Avatrade is a solid trading broker overall with an excellent proprietary trading platform. One drawback – it’s not FCA-regulated but it is regulated in other jurisdictions. As of December 2024, they don’t seem to be onboarding new UK clients.

AvaTrade UK Trading Platform Review

When I first tried AvaTrade, I didn’t really know what to expect. I’d heard of them before—being around since 2006, they’ve certainly built a name for themselves—but how would they stack up against big players like IG and City Index?

After spending a few weeks trading with them, I can confidently say that AvaTrade has some genuinely impressive features, especially for forex and CFD traders. From their tight fixed spreads to innovative tools like AvaProtect, AvaTrade felt like a broker that prioritises trader support.

Here’s my full breakdown of what AvaTrade offers, including what worked well and where they could improve.

- Competitive spreads, especially on forex pairs

- Excellent range of trading platforms, including MT4, MT5, and AvaTrade’s proprietary AvaTradeGO

- Regulated in multiple jurisdictions, including FCA equivalent in the EU

- Fixed spreads available for traders who prefer predictability

- Access to advanced tools like AvaProtect for managing risk

- Limited access to individual stocks compared to some competitors

- No fractional stock trading options

Is AvaTrade a Good Forex Broker for UK Traders?

AvaTrade is a solid option for UK traders, particularly those focused on forex, indices, and commodities. AvaTrade ticks many of the boxes I look for in a broker: competitive fees, a wide range of trading tools, and a strong regulatory framework. They combine competitive pricing with user-friendly tools and platforms.

One feature I loved was AvaProtect, which allows you to protect trades from losses for a small fee. This came in handy when I was navigating some particularly choppy markets. While their range of stocks could be expanded, AvaTrade shines in its core areas.

Overall Rating – 4.7 / 5 Stars

In Summary: AvaTrade excels in offering competitive pricing, intuitive platforms, and innovative features. While it could expand its stock trading options, it remains one of the most reliable and versatile brokers for UK traders.

Trading Markets – 4.5 / 5 Stars

AvaTrade provides access to over 1,200 markets. Now, this isn’t the largest range I’ve seen—brokers like City Index & IG definitely outshine them here—but for most traders, it covers all the essentials.

What You Can Trade

- Forex: AvaTrade offers more than 50 currency pairs, ranging from major pairs like EUR/USD to exotics. I tested their spreads on majors, and they held steady at 0.9 pips—a great rate for fixed spreads. If you value predictability in your trading costs, this is a huge plus.

- Indices: They’ve got all the big hitters here: FTSE 100, NASDAQ 100, S&P 500, and more. Spreads start at 0.5 points, which is competitive, and execution was smooth during my tests, even during high-volume trading sessions.

- Commodities: Gold, silver, crude oil, and even soft commodities like sugar and wheat are all available. Gold spreads start at 0.34 points, and while I’ve seen tighter rates elsewhere, the overall trading experience made up for it.

- Shares and ETFs: This is where AvaTrade falls a bit short. They do offer share CFDs for popular companies like Apple and Tesla, but the selection feels limited compared to brokers like XTB or City Index.

- Cryptocurrencies: Due to FCA regulations, AvaTrade only offers cryptocurrency CFDs to professional traders. If you qualify, you’ll find Bitcoin, Ethereum, and Litecoin among the available options.

My Experience

I spent most of my time trading forex and indices, and I was impressed. The fixed spreads really stood out—on EUR/USD, I knew exactly what I’d be paying, even during periods of higher volatility. This made it much easier to stick to my trading plan without worrying about sudden cost changes.

Indices like the FTSE 100 were a joy to trade. The spreads were tight, and I didn’t experience any delays in execution, even when markets were moving quickly. AvaProtect, which I tried on a few trades, was a lifesaver. For a small fee, I could protect against losses, and it took a lot of the stress out of trading volatile markets.

The limited range of shares was a bit of a letdown, though. If you’re heavily into stock trading, you might feel restricted, but for forex and indices, AvaTrade really delivers.

Verdict

AvaTrade’s market range is solid for forex, indices, and commodities, but the limited stock selection might leave some traders wanting more. For those focused on core markets, though, it’s a fantastic option.

Fees – 4.5 / 5 Stars

AvaTrade’s fee structure is competitive and, most importantly, easy to understand. Fixed spreads mean you always know what you’re paying, which is a rare but valuable feature.

What to Expect

- Forex Spreads: Fixed spreads start at 0.9 pips on pairs like EUR/USD.

- Indices Spreads: Spreads on major indices like the FTSE 100 and NASDAQ 100 begin at 0.5 points.

- Commodities Spreads: Gold spreads start at 0.34 points, while crude oil spreads are around 3.0 points.

- Overnight Swap Fees: Like most brokers, AvaTrade charges swap fees for positions held overnight. These vary based on the instrument.

- Inactivity Fees: This is where AvaTrade stumbles a bit. They charge £50 after just three months of inactivity, which is steeper than most brokers.

My Experience

I primarily traded forex, and the fixed spreads were a huge win for me. During a particularly volatile session, the spread on EUR/USD held firm at 0.9 pips, even as the market moved quickly. This level of consistency is a big plus if you’re a day trader or scalper.

I was less thrilled about the inactivity fee. Three months feels like a short window, and £50 is on the higher side. That said, it’s easy enough to avoid if you log in and make occasional trades.

Verdict

AvaTrade’s fees are competitive, especially for forex traders who value fixed spreads. While the inactivity fee is a drawback, the overall cost structure is transparent and easy to work with.

Trading Platforms – 4.7 / 5 Stars

AvaTrade offers an impressive selection of platforms, catering to traders of all experience levels.

What’s Available

- MetaTrader 4 (MT4):

A classic choice for forex traders, MT4 comes with customizable charts, automated trading options, and a wide range of technical indicators. - MetaTrader 5 (MT5):

MT5 expands on MT4, offering more timeframes, advanced charting tools, and a wider range of tradable assets. - AvaTradeGO:

This proprietary mobile app is sleek and modern. It offers live price alerts, integrated risk management tools, and the ability to trade on the go. - WebTrader:

AvaTrade’s browser-based platform is straightforward and user-friendly, with advanced charting tools and fast execution.

My Experience

I spent most of my time switching between MT4 and AvaTradeGO. MT4 worked perfectly for testing automated strategies—I set up a few Expert Advisors, and everything ran smoothly. AvaTradeGO, though, was the real standout. It’s hands-down one of the best mobile trading apps I’ve used. The interface is clean, and I loved being able to access features like AvaProtect right from my phone.

WebTrader is a good choice for those who prefer simplicity. It’s not as feature-packed as MT4 or MT5, but it’s intuitive and fast, which is all you need for straightforward trades.

Verdict

AvaTrade offers a platform for everyone, whether you’re a beginner or an advanced trader. AvaTradeGO, in particular, is a standout, and MT4/MT5 ensures you’re never short on tools.

Execution Speed – 4.7 / 5 Stars

Execution speed can make or break a trading experience, and AvaTrade does a great job in this department. Whether I was placing trades during quiet periods or testing during peak volatility, I found their execution to be smooth and reliable.

My Experience

I tested AvaTrade’s execution on forex, indices, and commodities, and I was impressed with how quick and consistent it was. For forex, in particular, trades executed almost instantly, with minimal slippage—even during volatile sessions like a central bank rate announcement. This gave me the confidence to scalp smaller price movements without worrying about delays eating into my profits.

Indices like the FTSE 100 also performed well. AvaTrade’s execution felt seamless, even when the market was moving fast. The spreads stayed consistent during news releases, and I didn’t experience any sudden changes that might throw off my strategy.

For automated trading on MT4 and MT5, I ran a few test scripts using Expert Advisors (EAs). The results were excellent, with no noticeable lag in execution. This is a crucial factor for traders who rely on precise timing to optimize their strategies.

Verdict

AvaTrade scores high for execution speed. Whether you’re trading manually or using automation, the platform delivers the kind of reliability you need to stick to your plan.

Deposit & Withdrawal – 4.5 / 5 Stars

Depositing and withdrawing funds with AvaTrade is a straightforward process. They offer multiple payment methods, making it easy to get your money in and out of your trading account.

What You Can Use

- Debit/Credit Cards: AvaTrade supports Visa and Mastercard, and deposits via these methods are processed almost instantly.

- Bank Transfers: For those who prefer traditional banking, transfers typically take 1–3 business days.

- E-Wallets: Options like PayPal, Neteller, and Skrill are available, providing a fast and secure alternative to cards and bank transfers.

My Experience

For my initial deposit, I used a debit card, and as expected, the funds were credited to my account instantly. I also tested PayPal, which worked just as smoothly—funds were added within minutes. It’s reassuring to see AvaTrade doesn’t charge deposit fees, which isn’t always the case with brokers.

When it came to withdrawals, I tested both PayPal and a bank transfer. The PayPal withdrawal was impressively quick—I requested it in the morning, and the funds arrived in my PayPal account within 24 hours. The bank transfer took two days, which is fairly standard, but I appreciated that AvaTrade kept me updated with progress notifications.

Another standout was how clearly AvaTrade communicates withdrawal times. They outline exactly how long each method typically takes, so there are no surprises.

Verdict

AvaTrade makes deposits and withdrawals as hassle-free as possible. The wide range of payment options, combined with their transparency and lack of deposit fees, makes managing your funds straightforward. If speed matters to you, e-wallets like PayPal are a fantastic option.

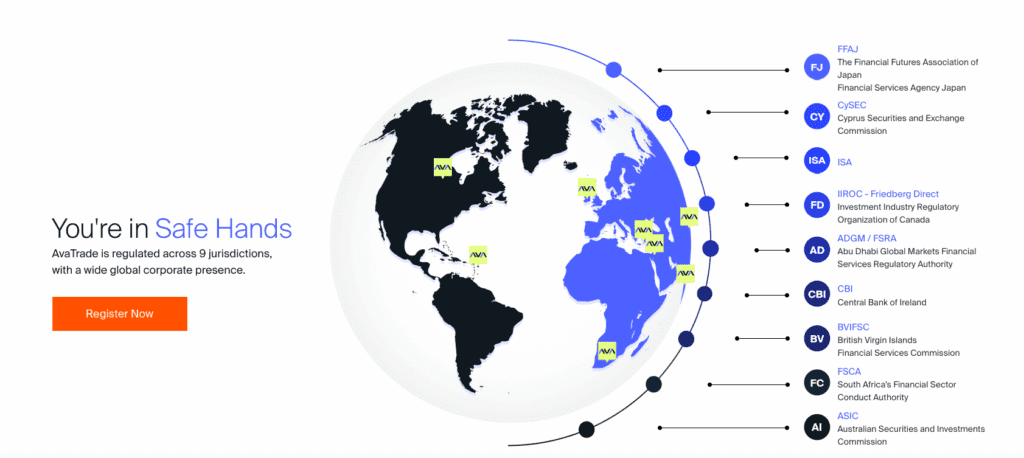

Regulation and Security – 5 / 5 Stars

When it comes to trustworthiness, AvaTrade gets top marks… well nearly. They’re regulated across multiple jurisdictions, including Europe, Australia, and South Africa, which means they follow strict guidelines to protect traders.

Who Regulates AvaTrade?

- Central Bank of Ireland (CBI): AvaTrade is regulated under MiFID in Europe, ensuring compliance with stringent EU trading standards.

- Australian Securities and Investments Commission (ASIC): AvaTrade is overseen in Australia, offering additional credibility.

- Financial Sector Conduct Authority (FSCA): South African regulation strengthens their global reach.

- Abu Dhabi Global Market (ADGM): Regulation in the Middle East adds another layer of reliability.

- Financial Services Regulatory Authority (FSRA): Ensures compliance for clients in the UAE.

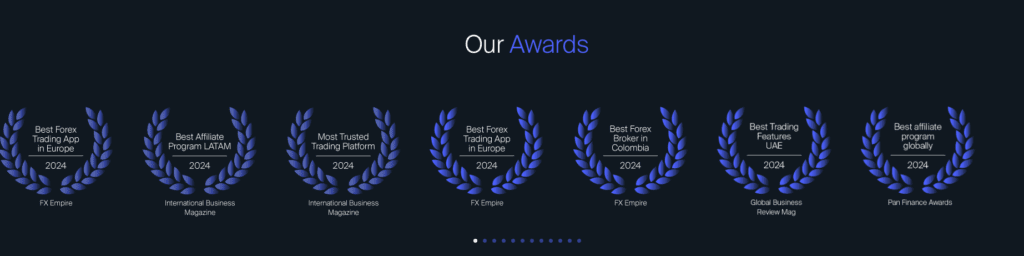

They have also won multiple awards from all kinds of reputable financial media outlets (see below) and to be honest that’s for good reason, they have an incredible reading app and fantastic proprietary technology.

My Experience

I say all of this to prime you, as AvaTrade is not regulated by the FCA. Now, I know what you are thinking, and I might have been thinking that too had I not done my due diligence. Despite no FCA-regulation (which I mean… there has to be a reason behind this somewhere right?) they are regulated by some heavy hitters like AIC, CySEC and the Central Bank of Ireland so would I say AvaTrade is an unregulated broker, definitely not. Would I say that FCA regulation would be a nice comfort blanket allowing me to sleep better at night. Yes, yes I would.

They do offer negative balance protection, which ensures you can’t lose more than your account balance so this is a huge plus if you’re trading with leverage, as it provides a safety net in case of unexpected market swings.

Verdict

AvaTrade’s global regulation and commitment to client fund security make them a trusted broker. With features like negative balance protection, they’re a great option for risk-conscious traders but No FCA regulation might scare some traders and I can’t blame them.

Onboarding – 5 / 5 Stars

Getting started with AvaTrade was far from painless at the beginning… After multiple error code issues (see below) I eventually managed to get in and start trading. It helped that they had a live chat just at the bottom of the screen so I was literally seconds away from dealing with a bot then Whether you’re an experienced trader or brand new to the markets, their onboarding process is smooth and beginner-friendly.

My Experience

The signup process was incredibly simple. I filled out an online form with basic details like my name, email, and trading experience. After submitting my ID and a proof of address (a utility bill worked fine), my account was verified within 24 hours.

For beginners, AvaTrade does a great job of guiding you through the process step by step. Even if you’ve never opened a trading account before, the platform provides clear instructions, and their customer support is always available if you get stuck.

One thing I appreciated was the option to open a demo account. AvaTrade lets you practice trading with virtual funds, which is perfect if you’re still figuring out your strategy or just getting comfortable with the platform.

Verdict

AvaTrade nails the onboarding process. It’s quick, user-friendly, and ideal for traders of all experience levels. The demo account is a great touch for those who want to practice or experiment.

Education – 4.5 / 5 Stars

AvaTrade provides a comprehensive range of educational materials, making it a great option for traders who want to improve their skills.

What’s Available

- Trading Academy: A comprehensive library of video tutorials covering everything from forex basics to advanced strategies.

- Webinars: Regular live sessions with market experts, focusing on trading strategies, market trends, and technical analysis.

- Market Analysis: Daily updates on economic events, price movements, and trading opportunities.

- Trading Tools: Features like AvaProtect and advanced charting tools on MT4/MT5 to refine your approach.

My Experience

I explored their Trading Academy, and I was impressed by how well-structured it is. The tutorials are concise yet thorough, making them ideal for beginners who might be overwhelmed by too much information. I also attended one of their webinars, which focused on identifying trends using technical indicators—it was packed with actionable tips that I could apply immediately.

The daily market analysis was another highlight. It helped me stay on top of key events that could impact my trades, like central bank announcements or economic data releases.

For experienced traders, I found the education section slightly basic, but the market analysis and tools like AvaProtect make up for it.

Verdict

AvaTrade’s educational materials are excellent for beginners and intermediate traders. While advanced traders might want more in-depth content, the webinars and market updates still add plenty of value.

FAQs

1. Is AvaTrade regulated?

Yes, AvaTrade is regulated by several authorities, including the Central Bank of Ireland, ASIC, FSCA, and more.

2. Does AvaTrade offer negative balance protection?

Yes, negative balance protection ensures that retail traders can’t lose more than their account balance.

3. What payment methods does AvaTrade accept?

AvaTrade supports debit/credit cards, bank transfers, and e-wallets like PayPal, Neteller, and Skrill.

4. Can beginners use AvaTrade?

Absolutely. AvaTrade offers a demo account, an extensive Trading Academy, and simple onboarding, making it ideal for new traders.

5. Does AvaTrade charge deposit or withdrawal fees?

No, AvaTrade doesn’t charge fees for deposits or withdrawals. However, your bank or payment provider might impose their own charges.

- How to Switch Trading Platforms - August 13, 2025

- Top 5 Trends for Trading Platforms in 2025 - January 31, 2025

- Best Trading Platforms for Investing - January 3, 2025