Plus500 is possibly the best-known mobile trading app for UK traders. They offer a clean and easy-to-use interface as well as FCA regulation and great customer service. But how does it stack up against our criteria?

Plus500 Broker Review for UK Traders

When it comes to trading brokers, Plus500 has certainly made a big splash in the UK trading scene, having been around since 2008, it’s a name that often pops up—especially for those looking for the best mobile trading apps or looking to dip their toes into trading for the first time. But does it live up to the hype? Is Plus500 actually any good for traders in the UK?

As someone who loves testing brokers (and maybe overanalysing just a little), I decided to find out.

In Summary: Plus500 knows what it’s doing, it really is the broker of choice for this generation and the next – it’s mobile-first, has low fees, and provides a seamless proprietary platform. The big promise is simplicity. They don’t bombard you with complex platform options and they focus entirely on CFDs. But is “simple” always better? Let’s break it down and see how it stacks up for UK traders.

Is Plus500 a Good Broker for UK Traders?

If you’re looking for a broker that’s straightforward, regulated, and mobile-friendly, Plus500 has a lot going for it. It’s FCA-regulated, offers a clean proprietary platform with lots of nifty tools and features, and keeps costs transparent with no commissions. However, there are some things you need to keep in mind if you want to trade with Plus500 long-term – we’ll get into some of that later.

- Commission-free trading on most CFDs.

- FCA-regulated, ensuring UK traders’ safety and transparency.

- Intuitive and user-friendly trading platform.

- Wide variety of deposit options.

- Great range of tradable assets including forex, indices, and commodities.

- Fast execution speeds, even during volatile conditions.

- competitive spreads & pricing.

- Free demo account for risk-free practice.

- Limited educational resources compared to competitors like IG or XTB.

- No support for popular third-party platforms like MetaTrader, TradingView or cTrader.

- Inactivity fees can add up and they kick in pretty quickly (3 months).

For short-term traders and those who want to focus on forex, indices, or commodities, Plus500 could be an excellent choice. But if you’re an advanced trader looking to trade on your ‘old faithfuls‘ of Metatrader, cTrader or TradingView, you might want to look away…. At Plus500 they do things a bit differently.

What Can You Trade on Plus500?

Market Range – 4/5 Stars

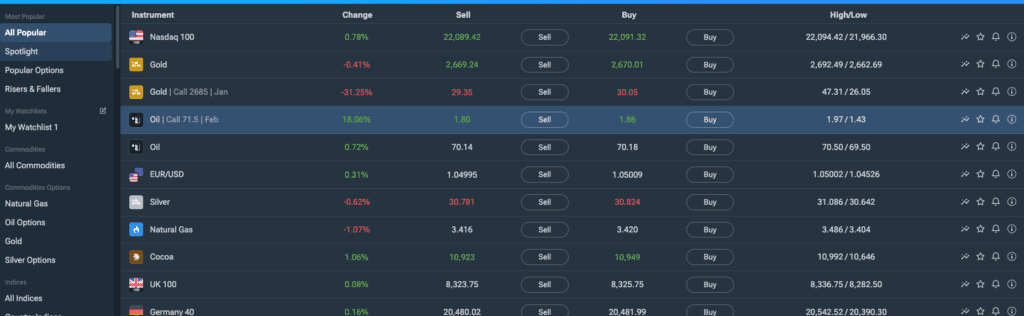

Plu500 has over 2,500 CFD instruments, which provides traders a well-rounded selection of markets. Here’s a closer look:

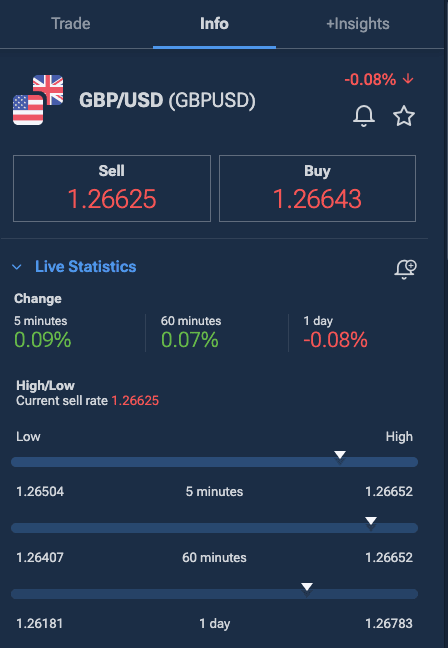

- Forex: Trade more than 60 currency pairs, with full 1:30 leverage, including GBP/USD, EUR/USD, and exotic options. Spreads start from 0.8 pips, which is competitive for a no-commission model.

- Indices: Major global indices such as the FTSE 100, NASDAQ 100, and S&P 500 have leverage of 1:20. Spreads start at 0.3 points for popular indices.

- Commodities: Choose from a variety of metals (gold, silver), energies (oil, natural gas), and agricultural products (wheat, coffee). Gold spreads start at 0.3 points, making it a great option for day traders.

- Shares: Trade CFDs on stocks at 1:5 leverage, including UK favourites like Tesco, BP, and Rolls Royce. US giants like Apple and Tesla are also available.

My Experience

During my testing, I focused on forex and indices, as those tend to be Plus500’s strengths. I was impressed with the tight spreads on GBP/USD, which stayed consistent around 0.8 pips during peak trading hours. Indices like the NASDAQ 100 also stood out, with spreads hovering near 0.3 points— great for short-term traders.

The leverage (seen above) is in line with most other brokers so I found it overall to be a great trading experience.

Verdict: Does Plus500 have a Lot of Markets to Trade?

While Plus500 doesn’t offer the jaw-dropping market variety of IG (17,000+ instruments), it’s a great starter pack of c. 2,500 CFD’s wrapped up in an excellent user interface. The balance of quality over quantity means you’re not overwhelmed by choice but still have plenty to trade.

Are Plus500’s Fees Competitive?

Fees – 4/5 Stars

Plus500’s fee structure is simple and commission-free, they simply bake their costs (your fee) into the spread, which is fairly standard and easy to understand. Here’s what you can expect:

- No Commissions: All trading costs are included in the spread.

- Forex Spreads: Starting at 0.8 pips for major pairs like GBP/USD.

- Overnight Fees: Applied to positions held overnight; these vary depending on the asset.

- Currency Conversion Fees: When converting currencies into GBP you might encounter a small currency conversion fee.

- Inactivity Fee: £10/month after 90 days of inactivity.

My Experience

The commission-free model is one of Plus500’s biggest selling points. Also during my forex trades, the spreads were competitive, especially for GBP/USD and EUR/USD. Indices trading was equally cost-effective, with tight spreads on the FTSE 100 and S&P 500.

However, the overnight fees can add up, particularly if you’re holding positions for several days. Plus, the £10 inactivity fee kicks in after just three months, which feels a bit harsh compared to brokers like IG (24 months).

Verdict: Does Plus500 have Low Fees?

It’s a mixed bag here, the answer is yes, if you are looking for a broker where the spreads are competitive then Plus500 is a great broker, however, the inactivity fee which kicks in after 90 days and is levied at £10 a month seems a bit much for the casual trader. Long-term traders may want to keep an eye on overnight charges and inactivity fees.

What is Plus500’s Trading Platform Like?

Trading Platforms – 3/5 Stars

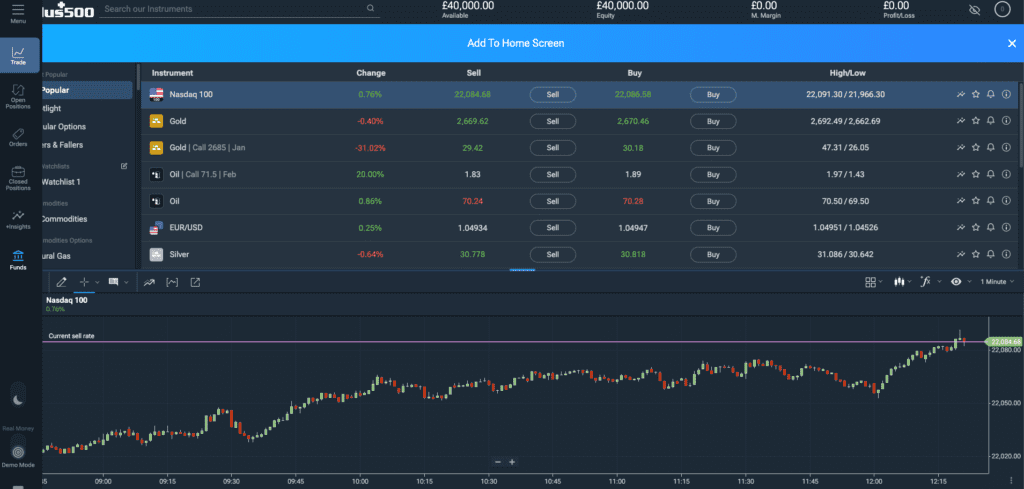

It’s worth mentioning here, whilst Plus500 has an excellent proprietary platform on both desktop and mobile, it lacks the breadth of platforms offered by most other conventional brokers like MetaTrader, TradingView or cTrader. This means that you trade via their platform or you don’t trade with them at all.

The rating of 3/5 does not reflect their excellent proprietary platform, but simply comparing it to other brokers where the range of trading platforms are wider, it seems Plus500 have (willingly!) boxed themselves into being both a technology company and a trading broker – both of which they excel at but it certainly won’t accommodate to a broad range of more advanced traders.

Here’s what you’ll get:

- User-Friendly Interface: The layout is straightforward, with clearly labeled menus and tools.

- Charting Tools: Includes indicators, drawing tools, and multiple timeframes. While not as advanced as TradingView, it’s enough for most retail traders.

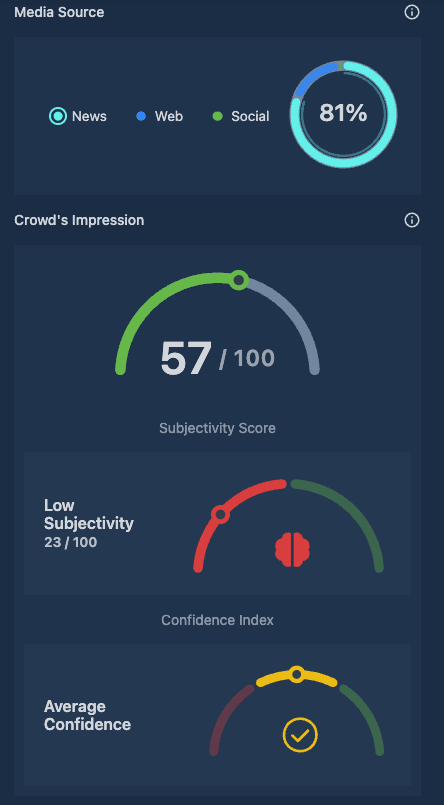

- Insights+: While this feature showing sentiment, media presence confidence scores etc might not be new technology, it’s certainly one that Plus500 makes feel unique and is a great, fun addition to my trading experience.

- Mobile App: The mobile version is excellent, with the same features as the desktop platform. It’s responsive and easy to use.

- Risk Management Tools: Plus500 offers built-in tools like guaranteed stop-loss orders, which can be invaluable for beginners. However, we recommend beginners use the demo account and Trading academy offered, to gain experience before trading with real capital due to the risks involved.

- No Third-Party Integration: There’s no support for MetaTrader or TradingView, which might disappoint advanced traders.

My Experience

I spent most of my time on the iOS mobile app and found it incredibly easy to navigate. The charting tools were fine in-and-of themselves for basic technical analysis, and placing trades was quick and intuitive.

The desktop app was a nice surprise – I knew they had one, but it doesn’t seem to get advertised as much. It was fun, clean and gave an ‘Oanda‘ feel to it, which is basic but refreshingly simple letting you focus on the technical analysis (either on the chart or elsewhere) and interact with it when needed.

The standout for me though was the level of depth they provide in the +Insights section for a particular market. It contains detailed analysis for the specific instrument itself in the pop-out tab – see the screenshot below for what I mean. This little section coupled with the more in-depth +Insights section (see my review below) was, and is, pretty unique in the space and something I thought provided a nice start to the trading day.

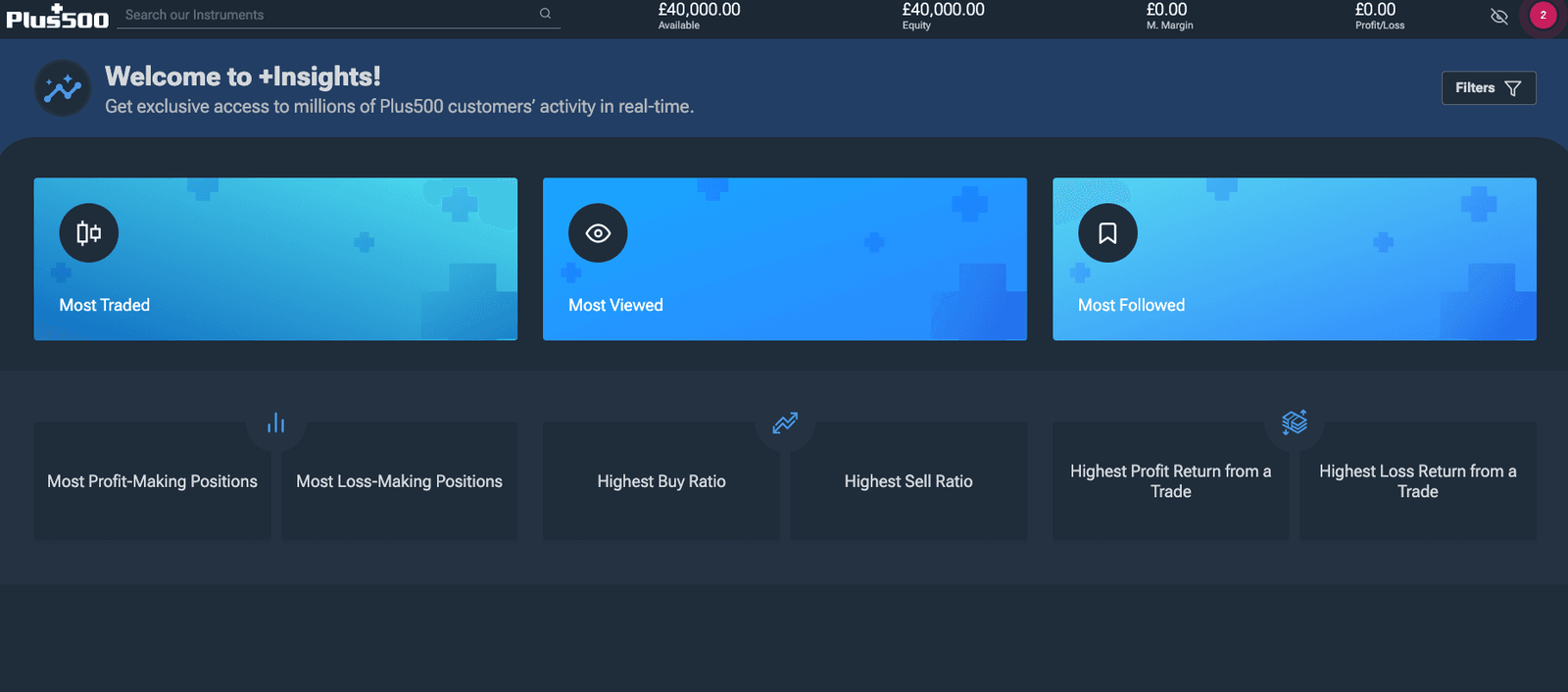

What is Plus500 +Insights?

As you can see in the screenshot below, Plus500 offers a really detailed analytics breakdown of what traders on their platform do in their +Insights section on their desktop and mobile app. +Insights is a great way to visualise key information at a glance. You can quickly find the most profit / loss-making positions, highest buy / sell ratio, most viewed instruments and more. It’s a brilliant way to visually assess and see what other traders are paying attention to.

Verdict: Is Plus500 a Good Trading Platform?

Plus500’s platform is perfect for casual traders. It might feel limiting for advanced users seeking automation, EA’s or advanced trading strategy, but the simplicity is a big plus for those just starting out and the +Insights feature is a great new addition to an already fun and engaging platform experience.

Is Plus500 Safe and Regulated?

Regulation and Security – 5/5 Stars

Plus500UK Ltd is authorised and regulated by the FCA (#509909), which means it meets the UK’s strict financial standards. Here’s what that means for you:

- Client Fund Segregation: Your funds are kept separate from the broker’s operational accounts, ensuring they’re protected.

- Negative Balance Protection: You won’t lose more than your account balance, which is a must for leveraged trading.

- FSCS Coverage: UK traders are covered up to £85,000 under the Financial Services Compensation Scheme.

- Global Regulation: Plus500 is also regulated by ASIC (Australia) and CySEC (Cyprus), adding an extra layer of credibility.

Verdict: Is Plus500 FCA Regulated

Yes Plus500 is FCA regulated. With FCA oversight and strong security measures, Plus500 is as trustworthy as they come.

How Easy Is It to Get Started with Plus500?

Onboarding – 5/5 Stars

Getting started with Plus500 was quick and painless. The entire process took me less than 10 minutes. Here’s what you’ll need:

- Personal Details: Name, address, and contact info.

- ID Verification: A passport or driving licence for proof of identity.

- Proof of Address: A recent utility bill or bank statement.

Plus500 also asks about your financial experience, which is standard for FCA-regulated brokers.

My Experience

The KYC process was smooth, and my account was verified within a few hours. I also tested the demo account, which comes preloaded with unlimited virtual funds. It’s a great way to practice before diving into live trading.

Is Plus500 Easy for Deposits and Withdrawals?

Deposit & Withdrawal – 4.5/5 Stars

Plus500 offers a range of deposit and withdrawal methods, keeping things simple and accessible for UK traders. The process is straightforward, with no deposit fees and clear timelines for withdrawals.

What You Can Use

- Debit/Credit Cards: Instant deposits and withdrawals processed in 1–3 business days.

- Bank Transfers: A bit slower, typically taking 3–5 business days.

- PayPal: Available for both deposits and withdrawals, offering speed and convenience.

- Other E-Wallets: Skrill and Neteller are supported but less common among UK traders.

My Experience

I tested a deposit via debit card, and the funds appeared in my account instantly—always a good start! For withdrawals, I opted for PayPal, and the process was surprisingly fast, with the funds hitting my account within 24 hours. Bank transfers were slower, as expected, but everything was processed within the stated timeframe.

One thing I appreciated was the absence of hidden fees. Plus500 doesn’t charge for deposits or withdrawals (though your bank or payment provider might).

Verdict: Is Depositing and Withdrawing Easy with Plus500

Yep, makes depositing and withdrawing funds from Plus500 is easy and efficient. PayPal is the standout option for UK traders though, offering a quick and secure way to move money.

How Fast is Plus500’s Execution Speed?

Execution Speed – 4.5/5 Stars

Speed is critical when you’re trading CFDs, especially during volatile market conditions. Plus500 performs well here, with fast order execution and minimal slippage.

My Experience

I tested Plus500’s execution during both calm and volatile trading sessions. Forex pairs like GBP/USD and indices like the S&P 500 executed almost instantly. Even during a big market-moving event (a central bank announcement), my trades were processed with minimal delay or slippage.

The platform’s speed and reliability are ideal for short-term traders. However, since Plus500 doesn’t support algorithmic trading, high-frequency traders may find it limiting.

Verdict

Plus500 delivers fast and reliable execution, making it a solid choice for manual traders who value precision.

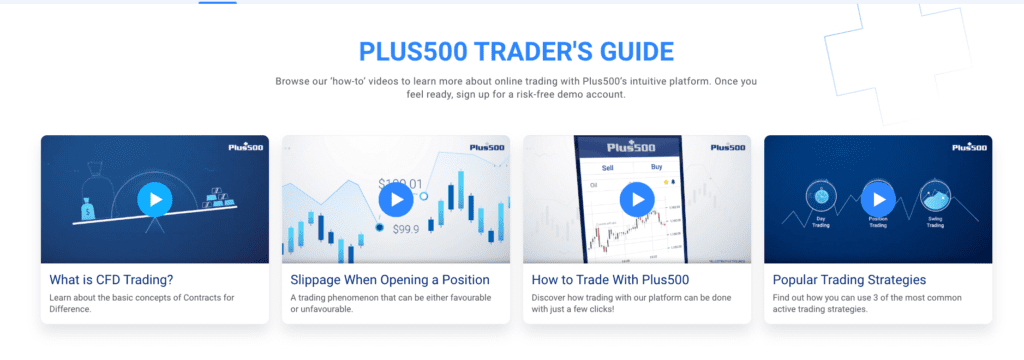

Does Plus500 Offer Good Educational Resources?

Education – 3.5/5 Stars

Here’s where Plus500 falls a bit short compared to some competitors. While their website actually includes all kinds of learning materials for beginners, and has some of the best, clearest video content I’ve seen, it can hardly be called a ‘Trading Academy’ and it doesn’t quite offer the same level of information – both evergreen and news content – as some of other competitors like XTB or IG.

What’s Available

- Trader’s Guide: Covers the basics of CFDs, options trading and risk management with great video content but lacks any real depth here – it’s also pitched a bit too high for beginners – not easy to follow for traders at any level.

- Beginner’s Guide: This seems to be their forte. All content is in-depth and when we say basic we have articles like ‘What is Trading’ and ‘What is an Order’ so yes, this hits the mark for very early beginners as well as more ‘advanced’ beginners.

- Economic Calendar: This in actually in-built into the platform itself when trading – super useful, easy to find and relevant so nice one here.

- Webinars: I think Plus500 has decided that no one will look at these and they are probably right, but they are long, Powerpoint-based and frankly a bit boring compared to their other videos. They are powered by a third-party provider so it’s not surprising the tone is slightly different, they also seem to be a hodgepodge of different levels of trader without any real categorisation so those changes would help.

- E-Book: It’s a bit of everything really, the Plus500 e-book contains basic trading content like ‘What is a Pip’ then explores their platform in the context of these questions and it’s overall a nice addition. You can also access / click on different sections in their ebook from the tabbed sidebar – overall very nice.

- FAQs: Detailed and thorough, answers a lot of common questions – unlike some other brokers – so it’s super simple if you have any queries just to head over there.

- News: I wouldn’t quite call this news, they are topic-relevant articles on events happening that affect the trading world. Not comprehensive or detailed really, it seems like they publish 1 a day which is nice but nowhere near enough to completely cover all relevant news events.

My Experience

As someone who loves a good deep dive, I found Plus500’s educational offerings a bit lacking overall. They definitely cover the basics and they do it well – the same goes with their platform as well – so it’s definitely enough if you are new to trading and don’t quite understand what pips are, or how to place an order on their platform – but when it comes to advanced market analysis or anything below surface level content, you’d be hard-pushed to find true value-add content. Most content is evergreen, so if up-to-date news and education is a priority for you, I’d recommend supplementing with third-party resources or looking at brokers with more robust offerings.

Verdict

Plus500’s education is fine for beginners but limited overall. Advanced traders may find it underwhelming.

Who is Plus500 Best Suited For?

Casual Traders

Plus500’s simplicity, intuitive platform, and commission-free model make it great for those dipping in and out of trading. The demo account is another big plus, allowing you to practice risk-free with virtual funds.

Short-Term Traders

Plus500 shines for short-term CFD traders who want tight spreads, fast execution, and minimal distractions. The platform’s focus on forex, indices, and commodities makes it ideal for day trading.

Mobile-First Traders

If mobile trading is your thing and you are looking for a quick reliable way to trade on-the-go, then you can’t really go wrong with Plus500’s clean and simple mobile trading experience. Is it as comprehensive as XTB’s proprietary app – no, but is it good enough to handle everything you need when placing a trade – most certainly.

Final Thoughts

Plus500 is a broker that knows its audience. If you’re a UK trader looking for a simple, no-frills CFD platform, it ticks all the right boxes. The FCA regulation, commission-free trading, and fast execution make it a reliable choice for casual and short-term traders.

That said, it’s not without its limitations. The lack of advanced educational resources and MetaTrader integration may leave advanced traders wanting more. And if you’re planning to hold positions overnight, be mindful of the fees.

Is Plus500 Right for You?

- Choose Plus500 if you enjoy trading on mobile and/or you are trader who values simplicity and tight spreads.

- Look Elsewhere if you need advanced trading tools, algorithmic strategies, or comprehensive education.

Still unsure? Open a demo account and explore the platform for yourself—it’s the best way to see if Plus500 is the right fit for your trading journey.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025