Who is a Better Broker: Vantage Markets vs Pepperstone?

OK, it’s that time for another broker match-up, this time it’s Vantage Markets vs Pepperstone. Choosing between Pepperstone and Vantage Markets, is tricky to say the least… Both brokers are FCA-regulated, highly reputable, and cater to traders of all experience levels, but there are some key differences.

Pepperstone excels with tighter spreads, platform variety, and execution speed, while Vantage stands out for its copy trading features and beginner-friendly education.

Let’s break it down to see who comes out on top.

1. Key Features Comparison

| Pepperstone VS Vantage Markets |  First

First | ||

|---|---|---|---|

| Regulation | FCA, ASIC, CySEC, SCB, BaFin | FCA, ASIC | |

| Number of Instruments | 1200+ | 1000+ | |

| MT4 | |||

| MT5 | |||

| cTrader | |||

| Proprietary Platform | |||

| TradingView Integration | |||

| Commission (Forex) | £4.5 per lot (Razor Account) | £6 per lot (Raw Account) | |

| Spreads | From 0.0 pips (Razor) | From 0.0 pips (Raw) | |

| Free VPS Access | |||

| Islamic Accounts | |||

| Customer Service | 24/5, multilingual | 24/5, multilingual | |

| Education | Moderate | Strong | |

| Copy Trading | |||

| Deposit Requirements | None | $200 | |

| Join Pepperstone | Join Vantage |

Here’s the quick version: Pepperstone is the go-to choice for advanced traders looking for tight spreads, low commissions, and platform variety. Vantage Markets, however, is excellent for beginners and copy traders thanks to its intuitive tools and stronger educational content.

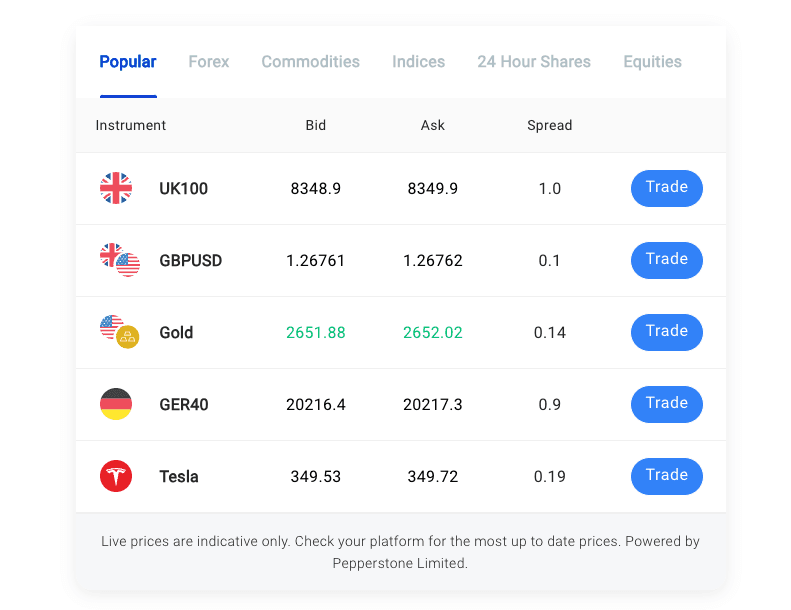

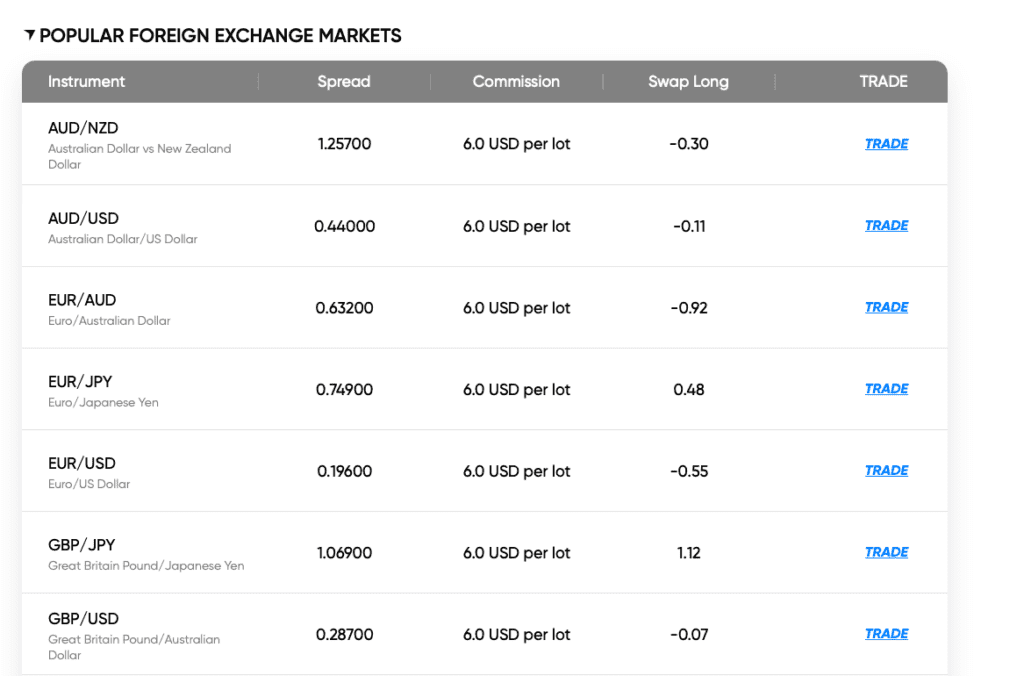

2. Fees and Spreads: Who Saves You More?

Pepperstone Fees

With Pepperstone, the Razor Account is where it’s at. Spreads start from 0.0 pips on major forex pairs like EUR/USD, combined with a £4.50 round-turn commission per lot. If you prefer a commission-free option, the Standard Account offers spreads starting from 0.7 pips—a solid option for casual traders.

Stock CFDs? No commissions here—just spreads. But keep an eye on overnight swap rates if you hold positions beyond the day.

Vantage Markets Fees

Vantage Markets’ Raw Account is competitive, offering spreads from 0.0 pips but with a slightly higher £6 round-turn commission per lot. Their Standard Account skips the commission but starts with spreads around 1.0 pips, which is slightly wider than Pepperstone’s.

Verdict: Pepperstone wins this one. The Razor Account’s combination of tighter spreads and lower commissions makes it perfect for scalpers and high-frequency traders.

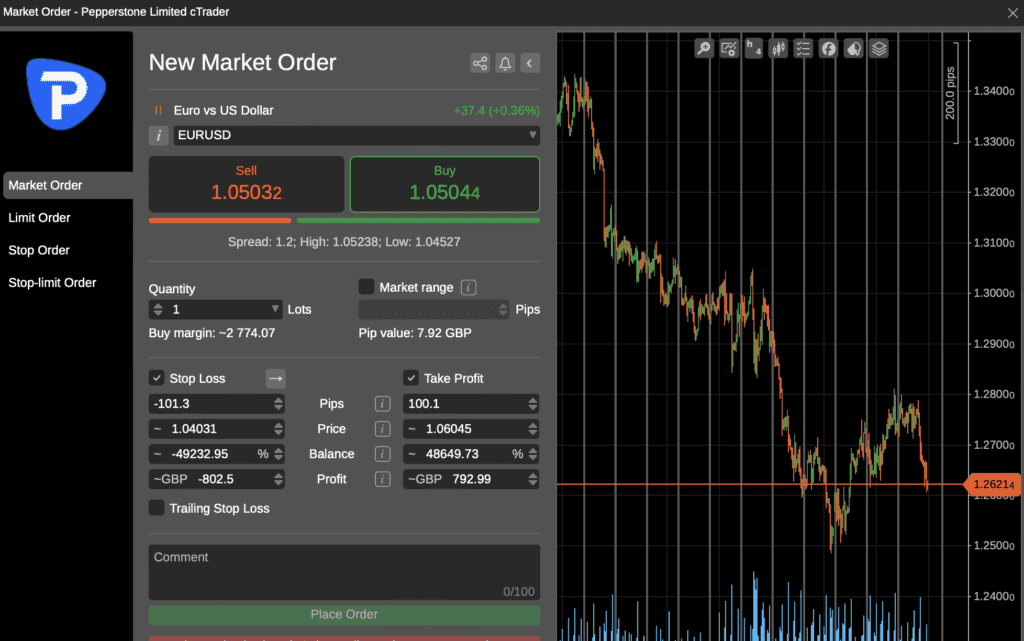

3. Trading Platforms: Flexibility vs Focus

Pepperstone Platforms

Pepperstone is the undisputed king of platform variety. You get:

- MT4 & MT5: Perfect for automation with Expert Advisors (EAs).

- cTrader: Ideal for scalpers with direct market access and advanced order tools.

- TradingView: A charting paradise for technical traders with seamless execution.

Whether you’re automating strategies, scalping, or running deep analysis, Pepperstone gives you everything you need.

Vantage Markets Platforms

Vantage Markets primarily focuses on MT4, MT5, and their TradingView ProTrader platform. While their integration with TradingView is excellent, the lack of cTrader might leave scalpers wanting more. That said, their SmartTrader Tools add valuable features like enhanced charting and trade management tools for MT4/MT5.

Verdict: Pepperstone edges ahead here. If you love having platform flexibility (especially cTrader), Pepperstone is your best bet. But if you’re happy sticking with MT4/MT5 and TradingView, Vantage Markets does the job well.

4. Range of Tradable Assets: Precision vs Variety

Pepperstone Assets

Pepperstone offers 1,200+ instruments, focusing on quality over quantity:

- 60+ forex pairs

- 1,200+ shares

- Indices, commodities, ETFs, and cryptocurrencies

They provide enough variety for most traders, with a particular emphasis on forex and stock CFDs.

Vantage Markets Assets

Vantage Markets delivers a solid range of 1,000+ instruments, including:

- Forex

- Indices

- Commodities

- Shares CFDs

While the essentials are covered, Pepperstone’s offering feels more comprehensive—especially when it comes to shares and ETFs.

Verdict: Pepperstone wins here for offering a broader selection of assets. If you’re a trader who likes options, Pepperstone has the edge.

5. Automated Trading and Copy Trading

Pepperstone

Pepperstone supports automated trading via MT4, MT5, and cTrader, with full compatibility for EAs (Expert Advisors). However, they don’t offer built-in copy trading.

Vantage Markets

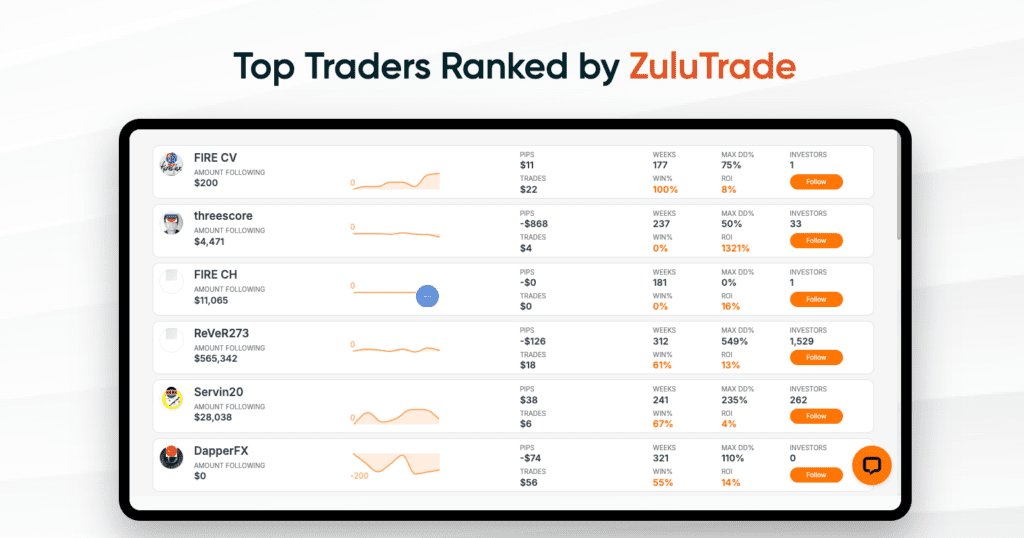

This is where Vantage Markets shines. In addition to automation tools on MT4/MT5, they offer built-in copy trading features that let you follow and replicate successful traders’ strategies. You can also integrate with platforms like ZuluTrade and Myfxbook AutoTrade for social trading.

Verdict: Vantage Markets takes this one. If copy trading is a priority, their tools make it simple and accessible for beginners.

6. Regulation and Security

Pepperstone: Regulated by FCA, ASIC, CySEC, BaFin, and SCB. Client funds are held in segregated Tier-1 bank accounts, and UK traders enjoy FSCS protection up to £85,000.

Vantage Markets: Regulated by the FCA, ASIC, and VFSC. Client funds are also segregated for added security.

Both brokers are highly reputable and meet top-tier regulatory standards, so you can trade with confidence.

Verdict: It’s a tie. Both Pepperstone and Vantage Markets are rock-solid in terms of security and regulation.

7. Educational Resources

Pepperstone Education

Pepperstone’s educational resources are comprehensive but lean towards intermediate and advanced traders. You’ll find detailed webinars, strategy guides, and platform tutorials, but there’s less hand-holding for beginners.

Vantage Markets Education

Vantage Markets goes the extra mile for beginners, with their super detailed and comprehensive Vantage Academy which offers structured trading courses, step-by-step guides, and webinars. Their focus on beginner education is refreshing and makes learning the ropes much easier.

Verdict: Vantage Markets wins here. If you’re a beginner looking to sharpen your skills, their resources are more approachable and detailed.

Which is Better—Pepperstone or Vantage Markets?

| Criteria | Winner |

|---|---|

| Fees and Spreads | Pepperstone |

| Trading Platforms | Pepperstone |

| Range of Assets | Pepperstone |

| Copy Trading | Vantage Markets |

| Regulation and Security | Tie |

| Education | Vantage Markets |

Choose Pepperstone if you want the lowest spreads, the most flexible platform options (especially with cTrader), and lightning-fast execution for scalping or high-frequency trading.

Choose Vantage Markets if you’re a beginner who values education and copy trading tools that help you follow the pros while learning.

Still undecided? Open a demo account with both brokers and see which one feels like the perfect fit for your trading style.

FAQ’s

1. Is Pepperstone better than Vantage Markets for forex trading?

Yes, Pepperstone is better for forex trading if you prioritise tight spreads and low trading costs. On their Razor Account, I hit spreads as low as 0.0–0.1 pips on EUR/USD during peak hours, with a round-turn commission of £4.50 per lot. That’s a game-changer for scalpers and high-frequency traders.

Vantage Markets offers competitive spreads too (starting from 0.0 pips on their Raw account), but the commission is slightly higher at £6 per lot. If cost savings are your focus, Pepperstone edges ahead.

However, if you’re after beginner-friendly tools or copy trading, Vantage has some nice extras.

2. Is Vantage Markets better than Pepperstone for beginner traders?

Yes, Vantage Markets is the better option for beginners. Their educational tools are tailored for new traders, with structured courses, webinars, and guides that make learning to trade much easier. I found their copy trading feature a real plus—it lets you follow experienced traders and learn as you go.

Pepperstone, while excellent for advanced traders, leans more towards experienced users with platforms like MT4, MT5, and cTrader, which come with a bit of a learning curve.

So, if you’re just starting out, Vantage Markets feels more approachable and beginner-friendly.

3. Is Pepperstone better than Vantage Markets for day trading?

Yes, Pepperstone takes the edge for day trading. Their Razor Account is purpose-built for this style, offering 0.0 pips spreads with ultra-low commissions. Execution speed is another highlight—Pepperstone’s infrastructure ensures orders are filled quickly with minimal slippage.

What sets Pepperstone apart is the platform flexibility. Whether you’re scalping on cTrader, automating trades on MT4/MT5, or analysing on TradingView, you’ve got all the tools you need to fine-tune your strategy.

Vantage Markets is solid too, but the slightly higher commissions and lack of cTrader mean Pepperstone wins for pure day-trading precision.

4. Is Vantage Markets better than Pepperstone for copy trading?

Yes, Vantage Markets is the better choice if you’re into copy trading. They offer a built-in copy trading platform where you can follow and replicate the trades of professional traders. It’s easy to set up and perfect for beginners or those short on time. They also integrate with tools like ZuluTrade and Myfxbook AutoTrade, giving you even more options.

Pepperstone, on the other hand, supports automation through MT4, MT5, and cTrader, but lacks a native copy trading feature.

If following the pros is your thing, Vantage Markets is the clear winner here.

5. Is Pepperstone better than Vantage Markets for trading platforms?

Yes, Pepperstone offers better platform variety. You get access to MT4, MT5, cTrader, and TradingView, covering everything from scalping to algorithmic trading and advanced charting. cTrader is a particular highlight for its direct market access and ease of use for scalpers.

Vantage Markets focuses on MT4, MT5, and their TradingView ProTrader platform. While their TradingView integration is excellent, the lack of cTrader makes Pepperstone the more versatile option overall.

If you love tinkering with platforms or need flexibility, Pepperstone wins.

6. Is Pepperstone safer than Vantage Markets?

Both brokers are equally safe, offering top-tier regulation and client protection.

- Pepperstone is regulated by the FCA (UK), ASIC (Australia), and CySEC (Europe), ensuring your funds are held in Tier-1 segregated accounts. UK traders also get FSCS protection up to £85,000.

- Vantage Markets is regulated by the FCA (UK), ASIC (Australia), and VFSC (Vanuatu). Like Pepperstone, they hold client funds in segregated accounts for extra security.

In short, both are rock-solid brokers. Your funds are safe with either one.

7. Is Pepperstone better than Vantage Markets for trading stocks?

Pepperstone is slightly better for trading stocks because of its broader range of stock CFDs. With over 1,200+ shares across the UK, US, and Europe, there’s plenty of choice for equity traders. Another bonus? Zero commissions on stock CFDs with Pepperstone’s Standard Account.

Vantage Markets also offers stock CFDs, but the selection is smaller, with just over 500+ options available.

If stock variety matters to you, Pepperstone comes out on top.

8. Is Vantage Markets better than Pepperstone for education?

Yes, Vantage Markets offers better educational resources, especially for beginners. I really liked their structured trading courses, beginner-friendly webinars, and market analysis tools. They make learning accessible and easy to follow, even if you’re completely new to trading.

Pepperstone, while excellent for strategy guides and tutorials, caters more towards intermediate and advanced traders. Their content focuses on practical tools rather than structured learning.

If you’re just starting out, Vantage Markets is the better choice.

9. Is Pepperstone better than Vantage Markets for execution speed?

Yes, Pepperstone has the edge for execution speed. Their ECN-like infrastructure and no dealing desk intervention ensure ultra-fast order execution with minimal slippage. In my testing, Pepperstone consistently delivered split-second fills, which is perfect for scalpers and day traders.

Vantage Markets also provides no dealing desk execution and solid speed, but Pepperstone’s infrastructure gives it the slight advantage.

If you’re placing frequent trades and need precision, Pepperstone wins.

10. Is Pepperstone better than Vantage Markets for high-volume trading?

Yes, Pepperstone is the better choice for high-volume trading thanks to its Razor Account. With spreads starting at 0.0 pips and a commission of £4.50 round-turn per lot, Pepperstone keeps trading costs extremely low—ideal for scalpers and active traders.

Vantage Markets’ Raw Account also offers 0.0 pips spreads, but the slightly higher £6 commission per lot can add up over time if you’re trading large volumes.

For traders looking to shave every penny off their costs, Pepperstone is the clear winner.

11. Is Vantage Markets better than Pepperstone for beginners trading stocks?

Yes, Vantage Markets is better for beginners trading stocks because of its more accessible educational content and intuitive tools. Their TradingView ProTrader platform makes analysing and executing trades a breeze, even if you’re new to trading.

Pepperstone offers more stock CFDs (1,200+), but beginners might find platforms like MT4 and cTrader a bit intimidating.

If you’re just starting out, Vantage Markets’ simpler approach is more beginner-friendly.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025