In our first ‘Broker Clash’ we have Pepperstone vs ActivTrades in a head-to-head for UK trading broker supremacy.

Which is the Better Trading Platform: Pepperstone or ActivTrades?

Choosing between ActivTrades and Pepperstone often comes down to your trading preferences, platform needs, and cost expectations. While both brokers are FCA-regulated and offer competitive trading conditions, there are noticeable differences in fees, platforms, and additional features.

Here’s an in-depth comparison to help you decide which broker best suits your trading style.

1. Key Features Comparison

| Pepperstone VS ActivTrades |  First

First |  Second

Second | |

|---|---|---|---|

| Regulation | FCA (UK), ASIC (Australia), CySEC (EU) | FCA (UK), CSSF (Luxembourg) | |

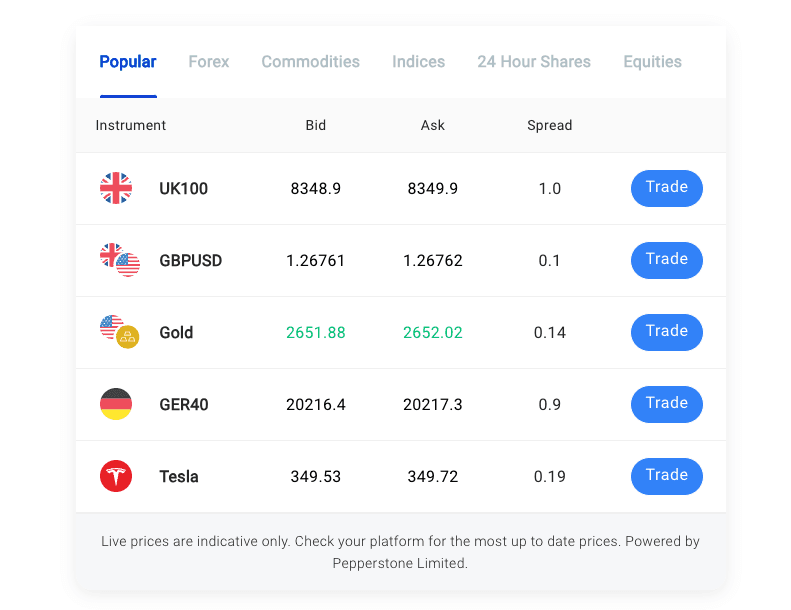

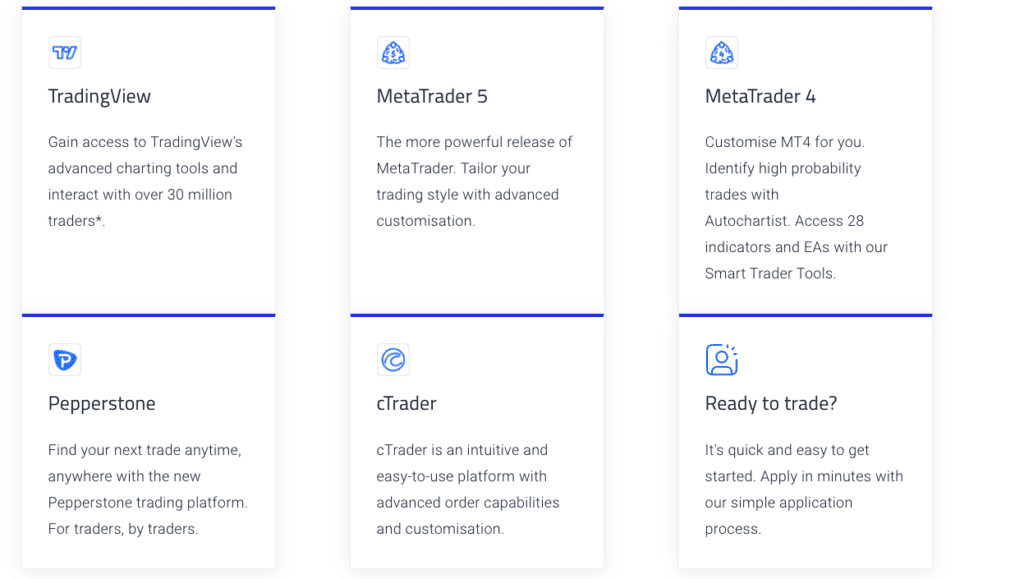

| Trading Platforms | MT4, MT5, cTrader, TradingView | ActivTrader, MT4, MT5, TradingView, | |

| Minimum Deposit | £0 (but £200 recommended) | £100 | |

| Spreads | From 0.0 pips (Razor Account) | From 0.5 pips | |

| Commissions | £4.5 per lot (Razor Account) | None on ActivTrader | |

| Range of Assets | 1,200+ | 1,000+ | |

| Education Resources | Extensive | Limited | |

| Customer Support | 24/5 | 24/5 | |

| Funding Options | Credit/Debit Card, Bank Transfer, PayPal, Skrill | Credit/Debit Card, Bank Transfer, PayPal | |

| Inactivity Fee | None | None | |

| Join Pepperstone | Join ActivTrades |

In Summary: Both brokers bring a lot to the table. ActivTrades shines with its proprietary platform and global regulation, while Pepperstone is famed for its razor-thin spreads and powerful automation tools. But which broker fits your style? Let’s dig into the details to find out.

2. Fees and Spreads: Which Broker Offers Better Value?

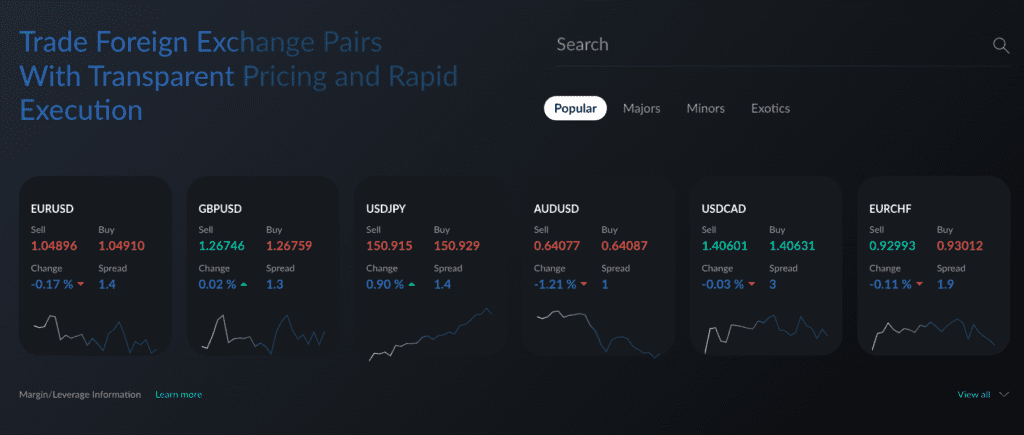

ActivTrades Fees

ActivTrades keeps it simple. Spreads on forex start at 0.5 pips, with no additional commissions. Share CFDs come with a 0.05% commission per trade, which works well for medium to large trades. And guess what? No inactivity fees. None. Nada. Zip.

Pepperstone Fees

If you’re a scalper or a high-volume trader, you’ll love Pepperstone’s Razor Account. Spreads start at a mind-boggling 0.0 pips, but there’s a catch: a £4.5 per round turn commission per lot. If you’re a casual trader, the Standard Account offers spreads from 1 pip, all-inclusive.

My Take: ActivTrades is budget-friendly for most traders, but Pepperstone’s Razor Account takes the cake for professionals looking to save on spreads.

Verdict / Winner

Our winner is Pepperstone for fees. The offer very low spreads on their Razor account and having multiple account types means they can offer better value for active traders (no pun intended).

3. Trading Platforms

ActivTrades Platforms

Let’s talk about ActivTrader—their proprietary platform. It’s a bit like a Volvo: reliable enough, definitely will get you from A to B but you probably wouldn’t want to be seen in it despite its reliability. However, it’s practical enough and suitable for learner drivers. Good thing they’ve got MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as a nice little backup.

Which platform should you choose? Luckily, ActivTrades integrates with TradingView (if you couldn’t tell from their giant TradingView screen embedded in their proprietary platform), so we would always trade ActivTrades on TradingView for a solid, reliable experience.

Pepperstone Platforms

Pepperstone doesn’t do “one platform fits all.” Instead, they bring you the Swiss Army knife of platforms: MT4, MT5, cTrader, and TradingView integration. Each option is tailored for different styles, from algo trading to manual scalping.

Verdict / Winner

If you’re looking for platform variety, Pepperstone wins hands-down. ActivTrader is solid for manual traders or beginners who might want to trade casually on TradingView, but Pepperstone’s broader range and TradingView integration provide unbelievable flexibility.

4. Trading Assets

ActivTrades

ActivTrades offers over 1,000 instruments, from forex and indices to share CFDs and commodities. It’s a respectable spread, but some niche traders might find the options limiting compared to bigger brokers.

Pepperstone

With over 1,200 tradable assets, including cryptocurrencies (for pro clients), Pepperstone has the edge. Their selection of forex pairs is particularly impressive, with 60+ pairs to trade.

Verdict / Winner

Pepperstone once again proves out here but only just. They offer a wider selection of tradable assets but only 200+ more and guaranteed you won’t even realise they are missing unless you trade something wild like TRY/SGD which, I mean, come on…

5. Regulation and Security

ActivTrades Regulation

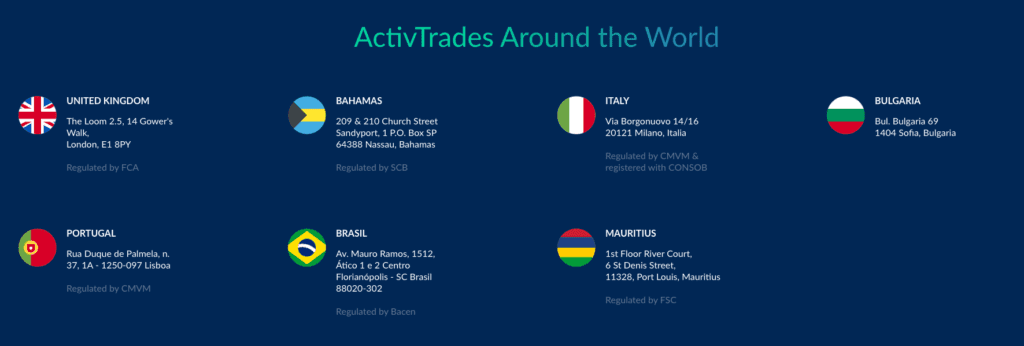

If trust were currency, ActivTrades would be a millionaire. They’re regulated by the FCA (UK), CSSF (Luxembourg), and SCB (Bahamas). Client funds are stored in segregated Tier 1 accounts, and UK traders get £1 million in excess insurance. That’s a safety net you can bounce on.

Pepperstone’s Regulation

Pepperstone really doesn’t do all that badly either with relation by the FCA (UK), ASIC (Australia), and more. UK clients benefit from FSCS protection up to £85,000, and funds are held securely in segregated accounts.

Verdict / Winner

ActivTrades’ additional insurance coverage is a clear advantage here so yeah it’s a shocker, maybe to some, but ActivTrades is just so darn secure.

6. Customer Support

ActivTrades

Their 24/5 multilingual support is responsive and helpful. I tested their live chat during market hours, and they answered my questions in minutes.

Pepperstone

Pepperstone also offers 24/5 support via live chat, phone, and email. Their team felt slightly more proactive in resolving issues, and their extensive FAQ section was a bonus.

Verdict / Winner

Both brokers provide reliable customer service, but I found Pepperstone’s support team slightly more accessible and it was pretty easy to resolve any issues I had myself on their site.

7. Educational Resources

ActivTrades

ActivTrades offers solid basics, with webinars, platform tutorials, and market analysis. However, I found their educational library less extensive than some competitors.

Pepperstone

Pepperstone’s educational resources are next-level. From strategy-focused webinars to detailed trading guides, they cater to everyone—from new traders to seasoned pros.

Verdict / Winner

Pepperstone’s deep educational resources make it the better choice for traders looking to build or refine their skills.

FAQ’s

1. Is Pepperstone better than ActivTrades for Forex trading?

If you want simplicity and zero commissions, ActivTrades is better for forex trading. Their spreads start at 0.5 pips on the standard account with no added costs, making it perfect for traders who want everything rolled into one.

That said, Pepperstone’s Razor Account is unbeatable if you’re chasing the lowest possible spreads. During testing, I consistently saw 0.0–0.1 pips on EUR/USD, but you do pay a £4.50 round-turn commission. If you’re scalping or trading large volumes, those ultra-tight spreads will save you a lot over time.

So, if you’re keeping things simple—go ActivTrades. If you’re laser-focused on spreads, Pepperstone is your guy.

2. Is Pepperstone better than ActivTrades for beginner traders?

ActivTrades is the better broker for beginner traders because their platform feels tailor-made for newcomers. The ActivTrader platform is intuitive, clean, and, frankly, calming. You log in, and everything just makes sense—no overload of buttons or complicated tools. Plus, having TradingView integrated means beginners can access brilliant charts without bouncing between screens.

Pepperstone, on the other hand, is amazing for pros, but platforms like MT4, MT5, and cTrader can feel overwhelming at first. If you’re a new trader, you don’t need to climb Everest right out of the gate—ActivTrades gives you the tools to start small and build confidence.

3. Is Pepperstone better than ActivTrades for day trading?

For day trading, Pepperstone wins hands down because of its super-low spreads and platform flexibility. When I tested Pepperstone, I saw spreads as low as 0.0 pips on EUR/USD during busy trading hours on the Razor Account. If you’re jumping in and out of trades multiple times a day, those savings stack up quickly.

Pepperstone also has MT4, cTrader, and TradingView for scalping, algo trading, or manual execution. ActivTrades is solid too, with 0.5 pips spreads and the ActivTrader platform, but if you’re serious about day trading, Pepperstone’s tools and costs give it the edge.

4. Is Pepperstone better than ActivTrades for UK traders?

ActivTrades is better for UK traders who prioritise safety and insurance coverage. Sure, both brokers are FCA-regulated and offer FSCS protection up to £85,000, but ActivTrades goes the extra mile with £1,000,000 insurance cover. Honestly, that’s peace of mind you can’t put a price on.

That said, Pepperstone isn’t far behind. They also segregate client funds and meet the highest UK regulatory standards. So, if you’re after the ultimate security net, ActivTrades has the edge. But if lower costs and better platforms are your priority, Pepperstone’s still an excellent choice.

5. Is Pepperstone better than ActivTrades for stock trading?

If you want more stock CFDs to choose from, Pepperstone is the better broker. They offer over 1,200 stocks across the UK, US, and Europe, all on a commission-free Standard Account—perfect if you’re trading frequently and want to keep costs down.

ActivTrades’ stock range is smaller, and you’ll pay a 0.05% commission per trade. That’s not a huge deal for larger positions, but for smaller trades, it adds up quickly. I like both brokers, but for stock variety and flexibility, Pepperstone wins this round.

6. Is Pepperstone better than ActivTrades for trading platforms?

Pepperstone is the clear winner for platform variety. You get MT4, MT5, cTrader, and even TradingView integration. Whether you’re running algorithms, scalping, or deep-diving into charts, Pepperstone gives you the freedom to trade how you want.

ActivTrades’ ActivTrader platform is great too—it’s clean, beginner-friendly, and integrates TradingView. But compared to Pepperstone’s range of tools, ActivTrades feels a bit like a one-trick pony. If you value options and flexibility, Pepperstone is your best bet.

7. Is ActivTrades better than Pepperstone for beginners trading stocks?

Yes, ActivTrades is better for beginners trading stocks because the experience is simple and stress-free. Their ActivTrader platform is easy to navigate, and everything feels familiar from the start. Add in TradingView integration for solid charting, and you’ve got a beginner-friendly setup that doesn’t overwhelm.

Pepperstone offers more stocks, but platforms like MT4 or cTrader can be intimidating if you’re just starting out. So, if you’re dipping your toes into stock trading, ActivTrades is a safe and simple choice.

8. Is ActivTrades safer than Pepperstone?

Yes, ActivTrades is safer because they offer an extra £1,000,000 in insurance for UK clients. Both brokers are FCA-regulated and keep your funds in segregated Tier-1 accounts, but that added insurance gives ActivTrades a real edge for safety-conscious traders.

That said, Pepperstone isn’t lacking when it comes to security. You still get FSCS protection up to £85,000, and they meet all the FCA’s strict requirements. It really comes down to whether you want that extra safety blanket—if you do, ActivTrades is the clear choice.

9. Is Pepperstone better than ActivTrades for educational resources?

Pepperstone wins for educational resources because their content is so practical and trader-focused. From strategy webinars to detailed trading guides, Pepperstone helps you learn how to actually improve your trading—not just the theory. I particularly liked their focus on forex and CFD strategies, which felt highly relevant.

ActivTrades’ education is solid too, with platform tutorials and webinars, but it’s not as comprehensive. If learning is a priority for you, Pepperstone’s resources have a lot more to offer.

10. Is Pepperstone better than ActivTrades for high-volume trading?

Yes, Pepperstone is better for high-volume trading because of its ultra-low spreads on the Razor Account. With spreads starting at 0.0 pips and a £4.50 round-turn commission per lot, it’s perfect for scalpers or traders placing large volumes of trades. The cost savings are significant, and the execution is spot on.

ActivTrades keeps things simple with 0.5 pips spreads and no commissions, which is great for casual traders. But if you’re pushing big volumes, those razor-tight spreads from Pepperstone will make a real difference over time.

Final Verdict

| Criteria | Winner |

|---|---|

| Fees and Spreads | Pepperstone |

| Platforms | Pepperstone |

| Asset Range | Pepperstone |

| Regulation and Security | ActivTrades |

| Customer Support | Pepperstone |

| Educational Resources | Pepperstone |

No Minimum Deposit

Best Overall

Pepperstone is a Melbourne-based broker that offers an excellent range of assets in the financial trading markets, including CFD's for commodities, shares, ETFs and more.

75.5% of retail investor accounts lose money when trading on margin with this provider

Who Should You Choose?

- Pick ActivTrades if you’re a beginner looking for a user-friendly platform, transparent fees, and top-notch security.

- Go with Pepperstone if you’re a seasoned trader seeking tight spreads, algo trading tools, and a wide range of assets.

In the end, the right broker depends on your style. Are you team ActivTrades or team Pepperstone? Let me know in the comments below—I’d love to hear your take!

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025