IG is one of those brokers you have probably heard of before, and if you haven’t you probably should have. It’s a stalwart of the British trading industry and offers the widest selection of tradable assets by far. Let’s see how it does against our criteria.

IG Trading Broker Review UK

When I first considered using IG, I already knew its reputation as a market leader (say less as the kids would say…). Founded in 1974, IG has been a dominant name in the trading world for decades. But with so many brokers stepping up their game, I wanted to find out if IG truly still lives up to its prestigious reputation or if it’s simply resting on its laurels.

After weeks of testing everything from its trading platforms to execution speed, I can confidently say that IG deserves its title as one of the best brokers for UK traders. Here’s my detailed and personal review based on hands-on experience.

- Access to over 17,000 markets, including forex, shares, indices, and commodities

- Proprietary platform and MetaTrader 4 support, offering flexibility for traders

- Highly regulated, including FCA oversight, ensuring security and transparency

- Top-notch educational resources, ideal for both beginners and experienced traders

- Seamless integration with TradingView, a rare and valuable feature

- High minimum deposit (£250) for UK clients compared to competitors

- Inactivity fee applies after 24 months of no trading

Is IG a Good Broker for UK Traders?

If you’re looking for a broker with a wide range of markets, competitive spreads, and reliable regulation, IG is one of the best choices in the industry. Whether you’re a beginner wanting to trade on a user-friendly platform or a seasoned trader looking for advanced tools, IG caters to a variety of needs.

However, the higher minimum deposit and inactivity fees might be a downside for more casual traders.

Does IG have a Lot of Markets to Trade?

Market Range Rating – 5/5

IG’s market range is truly unrivalled, with access to over 17,000 instruments. From forex to shares and ETFs, the sheer variety means you’ll rarely find yourself limited in what you can trade. It’s why they are recommended trading broker in the Uk for market range. They simply cannot be beaten in terms of sheer number of asset classes they offer.

What You Can Trade on IG:

- Forex: With over 80 currency pairs, IG covers all the bases, including majors like EUR/USD and GBP/USD, as well as more exotic options. Spreads start at 0.6 pips, which is competitive for retail accounts.

- Indices: Major indices such as the FTSE 100, NASDAQ 100, and DAX 40 are available with spreads starting at 0.4 points.

- Commodities: Includes a wide range of metals, energies, and soft commodities. Gold spreads start at 0.3 points, and oil spreads are equally competitive.

- Shares and ETFs: IG stands out with direct market access (DMA) and CFDs for thousands of stocks across global markets, including the UK, US, and Europe.

- Cryptocurrencies: Limited to professional clients in the UK, IG offers CFDs on major cryptos like Bitcoin and Ethereum.

My Experience

I spent most of my time trading forex and indices (as always) and IG performed really well here. The spreads on EUR/USD and GBP/USD consistently hovered around 0.6 pips during my tests, even during periods of higher volatility.

The indices were another standout feature. I tested the FTSE 100 and NASDAQ 100, and the spreads were tight at 0.4 points, with near-instant execution. Trading shares was also a highlight—having both DMA and CFD options gave me flexibility depending on my strategy.

Verdict

IG’s market range is one of the best I’ve seen. Whether you’re into forex, shares, or indices, the variety ensures you’ll always have options.

IG Trading Markets Summary.

Kicking of with full marks, IG has the widest selection of tradable assets in the UK.

Are IG’s Fees Competitive?

IG Fees Rating – 3.5 / 5 Stars

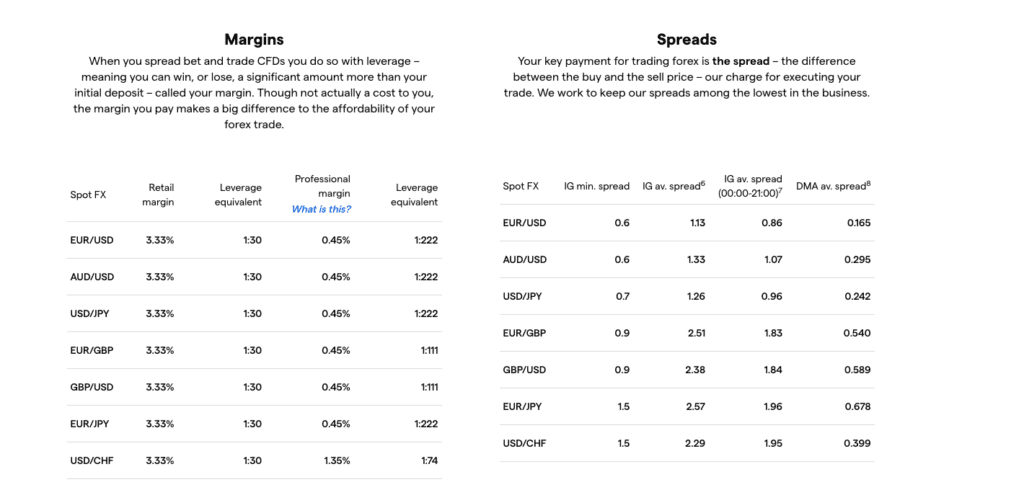

IG’s fees are competitive for most asset classes (see above for margin requirements & average spreads) though the high minimum deposit (£250) and inactivity fees (£12 after 24 months) might deter some traders.

What to Expect

- Forex Spreads: Start at 0.6 pips for major pairs like EUR/USD.

- Share CFD Commissions: UK shares are charged at 0.10% per trade, with a minimum fee of £10. US shares have a flat rate of $10.

- Indices Spreads: As low as 0.4 points for major indices like the FTSE 100.

- Commodities Spreads: Gold spreads start at 0.3 points.

- Inactivity Fees: A £12 monthly fee applies after 24 months of inactivity.

My Experience

The forex spreads were consistently competitive, especially during peak trading hours. Trading indices like the S&P 500 and FTSE 100 was cost-effective, with spreads that remained tight regardless of market volatility.

Share trading costs, while slightly higher than some competitors, felt justified given the breadth of options available. The £10 minimum fee for UK shares could be a drawback for smaller trades but works well for medium to large positions.

One fee I didn’t love was the inactivity charge, which kicks in after 24 months. While it’s avoidable, it’s worth noting if you’re not a frequent trader.

Verdict

IG offers a transparent and competitive fee structure for active traders. However, the inactivity fee and high minimum deposit might be a consideration for less frequent users.

IG Trading Markets Summary.

Faltering at the second hurdle, IG kicks a punch with it’s fees which are numerous and hard-hitting.

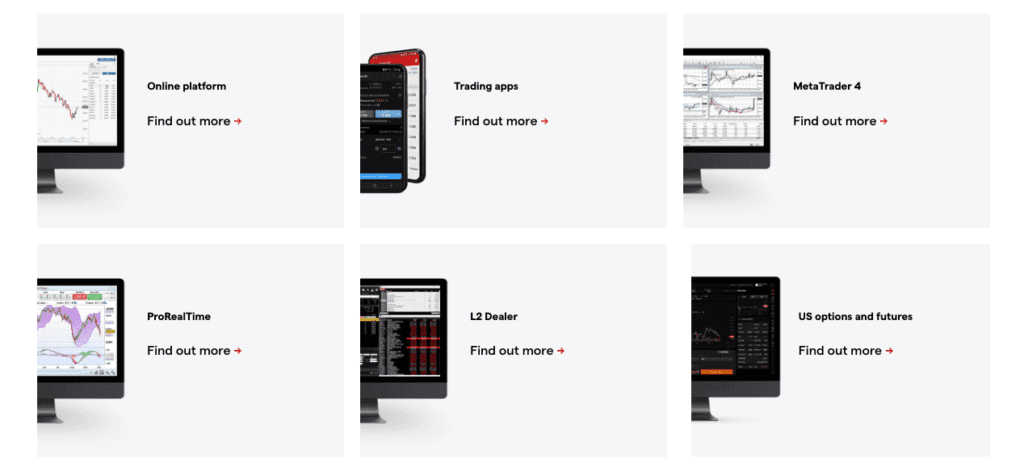

What are IG’s Trading Platforms?

Trading Platforms – 5 / 5 Stars

IG has 6 trading platforms: TradingView, MetaTrader 4, MetaTrader 5, ProRealTme, L2 Trader and their standard web trader those platforms all have their positives and negatives although I imagine most people will use IG’s web trader or mobile app. Here’s a breakdown of their trading platforms:

Trading Platforms

- Proprietary Platform: IG’s browser-based platform is intuitive, with customizable charts, advanced order types, and integrated risk management tools.

- MetaTrader 4: For those who prefer the classic interface and automated trading capabilities of MT4, IG provides seamless integration.

- TradingView: A standout feature, IG’s integration with TradingView allows traders to use advanced charting tools and social trading features.

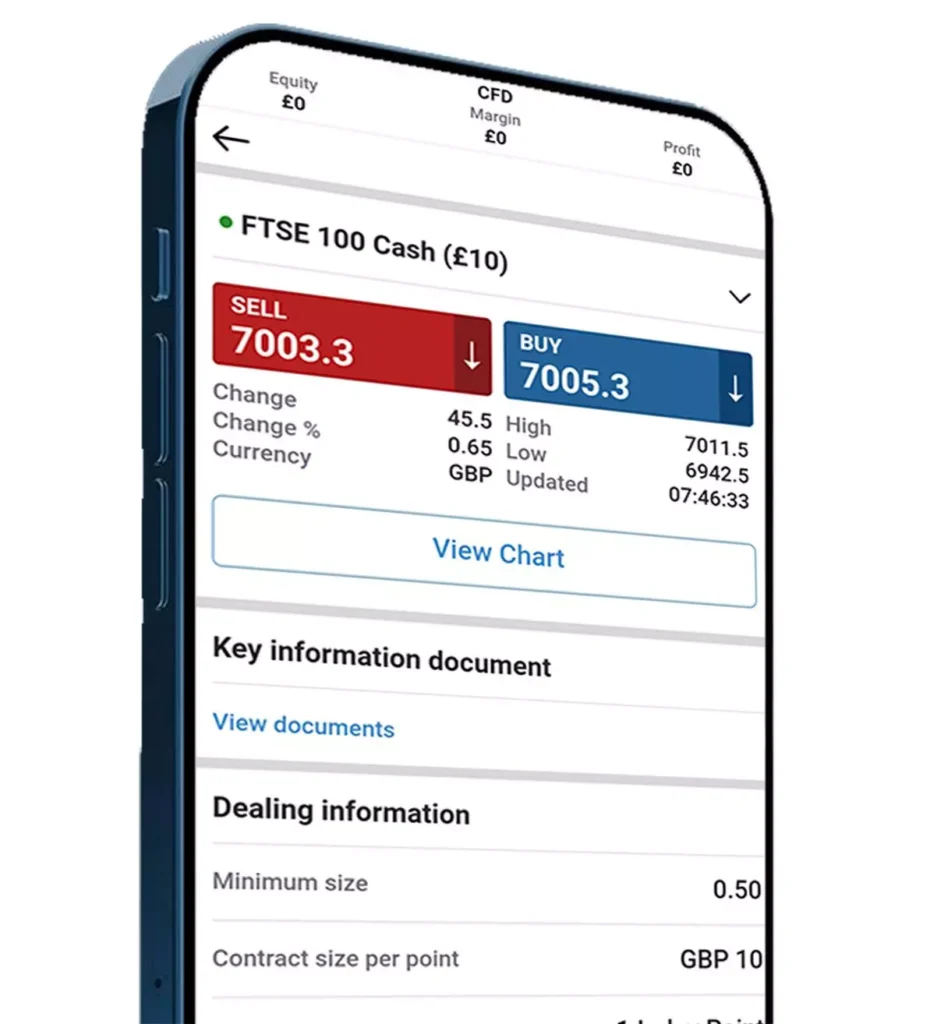

- Mobile App: The IG mobile app offers full functionality, letting you trade, analyze, and manage your account on the go.

My Experience

I spent most of my time on IG’s proprietary platform and mobile app and it didn’t disappoint. The layout was clean and easy to navigate, and the charting tools were more advanced than I initially expected. In fact I’d even go out on a limb and say it’s probably one of the most advanced mobile apps in terms of ‘pure trading information‘ for each instrument that I’ve had the pleasure interacting with. Whilst this might be TMI (too much information) for beginner traders, it is perfect for intermediate and more advanced traders.

The TradingView integration was a game-changer for me too. Being able to analyze the markets using TradingView’s extensive tools and then execute trades seamlessly through IG was a huge plus.

The mobile app also impressed me. Whether I was monitoring trades or analyzing charts, the experience felt seamless across devices.

Verdict

IG’s platform variety is unmatched. Whether you’re a beginner or an advanced trader, their options cover all the bases.

IG Platforms Summary.

IG knows what traders want when it comes to platform experience and they nail this.

Does IG have Fast Execution Speed?

Execution Speed – 5 / 5 Stars

Yes, IG has extremely fast execution speed for UK traders. They offer Direct Market Access (DMA) through their L2 Trader platform and operate an over-the-counter trading model where they act as a counter-party for standard accounts. IG’s infrastructure ensures reliable and fast order processing across all platforms.

My Experience

I tested IG’s execution during both quiet and highly volatile periods, including news events like a major central bank decision. My trades were consistently executed within milliseconds, and I noticed little to no slippage—even on fast-moving pairs like GBP/USD.

Indices trading was similarly seamless. For instance, I tested the S&P 500 during peak market hours, and orders went through instantly without any noticeable delay. This level of precision is essential for strategies like scalping or short-term trades.

The reliability extended to shares and commodities as well. Whether trading CFDs on Tesla or gold, the execution was flawless. For traders relying on accurate entries and exits, IG delivers.

Verdict

IG’s execution speed is top-tier, making it ideal for traders who require precision and reliability. Whether you’re a scalper or swing trader, you can count on their fast processing times.

IG Speed Summary.

Quick and reliable execution, no noticeable issues.

Is it Easy to Withdraw Money from IG?

Deposit & Withdrawal – 4 / 5 Stars

Yes, although as with most brokers, depositing is much quicker than withdrawals. IG’s deposits are usually instant (literally a few minutes) and their withdrawal times are roughly 1-3 business days. Whilst not the fastest around it is certainly quick for UK traders to withdraw money. Here are some key facts:

What You Can Use

- Debit/Credit Cards: Most deposits are processed instantly.

- Bank Transfers: Typically take 1–3 business days, depending on your bank.

- PayPal: Available for deposits and withdrawals, offering convenience and speed.

My Experience

I used a debit card for my initial deposit, which was processed instantly. This allowed me to start trading right away. I also tested PayPal for a deposit, and the funds were available in my account within minutes—a great option for those who value speed.

Withdrawals were equally straightforward. I requested a withdrawal via bank transfer, which took two business days to reach my account, well within IG’s stated timeframe. PayPal withdrawals were even faster, with the funds arriving within 24 hours.

One thing I appreciated was the lack of deposit fees, though it’s worth noting that small charges may apply for international bank transfers or currency conversions.

Verdict

IG’s deposit and withdrawal process is efficient and transparent. The inclusion of PayPal adds convenience, though some users might find the £250 minimum deposit a bit high compared to competitors.

IG Deposit & Withdrawal Summary.

Quick and reliable execution, no noticeable issues.

Is IG a Legit & Trusted Broker?

Regulation and Security – 5 / 5 Stars

IG is one of the most trusted brokers globally, regulated by the FCA in the UK. So yes, it’s a ‘legit’ broker which has a robust regulatory framework and decades of experience.

Who Regulates IG?

- Financial Conduct Authority (FCA): In the UK, IG operates under FCA regulation, ensuring strict adherence to financial standards and client fund protection.

- Other Regulators: IG is also regulated in Australia (ASIC) and across Europe, further solidifying its global reliability.

Key Security Features

- Client Fund Segregation: All client funds are held in segregated accounts, separate from IG’s operational funds.

- Negative Balance Protection: Retail clients are protected from losing more than their account balance.

- FSCS Coverage: UK traders are covered up to £85,000 under the Financial Services Compensation Scheme.

Verdict

IG’s regulation and security measures are second to none. If safety and transparency are priorities for you, IG is an excellent choice.

IG Regulation Summary.

Highly-regulated UK Broker, publicly-traded and one of the longest standing brokers in the UK.

Is it easy to join IG?

Onboarding – 4.5 / 5 Stars

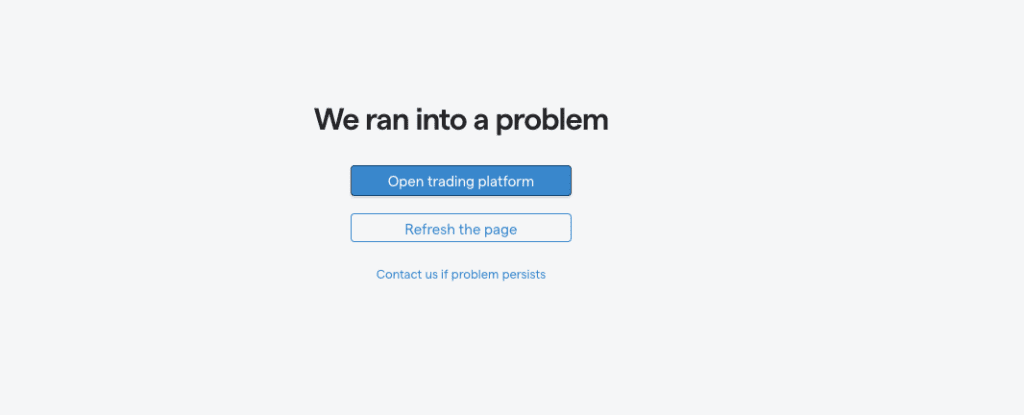

Opening an account with IG is a smooth and straightforward process – kind of… We ran into an issue opening a demo account (see screenshot below), and it is slightly more invasive than other brokers asking you for a bit more information than XTB or ActivTrades which seems to align with their dedication to traders who have a bit more to spend – maybe that’s why it was difficult !(?) but it seemed to be just a technical error and we were quickly up and running within a few minutes, so if you get the ‘We ran into a problem’ error on a demo account – just refresh the page a few times and that should solve it.

My Experience

The account setup process took me less than 15 minutes. IG’s online application was intuitive and asked for standard details like name, address, and trading experience. I uploaded my ID and proof of address for verification, and my account was approved within 24 hours.

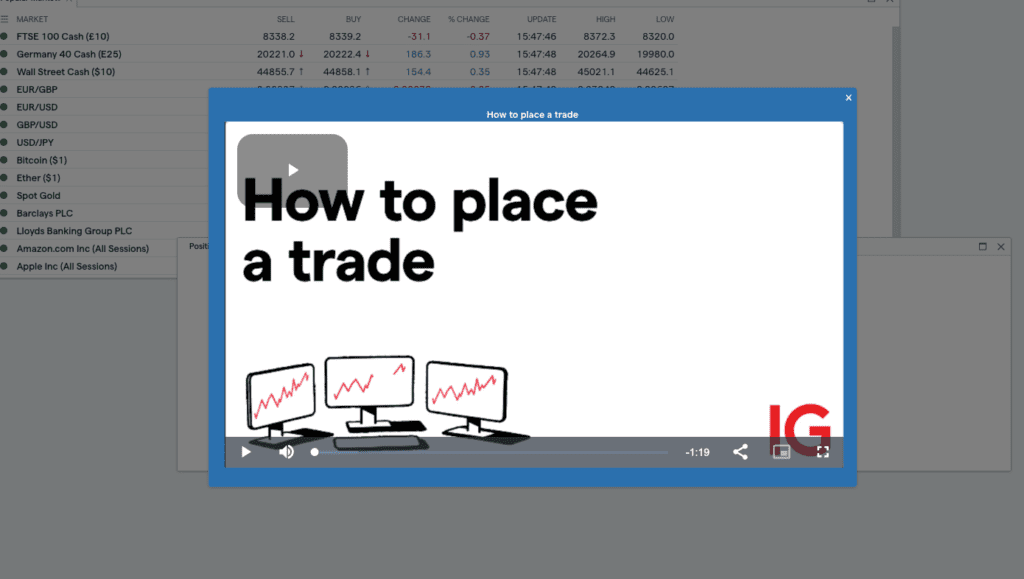

One feature I really liked was the step-by-step guidance during onboarding (see the screenshot above) . For beginners, IG provides helpful explanations for each stage, making the process feel less intimidating because the actual workspace is very scary for beginner traders. I remember when I fast encountered it I was overwhelmed by the desktop trading experience and quickly scurried over to the mobile app instead.

I also tested their demo account too, which was preloaded with virtual funds. It’s an excellent way to explore the platform and test strategies before trading live. Switching to a live account was seamless (after you go through the proper onboarding process).

Verdict

IG’s onboarding process is efficient, beginner-friendly, and well-supported. Whether you’re new to trading or a seasoned pro, getting started is a hassle-free experience.

IG Onboarding Summary.

Barring a few hiccups – it took me 5m to get the demo account up and running and only a few hours for the real account.

Is IG Good for Beginners?

Education – 5 / 5 Stars

Yes, IG has fantastic resources for beginners and it’s truly one of the best in the business with webinars, IG Academy, Market Analysis and in-built educational trading tools in their proprietary platforms. They rival even the XTB‘s and City Index‘s of the industry.

Their UI is intuitive for a broker that has frankly mountains of content and I loved using their ‘Experienced Trader?’ ‘New to Trading?’ feature to quickly direct you to different kinds of content assets.

What’s Available

- IG Academy: A dedicated learning platform with courses on everything from beginner basics to advanced strategies.

- Webinars and Seminars: Regular live events hosted by market experts.

- Market Analysis: Daily updates on economic events, market trends, and trading opportunities.

- Trading Tools: Interactive tools like risk management calculators and sentiment indicators.

My Experience

The IG Academy is one of the most thorough educational hubs I’ve encountered and frankly it would take me more time than I have to cover it all so here are some highlights:

I went through a few of their intermediate courses, which covered technical analysis and risk management in detail. The content was clear, engaging, and actionable.

I also attended a webinar on trading central bank announcements, which provided practical tips and insights into how monetary policy impacts markets. The presenter was knowledgeable, and the session included a Q&A segment, which I found helpful.

Their daily market analysis was another standout feature. I used their updates to supplement my own research, and the insights often aligned with key market movements.

Verdict

IG’s educational offerings are exceptional, making it an excellent choice for both beginners and experienced traders. The mix of online courses, webinars, and market analysis ensures there’s something for everyone.

IG Education Summary.

What a beast. IG truly knows that education is important and invests a lot of time and effort in making their resources some of the best around.

FAQs

IG provides clear answers to common questions, but here are the key takeaways:

- Is IG regulated?

Yes, IG is regulated by the FCA in the UK, ensuring a secure and transparent trading environment. - What is the minimum deposit?

The minimum deposit for UK clients is £250. - What platforms does IG offer?

IG supports its proprietary platform, MetaTrader 4, and TradingView. - Does IG charge inactivity fees?

Yes, a £12 monthly fee applies after 24 months of inactivity. - Can retail traders trade cryptocurrencies?

No, crypto CFDs are restricted to professional clients in the UK due to FCA regulations. - Are deposits and withdrawals free?

Yes, deposits and withdrawals are fee-free on IG’s side, though third-party charges may apply. - Is there a demo account available?

Yes, IG offers a demo account with virtual funds for practice trading. - Does IG provide negative balance protection?

Yes, retail clients are protected from losing more than their account balance.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025