I know some people assume that trading platforms have hit a plateau, or that once you’ve got basic charting, news feeds, and a neat “Buy” button, you’re set for life. But in 2025, the innovation hasn’t just continued—it’s supercharged. We’re watching an explosion of new features that completely transform how we interact with the best trading platforms in the UK and beyond.

Here are the five trends I’ve noticed in the trading platform space—trends that are already making a difference for brokers, active traders, and even beginners who are just dipping their toes into the markets.

1. Real-Time Sync with Your Trading Ecosystem

What It Does

Remember the days when you had to refresh your screen every few seconds to keep track of changing prices, or cross-reference multiple tabs to see your portfolio updates? In 2025, modern trading platforms handle all of that automatically, pulling in live balance, open trades, and margin data in real time.

Key Features

- Automatic account updates: If you close a trade on your phone, your desktop interface shows the updated balance instantly.

- Plug-in compatibility: Some brokers now let you integrate with advanced lot size calculators or algorithmic trading bots that automatically adjust position sizes.

- Unified watchlists: A single watchlist that synchronises across all your devices—so you don’t have to re-enter the same stock or currency pair every time.

These real-time connections mean fewer missed opportunities—no more fumbling between separate apps or websites just to see if your margin can handle a new position.

2. AI-Enhanced Trading Decisions

What It Does

Artificial intelligence in trading used to mean chatbots answering customer queries. Now, it’s about smarter tools that help you spot patterns or high-volatility events. For example, some of the best trading platforms in the UK can serve up AI-based signals that warn you if a stock’s volume is unusually high or if a currency pair’s volatility is spiking.

Key Features

- Pattern alerts: The AI might notify you that EUR/USD is forming a head-and-shoulders pattern and provide potential profit targets.

- Personalised signals: Over time, the system “learns” your trading style—so if you typically trade breakouts on GBP/JPY, you’ll get alerts specific to that pair.

- Risk warnings: If the AI detects you’re about to open multiple correlated trades, it may advise you to reduce your positions or increase your stop-loss distance.

I’ve seen people new to trading platforms feel more confident and less overwhelmed because the AI flags key points they might otherwise miss. Of course, it’s still crucial to do your own research, but these features can be a lifesaver when markets get busy.

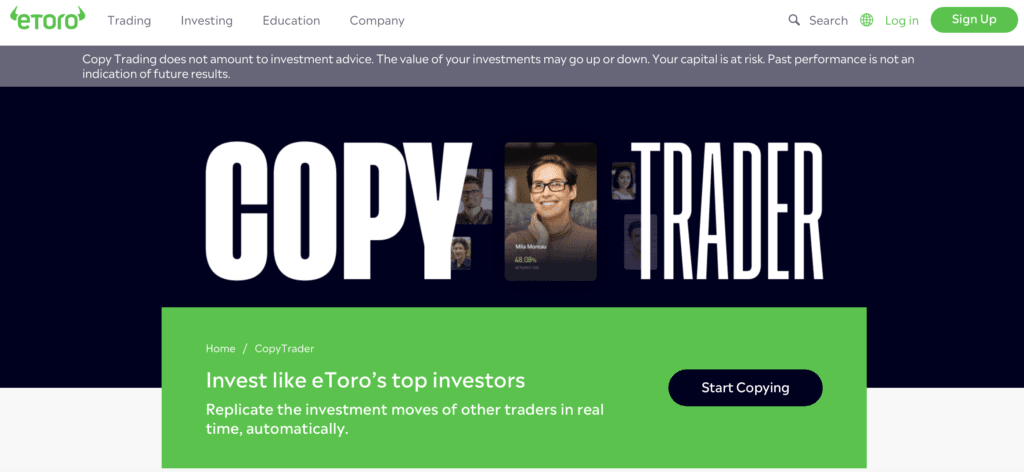

3. Social Trading and Community Features

Why It Matters

While social trading hit the scene a few years ago with ZuluTrade and eToro’s CopyTrader features blowing up, letting users copy trades from top-ranked traders. But in 2025, community-driven platforms are stepping it up further. Now you can see why someone is taking a specific position, ask questions directly, or even share your own charts for feedback.

Key Features

- “Community sentiment”: You might see an alert if 65% of the platform’s users are going short on a particular commodity.

- Q&A on live trades: Real-time comments on your open positions, with fellow traders suggesting exit strategies or second opinions.

- Badges and leaderboards: While a bit gamified, they motivate traders to share insights—and help you quickly spot who’s genuinely consistent.

I’ve personally used these kind of platforms to double-check correlation or get a second opinion on a tricky chart setup. It’s like having a global trading buddy you can tap for advice 24/7.

4. Fee Structures and Transparent Costs

What It Does

One of the biggest complaints about older trading platforms was hidden fees—like sudden spreads widening at key times or “inactivity charges.” In 2025, the push for transparency is leading brokers like forex.com to adopt micro-fee structures and openly display all possible costs.

Key Features

- Pay-as-you-go commissions: Instead of a monthly subscription, some platforms let you trade with a small commission per order, displayed before you click “Confirm.”

- Transparent overnight fees: If you hold a position overnight, the platform calculates your exact swap cost in real time.

- Tiered memberships: Traders with higher volumes might see lower fees, but the platform always explains those discounts clearly.

I think trading fees are one of the biggest ‘bug bears’ of beginner and intermediate traders alike and it just annoys people – especially when hidden fees take away from potential profits.

5. Integrated Education and Coaching Tools

What It Does

Trading can feel like a steep learning curve—especially if you’re venturing into more complex assets like crypto or options. In 2025, more of the best trading platforms in the UK are building in education modules and in-platform coaching to help you learn on the fly.

Key Features

- Live tutorials: While you’re about to place your first options trade, a pop-up might offer a 60-second explainer on calls vs. puts.

- Personalised progress tracking: Some platforms grade your trade journal, highlighting which days or asset classes work best for you.

- Coach interactions: AI-driven coaches might suggest you watch a quick video or take a mini-quiz after a losing streak, giving you tips on position sizing or risk management.

I’ve watched new traders come up to speed way faster than before, simply because the learning resources are built into the same tool they’re using to place trades.

What’s Next for Trading Platforms?

From real-time syncing across devices to AI-driven signals, social trading features, transparent micro-fees, and built-in education, 2025’s trading platforms are becoming far more than simply pushing a button and trading. They’re leaning into user experience, community engagement, and advanced technology to make trading as seamless as possible.

If you’re in the market for the a trading platform, keep an eye out for these five trends. Chances are, the platforms that embrace them will offer a smoother, more informed, and ultimately more enjoyable trading journey. As technology continues to evolve—who knows what next year might bring? Perhaps voice-activated orders or AR-based chart overlays? Either way, it’s an exciting time to be a trader, and staying aware of these trends will help you make the most of the opportunities out there.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025