Pepperstone is a highly-regulated trading broker based in Melbourne with offices in the UK. They offer the widest range of third-party platform options like TradingView, cTrader, MT4, MT5 which makes it a great broker for intermediate to advanced UK traders.

Pepperstone UK Trading Broker Review: 2025

When I first decided to try Pepperstone, I’d already heard plenty of buzz about them being a favourite among forex and CFD traders. Founded in 2010, they quickly gained a reputation for offering competitive pricing and an excellent breadth of trading platforms. But with so many brokers out there, I wanted to see if Pepperstone could truly stand out from the crowd.

After spending a few weeks exploring their features, trading platforms, and fees, I can confidently say that Pepperstone delivers in many key areas. From razor-sharp spreads to lightning-fast execution speeds, it’s clear why they’re popular among active traders.

Here’s my full review, based on hands-on experience.

- Extremely low spreads, starting from 0.0 pips on Razor accounts

- Access to industry-leading platforms like MT4, MT5, TradingView and cTrader

- FCA-regulated, ensuring a secure and trustworthy trading environment

- No dealing desk model for faster and more transparent trade execution

- Comprehensive educational resources and excellent customer support

- Limited range of non-CFD assets like individual stocks

- No proprietary platform, which some traders may prefer

- Inactivity fees after 12 months of no trading activity

Is Pepperstone a Good Broker for UK Traders?

Let’s cut to the chase: Pepperstone is an excellent broker for traders who prioritise low spreads, fast execution, and access to advanced trading tools. It has the widest range of trading platforms with MT4, MT5, TradingView, and cTrader which is more than enough to satisfy pretty much every UK trader – whether you’re a scalper, day trader, or even an algorithmic trader, Pepperstone’s infrastructure and account options cater perfectly to your style.

What really stood out for me was the combination of razor-thin spreads and their no-dealing desk (NDD) model. It’s rare to find a broker that combines both affordability and transparency so effectively.

That said, their limited range of individual stocks might be a drawback for those looking to trade beyond CFDs.

What Can You Trade on Pepperstone in the UK?

Trading Markets – 4.5 / 5 Stars

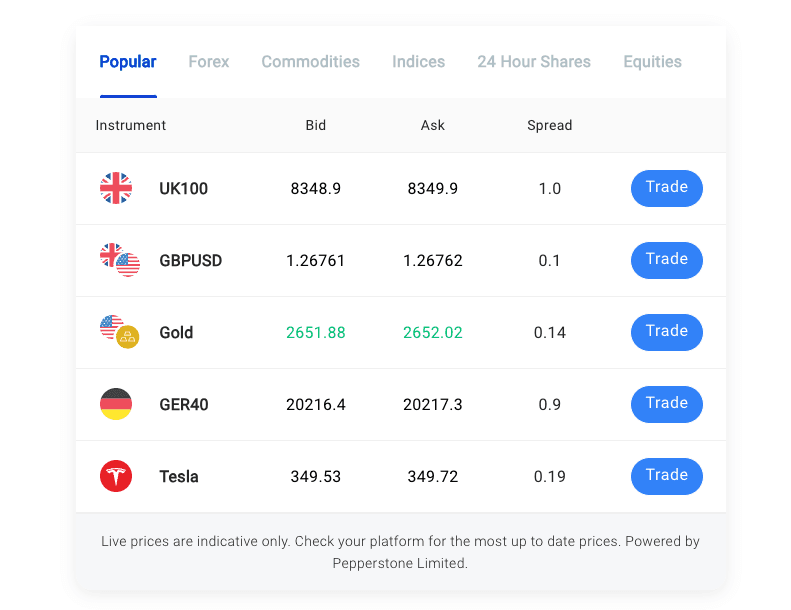

Pepperstone offers a wide range of markets (1200+ instruments), including forex, indices, commodities, and cryptocurrencies. While their CFD offerings are solid, they lack the depth of non-CFD assets like individual stocks and ETFs compared to some competitors.

What You Can Trade

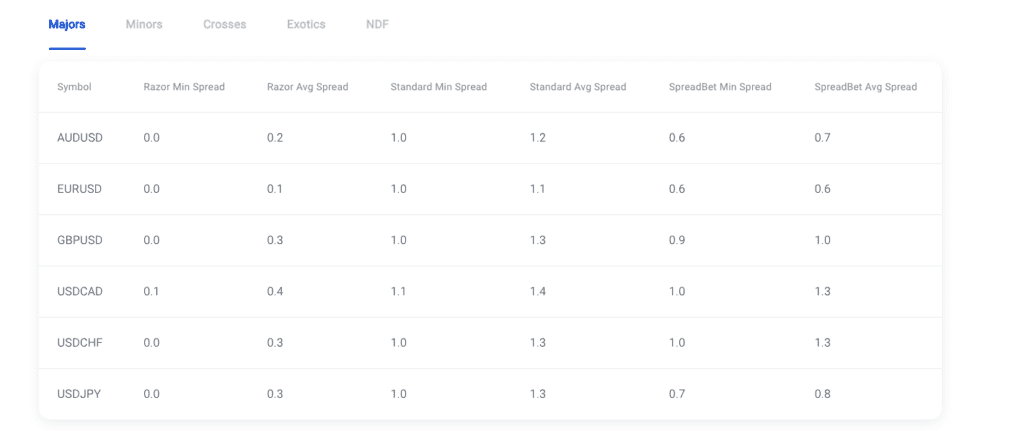

- Forex: This is where Pepperstone really excels. With 100+ currency pairs, including majors, minors, and exotics, the selection is comprehensive. Spreads start from 0.0 pips on the Razor account, making it a top choice for scalpers and high-frequency traders.

- Indices: You can trade major indices like the FTSE 100, NASDAQ 100, and S&P 500 with spreads as low as 0.4 points. This is competitive, especially for day traders focusing on global markets.

- Commodities: Pepperstone offers a solid selection of commodities, including gold, silver, and crude oil. Spreads on gold start from 0.1 points, which is incredibly tight.

- Cryptocurrencies: They provide CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. However, these are only available for professional traders due to FCA regulations.

- Shares and ETFs: While individual stocks are limited, you can access a selection of share CFDs for companies like Apple and Amazon. The range is narrower compared to brokers like City Index or XTB.

My Experience

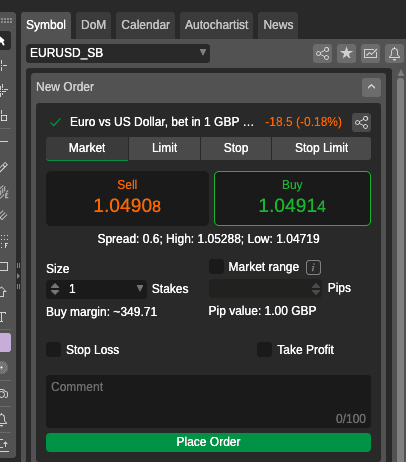

I spent most of my time trading forex and indices, and Pepperstone didn’t disappoint. The spreads on EUR/USD stayed consistently tight, 0.0 pips on the Razor account. This made a noticeable difference when I was scalping smaller price movements.

Indices like the NASDAQ 100 were another highlight. The low spreads and fast execution meant I could confidently trade during volatile sessions without worrying about slippage or delays.

Verdict

Pepperstone offers an excellent range of markets for forex and index traders. While their share CFD selection is smaller, the overall offering is strong enough for most traders.

Pepperstone Trading Markets Summary.

Not the widest range of assets by any means (1,200+) but it certainly feels more than enough when you are trading – so seems like a solid, manageable amount.

What are Pepperstone’s Fees in the UK?

Fees – 4.5 / 5 Stars

Pepperstone’s fee structure is one of the most competitive I’ve seen. They have no inactivity fee and their Razor account, in particular, stands out for its low spreads and transparent commission model (see above for the average spreads).

What to Expect

- Forex Spreads: Razor spreads start at 0.0 pips with a £4.5 per round-turn commission per lot.

- Indices Spreads: Spreads start at 0.4 points on major indices like the FTSE 100 and S&P 500.

- Commodities Spreads: Gold spreads start at 0.1 points, while crude oil starts at 2.0 points.

- Cryptocurrency Spreads: Crypto CFD’s are competitive but only available for professionals.

My Experience

The Razor account was my go-to, and it didn’t disappoint. Spreads on EUR/USD regularly hit 0.0 pips, and even with the £4.5 commission, the overall cost was lower than most brokers I’ve used.

For indices, the 0.4-point spread on the FTSE 100 was consistent, even during busy market hours. Commodities like gold and oil were equally competitive, with tight spreads that made shorter-term trades cost-effective.

The inactivity fee is worth keeping in mind, but it’s easy to avoid with occasional trading.

Verdict

Pepperstone’s low spreads and transparent commissions make them an ideal choice for active traders. The cost structure is hard to beat, especially on the Razor account.

Pepperstone Fees Summary.

I will always come back to Pepperstone for the fees – not because they are even the tightest around,the standard account is competitive but not the best, but the Razor account is a dream.

What are Pepperstone’s Trading Platforms?

Trading Platforms – 4.5 / 5 Stars

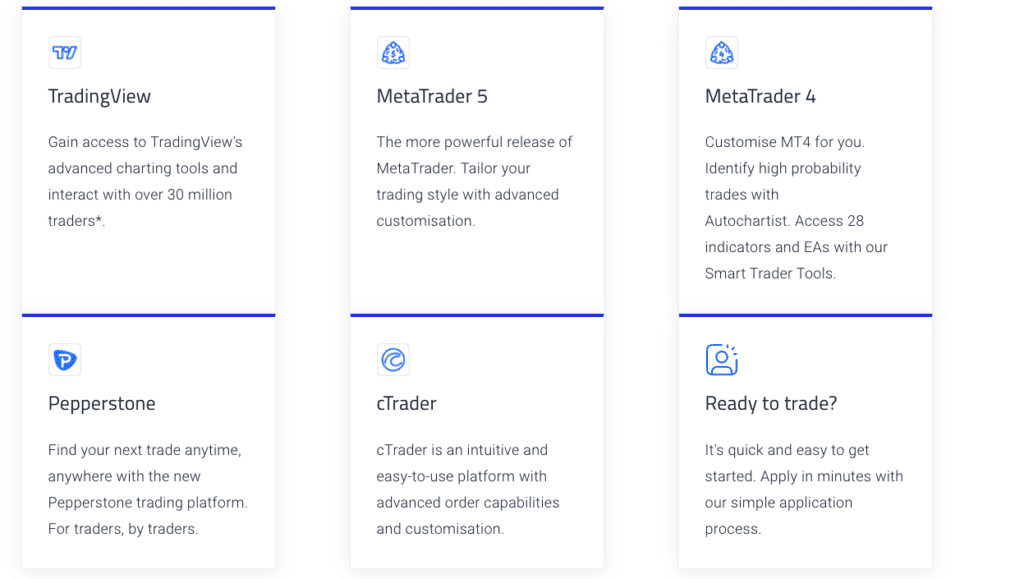

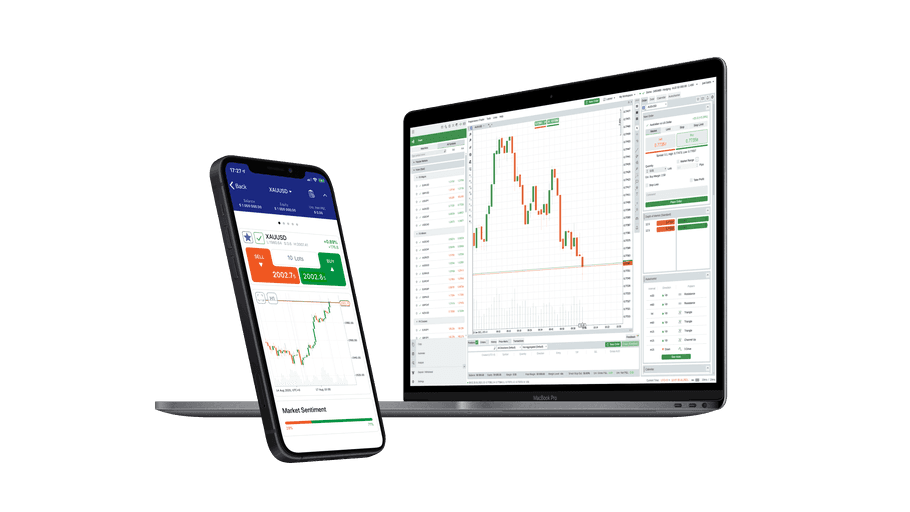

OK so we are onto the meat-and-potatoes of why I think Pepperstone is a truly extraordinary broker. The trading platform offering is just superb and the best around hands-down not only do you get access to TradingView, cTrader and MT4 & MT5 but all of this means trading on your phone is just so so easy.

Quick note for UK Traders: They have a special ‘EU’ version of their app for UK traders so just be aware of which version you download but after you get to grips with which one it is easy to download on both iOS & Android (we tested both).

Pepperstone seems to understand what most brokers don’t… traders need the freedom to be able to trade how they want and a broker shouldn’t stand in the way of that. They should facilitate it.

What’s Available

- MetaTrader 4 (MT4):

A classic choice for forex traders, MT4 comes with customizable charts, automated trading options via Expert Advisors (EAs), and a wide range of technical indicators. - MetaTrader 5 (MT5):

MT5 builds on MT4’s foundation, offering additional timeframes, advanced charting tools, and access to a wider range of assets. - cTrader:

This platform is designed for algorithmic traders. It offers detailed market depth analysis, lightning-fast execution, and customizable automation tools. - TradingView Integration:

For TradingView enthusiasts, Pepperstone’s TradingView integration is a standout feature, letting you execute trades directly from advanced charts.

My Experience

I tested all three platforms, but cTrader stole the show for me. The depth of tools available for algo trading and the smooth execution made it a pleasure to use.

MT4 and MT5 were as reliable as ever, especially for testing automated strategies. I also loved the TradingView integration—it felt seamless, and having everything in one place made technical analysis easier.

Verdict

Pepperstone’s platform variety is one of its strongest assets. Whether you’re into manual trading or automation, you’ll find something that fits your style.

Pepperstone Platforms Summary.

Another huge win for pepperstone here. Despite not having a proprietary platform, they more than compensate by having every major platform available.

Is Pepperstone Fast at Trade Execution?

Execution Speed – 5 / 5 Stars

If you’re a scalper or someone who trades during fast-moving markets, execution speed can make or break your strategy. Thankfully, Pepperstone absolutely delivers in this area. Their no-dealing desk (NDD) model ensures your trades are executed directly in the market with minimal interference, and I found this to be consistent across all the instruments I tested.

My Experience

I started by testing Pepperstone during a relatively calm trading session to gauge its baseline performance. My forex trades were executed almost instantly, with only a little bit of slippage… The tight Razor spreads were great though, and it was refreshing to see execution that matched their marketing claims.

To really put Pepperstone to the test, I traded indices like the FTSE 100 and NASDAQ 100 during high-volatility periods, including major news events. This is where the broker truly shone. Despite rapid market fluctuations, my trades went through smoothly, and the spreads remained competitive without significant widening.

For algorithmic trading, I ran multiple Expert Advisors (EAs) on MT4, and the performance was flawless. Trades were triggered exactly as programmed, with no issues related to lag or poor order execution. This is a huge win for anyone who relies on precision in automated strategies.

Verdict

Pepperstone’s execution speed is among the best I’ve experienced. Whether you’re trading manually or running EAs, you can rely on their infrastructure to execute trades swiftly and transparently.

Pepperstone Speed Summary.

No issues with speed, slippage did happen, which wasn’t great but nothing major and no issues when trading on my VPS.

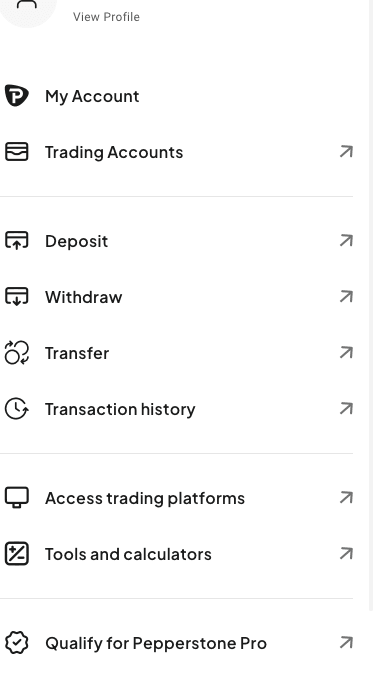

Is it Easy to Deposit & Withdraw from Pepperstone?

Deposit & Withdrawal – 5 / 5 Stars

Managing your funds with Pepperstone is a straightforward process, thanks to their wide range of payment options and quick processing times. While there are no deposit fees, some withdrawal methods might incur third-party charges, which is something to keep in mind.

What You Can Use

- Debit/Credit Cards: Pepperstone accepts Visa and Mastercard, with deposits processed almost instantly.

- Bank Transfers: Bank transfers are available but take 1–3 business days to clear, depending on your bank.

- E-Wallets: Options like PayPal, Neteller, and Skrill offer fast and secure transactions, often processed within hours.

- Other Methods: Regional payment systems, such as POLi in Australia, are also supported for international clients.

My Experience

For my initial deposit, I used a debit card, and the funds were credited to my account instantly.

When it came to withdrawals, I tested PayPal and a bank transfer. The PayPal withdrawal was processed the same day and reflected in my account within 24 hours. The bank transfer, while slower, arrived within the promised 2–3 business days (it was over the weekend so actually took a bit longer which wasn’t great..)

What stood out for me was the transparency of their processing times. Pepperstone clearly states how long each method takes, so you always know what to expect. They also send email notifications at every stage of the withdrawal process, which was a nice touch.

Verdict

Pepperstone makes depositing and withdrawing funds effortless. With no deposit fees and fast e-wallet withdrawals, it’s a broker that prioritizes convenience. Just keep an eye on third-party charges for certain withdrawal methods.

Pepperstone Deposit & Withdrawal Summary.

Major banks and PayPal accepted and withdrawals processed quickly during the week.

Is Pepperstone a Legit UK Broker?

Regulation and Security – 5 / 5 Stars

One of Pepperstone’s strongest selling points is its regulation. They’re overseen by some of the most respected authorities in the trading world (including the FCA for UK traders), providing a secure environment for UK traders and beyond.

Who Regulates Pepperstone?

- Financial Conduct Authority (FCA): Regulation in the UK ensures strict compliance with client fund safety and transparency standards.

- Australian Securities and Investments Commission (ASIC): A trusted name in financial regulation, particularly for their robust operational oversight.

- Cyprus Securities and Exchange Commission (CySEC): Covers EU traders under MiFID II compliance.

- Dubai Financial Services Authority (DFSA): Adds a layer of security for traders in the Middle East.

Verdict

Pepperstone’s regulatory credentials and focus on fund security make them one of the most trustworthy brokers I’ve used. For UK traders, the FCA regulation adds an extra layer of protection and peace of mind.

Pepperstone Onboarding Summary.

Highly regulated and secure. FCA regulated in the UK and regulated internationally.

Is it Easy to get Started with Pepperstone?

Onboarding – 4.5 / 5 Stars

Pepperstone’s onboarding process is simple and efficient, making it easy for UK traders of all levels to get started.

My Experience

Signing up with Pepperstone took me less than 10 minutes. The online form asked for basic details like my name, address, and trading experience, followed by document uploads for ID verification. I submitted a passport and a utility bill (after digging around in my flat!), and my account was approved within 24 hours.

What really stood out was the demo account option. Pepperstone gives you access to a fully functional demo account with virtual funds, which is perfect for testing strategies or familiarizing yourself with their platforms.

I also appreciated how beginner-friendly the process felt. The interface guided me through every step, and there were no confusing terms or unnecessary hurdles to jump over.

Verdict

Pepperstone’s onboarding process is seamless and user-friendly. The quick approval times and demo account option make it a great choice for both beginners and seasoned traders.

Pepperstone Onboarding Summary.

Easy to get started and demo accounts available.

Is Pepperstone Good for Beginner Traders in the UK?

Education – 4.5 / 5 Stars

Pepperstone provides a huge range of educational resources for beginner traders although we have to mention it’s not as large as XTB, it does cater to traders at all skill levels. From tutorials & webinars to market analysis, there’s something for everyone.

What’s Available

- Video Tutorials: Covering topics from basic forex concepts to advanced trading strategies.

- Webinars: Hosted by trading experts, offering actionable insights into market trends.

- Market Analysis: Daily updates on key economic events and price movements.

- Trading Guides: In-depth guides on topics like risk management and technical analysis.

My Experience

The webinars were a standout for me. I attended one on risk management, and it was packed with useful tips that I immediately applied to my trading. The presenter explained complex concepts in a way that was easy to understand, which I found refreshing.

I also made good use of their market analysis / ‘Navigating markets’ section. The daily updates were pretty good to be honest, and helped me stay ahead of major news events.

For beginners, the video tutorials are a goldmine. They’re well-structured and easy to follow, covering everything you need to get started.

Verdict

Pepperstone’s educational resources are top-notch. Whether you’re new to trading or an experienced pro, the mix of webinars, tutorials, and market insights will add value to your experience.

Pepperstone Education Summary.

Modern and up-to-date information, well structured and easy to follow for beginners through to more advanced traders.

FAQs

1. Is Pepperstone regulated?

Yes, Pepperstone is regulated by 7 regulators including the FCA (UK), ASIC (Australia), CySEC (EU), CMA, BaFin and SCB and more.

2. Does Pepperstone charge inactivity fees?

No, Pepperstone does not have an inactivity fee as of December 2024.

3. What platforms does Pepperstone offer?

Pepperstone provides access to MT4, MT5, cTrader, and TradingView integration.

4. Are there fees for deposits or withdrawals?

No deposit fees, but third-party withdrawal charges may apply.

5. Can beginners use Pepperstone?

Yes, Pepperstone offers a demo account, educational resources, and user-friendly platforms but it’s not the most beginner friendly platform and caters to more intermediate to advanced traders to make the most of the different features.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025