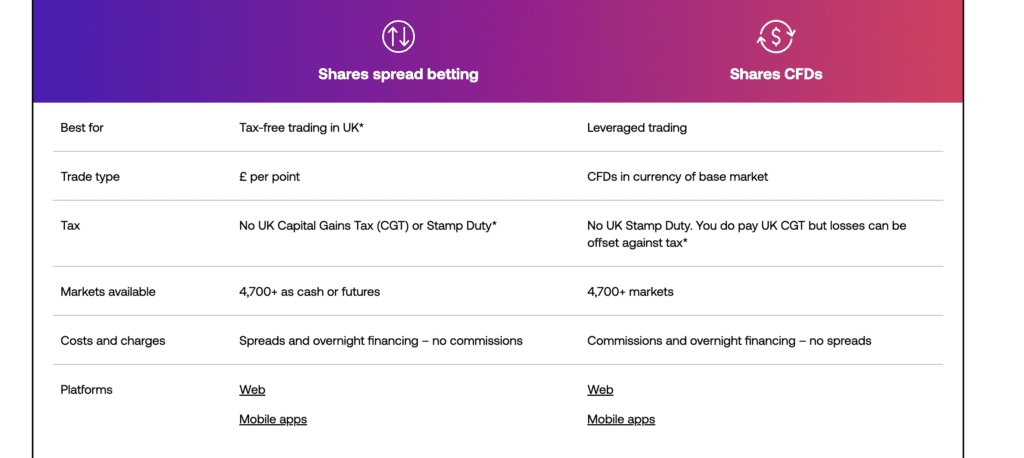

3. City Index: Best for Tax-Free Stock Trading

City Index keeps it simple and effective with access to 4,700+ stocks, an easy-to-use platform, and tax-free spread betting options. It’s perfect if you want a no-fuss trading experience.

City Index: Great Stock Spread Betting Option

City Index makes stock trading simple without sacrificing advanced tools for experienced traders. It’s an ideal broker for those who want a streamlined experience with great customer support and tax-free spread betting options.

Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why UK Stock Traders Love City Index

Cost of Trading Stocks on City Index

City Index charges 0.1% commission per trade for stock CFDs. There are no additional fees for deposits or withdrawals.

How Many Stocks Can You Trade on City Index?

With a range of over 4,700 stocks, City Index provides extensive access to equities from global markets, including the UK, US, and Europe.

What Platforms are Available for Stock Traders?

City Index’s proprietary Web Trader platform is intuitive and user-friendly, while MetaTrader 4 is available for those seeking more advanced tools.

How Fast Are the Stock Execution Speeds?

City Index’s advanced trading technology ensures fast execution speeds with minimal slippage, even during volatile market conditions.

Key Features of City Index

- Intuitive Web Trader Platform: Easy to navigate, even for beginners.

- Wide Range of Assets: Includes stocks, forex, commodities, and indices.

- Spread Betting Option: Trade stocks tax-free with spread betting in the UK.

Cost of Stock Trading on City Index

- Spreads start from 0.1% per trade (commission-free).

- No fees for deposits or withdrawals.

Stock Range on City Index

City Index provides access to over 4,700 stocks from markets in the UK, US, Europe, and beyond.

Regulation and Security

Fully FCA-regulated, City Index offers negative balance protection and holds funds in segregated accounts for client safety.

Summary of City Index for Stock Trading

City Index is one of those brokers that just makes life easy. They’ve been around for decades, and they know exactly what traders need. With access to over 4,700 stocks from the UK, US, and Europe, there’s more than enough choice for most traders.

Their Web Trader platform is just super simple to use. I’m talking super intuitive—you can pick it up without feeling overwhelmed. For more experienced traders, they also offer MT4, which is always a nice option to have.

Fees are competitive, with stock CFD commissions starting at just 0.1%. And if you’re trading stocks as spread bets, you can do it tax-free in the UK. That’s a huge bonus for anyone looking to maximise their profits.

Another thing I love about City Index is the reliability. They’re FCA-regulated, funds are held securely in segregated accounts, and they’ve got a solid customer support team to back you up.

No Minimum Deposit

Best to Spread Bet

City Index is a historic spread betting & CFD Trading brand in the UK, backed by StoneX group, a publicly traded broker in the UK.

Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

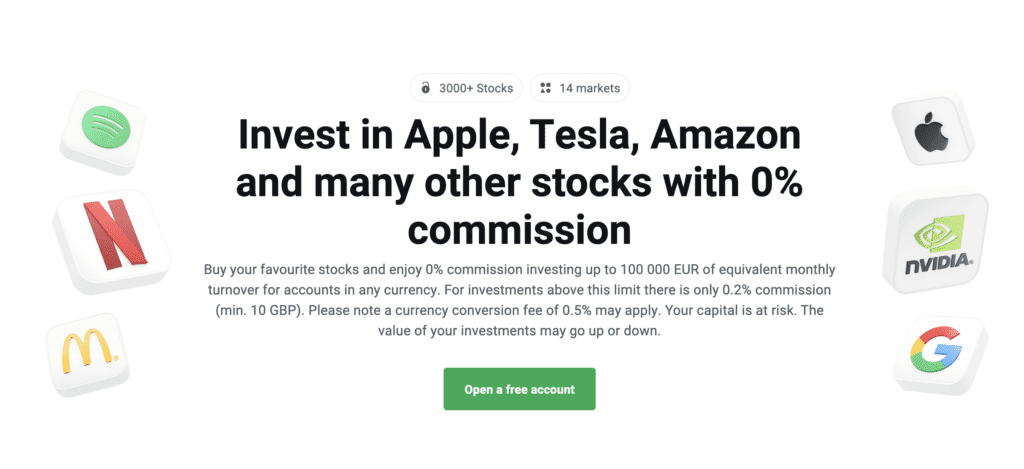

4. XTB: Proprietary Platform for Investing & Trading

XTB makes stock trading easy with its beginner-friendly xStation 5 platform. With access to over 3,000+ stocks and commission-free trading on many CFDs, it’s a great choice for traders starting out.

XTB: Best for ‘tradevesting‘

XTB has carved out a niche as one of the most beginner-friendly brokers in the UK. Its proprietary xStation 5 platform provides a straightforward yet powerful interface for trading stocks, while its educational resources help new traders get up to speed quickly.

76% of retail investor accounts lose money when trading CFDs with XTB Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why UK Stock Traders Like XTB

Cost of Trading Stocks on XTB

XTB offers an interesting combination of access to fractional shares & commission-free trading on many stock CFDs, with spreads starting at 0.2% per trade. No deposit or withdrawal fees make it even more appealing.

How Many Stocks Can You Trade on XTB?

XTB gives you access to over 3,000+ stocks from global markets, including the UK, US, and Europe.

What Platforms are Available for Stock Traders?

Only one platform unfortunately (or fortunately – depending on how you look at it…) The proprietary xStation 5 platform provides a seamless experience with advanced tools and a user-friendly interface but there is no MetaTrader or TradingView.

How Fast is Stock Trade Execution?

With its state-of-the-art platform, XTB ensures rapid execution speeds with minimal slippage, perfect for both beginners and experienced traders.

Why UK Stock Traders Love XTB

- No Minimum Deposit: Get started without needing to fund your account upfront.

- Comprehensive Education: XTB Academy offers in-depth tutorials and live webinars.

- User-Friendly Platform: xStation 5 is intuitive yet packed with useful features.

Cost of Stock Trading on XTB

- Spreads start as low as 0.2% per trade, with no commissions on many stocks.

- No deposit or withdrawal fees.

Stock Range on XTB

XTB offers 3,000+ stocks, focusing on equities from the UK, Europe, and the US.

Summary of XTB for Stock Trading

If you’re new to trading or just want a broker that keeps things straightforward, XTB is worth considering. Their proprietary xStation 5 platform is an absolute gem—it’s intuitive, sleek, and packed with useful features like built-in education and real-time market analysis.

XTB gives you access to over 3,000+ stocks from global markets, including popular UK and US equities. Plus, they’re big on affordability: many stock CFDs are commission-free, with spreads starting as low as 0.2%. There are no deposit or withdrawal fees either, which is always a bonus.

While they don’t offer as many platform options (no MT4 or TradingView here), xStation 5 more than makes up for it with its ease of use and fast execution speeds.

Overall, if you’re looking for a broker that offers simplicity without skimping on quality, XTB is a solid pick.

No Minimum Deposit

Best for Investing

XTB offers a proprietary platform with incredible trading resources & educational material in an easy-to-use, low cost trading environment. Perfect for currency traders.

73% of retail investor accounts lose money when trading CFDs with XTB Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

5. ActivTrades: Best Regulatory Approvals

ActivTrades might not be the flashiest broker on the list, but what it lacks in glamour, it makes up for in security and reliability. Access to over 1,000+ stocks & regulated by multiple authorities, including the FCA, ActivTrades is a top choice for traders who value safety and transparency.

ActivTrades: Great Regulation

ActivTrades is all about reliability and security, with FCA regulation, extra insurance, and access to over 1,000 global stocks. It’s a no-frills option that delivers where it counts.

83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Why UK Stock Traders Love ActivTrades

Cost of Trading Stocks on ActivTrades

ActivTrades charges 0.1% per trade for stock CFDs, with no additional commissions or inactivity fees.

How Many Stocks Can You Trade on ActivTrades?

ActivTrades provides access to over 1,000 stocks, including popular UK and US equities.

What Platforms are Available for Stock Traders?

ActivTrades offers its proprietary ActivTrader platform alongside support for MetaTrader 4 and MetaTrader 5.

How Fast Are the Stock Execution Speeds?

With FCA regulation and a focus on reliability, ActivTrades ensures fast and secure execution with minimal slippage.

Key Features for Stock Trading on ActivTrades

- Focus on Security: FCA regulation, segregated funds, and additional insurance make it one of the safest brokers around.

- User-Friendly ActivTrader Platform: While not the most advanced, the platform offers easy navigation and intuitive stock trading features.

- Global Reach: Access to stocks from major markets in the UK, US, Europe, and beyond.

Cost of Stock Trading on ActivTrades

- Spreads start at 0.1% per trade on stock CFDs.

- No commission fees on some accounts, making it affordable for casual traders.

- No inactivity fees, so you can take breaks without penalties.

Stock Range on ActivTrades

With access to over 1,000 stocks, ActivTrades offers a well-rounded selection of equities from global markets.

Summary of ActivTrades for Stock Trading

ActivTrades is a fantastic choice for traders who value safety and reliability. With FCA regulation, segregated funds, and even additional insurance coverage, you know your money is in safe hands.

They offer access to over 1,000 stocks, focusing on popular markets like the UK, US, and Europe. It’s not the largest range, but it’s enough for most traders. The ActivTrader platform is simple yet effective, and if you prefer something more familiar, you can also use MT4 or MT5.

Fees are competitive, with spreads starting at 0.1% per trade, and there are no inactivity fees—so you can take a break from trading without worrying about extra charges.

If you’re looking for a no-nonsense broker with a strong focus on security, ActivTrades is a great option.

£250 recommended deposit

Best Security

Founded in 2001, ActivTrades is a globally regulated and widely-recognised broker offering incredible educational materials.

83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Customer Support: Who’s Got Your Back?

Let’s be honest—when things go wrong, the last thing you want is to feel stranded. A broker’s customer support can make or break your trading experience, and I’ve put these brokers to the test to see who’s really there when you need them.

Top Performers

Pepperstone

I was seriously impressed with Pepperstone’s customer support. They’re available 24/5 via live chat, email, and phone, and every query I threw at them was met with a helpful, detailed response within minutes. Whether you’re having technical issues or just need help understanding a feature, their team is fast and reliable. For me, this sets the gold standard in support.

City Index

City Index doesn’t just have a great platform—they’ve got the support to match. Their team was super friendly during my testing, resolving issues quickly and with zero fuss. If you’re a beginner who might need a bit of extra hand-holding, City Index feels like a safe pair of hands.

IG

IG’s live chat is responsive, but it can take a few minutes to connect during busy periods. That said, their extensive FAQ section and platform tutorials saved me a lot of time when I needed answers to common questions. It’s not perfect, but it’s dependable.

Room for Improvement

ActivTrades

Don’t get me wrong—ActivTrades’ support is reliable, but it’s not as quick or proactive as Pepperstone or City Index. If you’re patient, you’ll get the help you need, but I’d love to see them step up their response times.

Educational Resources: Who Helps You Learn?

Even the most experienced traders need to brush up on their skills sometimes. For beginners, having access to quality education is an absolute game-changer. So, who’s really helping traders up their game?

Top Performers

IG Academy

IG blows everyone out of the water here. Their Academy is packed with courses, webinars, and live tutorials that cover everything from the basics of stock trading to advanced strategies. I found their content well-structured and easy to follow, whether you’re a complete beginner or brushing up on your technical analysis skills.

XTB Trading Academy

XTB’s Trading Academy is another standout. Their interactive lessons, video tutorials, and quizzes make learning genuinely enjoyable. It’s like having a personal trainer for your stock trading journey. Whether you want to deep-dive into technical analysis or get the basics of risk management down, XTB delivers.

Pepperstone

Pepperstone’s webinars and strategy guides are great for those looking to learn more about stock CFDs specifically. They’re not as broad as IG’s offerings, but they’re incredibly focused and practical—perfect if you’re looking to refine your trading techniques.

Room for Improvement

City Index Academy

City Index offers a solid educational platform, but it doesn’t quite match the depth of IG or XTB. That said, their tutorials and webinars are more than enough for beginners looking to get a strong start in stock trading.

Which Broker is Best for Stock Trading?

Best Overall Broker: IG

With its unparalleled stock range (6,000+ shares), user-friendly platform, and exceptional educational resources, IG is the go-to broker for most UK stock traders.

Best for Low Costs: Pepperstone

For traders focused on minimising fees, Pepperstone’s competitive spreads and flexible platforms are unbeatable.

Best for Beginners: XTB

If you’re new to stock trading, XTB’s intuitive platform and educational resources make it an excellent starting point.

Best for Advanced Traders: EightCap

For those who love digging into charts and customising strategies, EightCap’s TradingView integration is second to none.

Best for Security: ActivTrades

Safety-conscious traders will appreciate ActivTrades’ FCA regulation and extra insurance coverage.

FAQs

1. Which Broker Has the Most Stocks?

- IG leads the pack with access to over 6,000 stocks from global markets.

2. Which Broker is Cheapest for Stock Trading?

- Pepperstone offers the lowest trading costs, especially for stock CFDs, with tight spreads starting at 0.0 pips.

3. Can I Start Stock Trading with £50?

- Yes, brokers like Vantage and XTB allow you to start with minimal deposits (£50 or less).

4. Which Stock Trading Platform is Best for Beginners in the UK?

- XTB is ideal for beginners thanks to its user-friendly platform, great educational resources and no minimum deposit requirement.

5. Can I Practice Stock Trading?

- All brokers listed here offer demo accounts, allowing you to practice risk-free with virtual funds.

Final Thoughts

Choosing the right stock trading broker can feel like finding a needle in a haystack, but after thorough testing, I’ve narrowed it down to five fantastic options, each catering to different trading styles and needs.

If you’re looking for the ultimate all-rounder, IG is hard to beat. With over 6,000 stocks from markets worldwide, competitive fees, and a user-friendly yet powerful platform, it’s perfect for both beginners and seasoned traders. Their IG Academy is a standout feature for anyone looking to deepen their market knowledge.

For those focused on low costs and fast execution, Pepperstone is a dream. While their stock range is smaller (1,200 stocks), their ultra-tight spreads and platform flexibility (MT4, MT5, cTrader, and TradingView) make them an excellent choice for active traders.

If simplicity and tax advantages are priorities, City Index is your go-to. With 4,700 stocks and the option for tax-free spread betting, it’s an excellent choice for UK traders looking for a no-fuss experience.

For beginners, XTB excels with its intuitive xStation 5 platform, no minimum deposit, and extensive educational resources. It’s a great place to start without feeling overwhelmed.

Finally, ActivTrades is the broker for safety-conscious traders. FCA regulation, segregated funds, and additional insurance make them a secure option, especially if you value reliability over bells and whistles.

Why These Brokers Stand Out

- IG: Best for stock variety and overall value.

- Pepperstone: Ideal for cost-conscious, active traders.

- City Index: Simplifies trading with tax-free spread betting and a user-friendly platform.

- XTB: Perfect for beginners with its intuitive platform and no deposit requirement.

- ActivTrades: A reliable, secure option for those who prioritise safety.

No matter where you are in your trading journey, these brokers bring something unique to the table. The key is to choose the one that aligns with your goals, test their demo accounts, and dive in.

Resources / Sources

- Pepperstone Number of Stocks for UK Traders

- Number of Tradable Shares on IG (2023)

- Number of Stocks Tradable on XTB

- Number of Stocks Tradable on ActivTrades

- Number of Stocks Tradable on City Index

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025